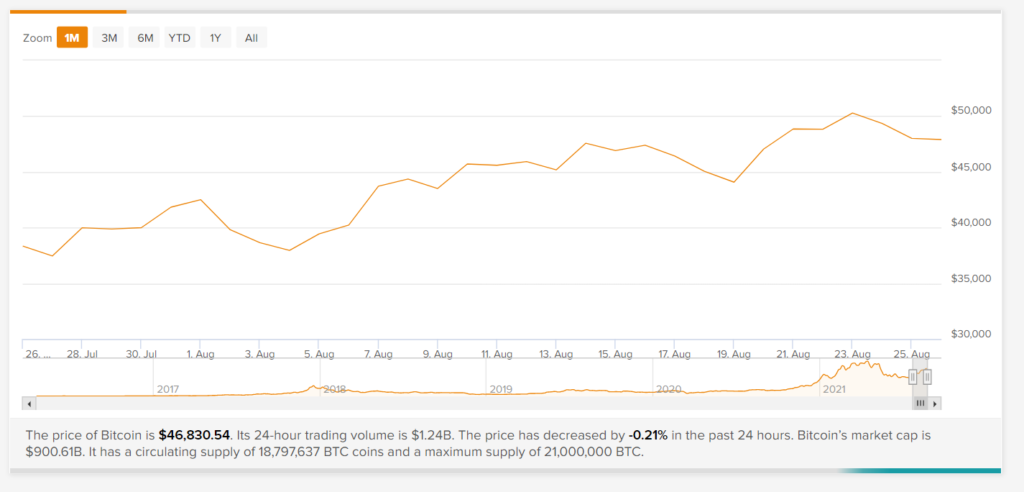

Bitcoin (BTC-USD) prices slipped below the $50,000 mark, with strong indications of a horizontal consolidation over the coming days. The overall trend remains bullish, as long-term momentum strengthens and the slope of the 40-week moving average remains on the rise.

The Fundamental Look

The week started with bitcoin prices hovering just above $45,000, crossing $50,000 by mid-week for the first instance in the last three months, before consolidating within the $47,000 to $49,000 range. Since its plunge in May, Bitcoin has recouped 55% in value, following a period of extreme volatility over the past two months. This has helped propel the aggregate market capitalization of cryptocurrencies back above the $2 trillion mark.

Concerns about potential supply shortages of the seminal cryptocurrency continue to support recent price gains, especially as institutional and corporate accumulation climb. To that end, MicroStrategy’s SEC filings revealed that the company picked up another 3,907 Bitcoin in a transaction worth approximately $177,000,000. This echoes a report from Deep Dive, indicating that the long-term Bitcoin holder supply has reached a new peak, due to aggressive spot market accumulation.

In institutional news, Eurex, Deutsche Boerse’s European derivatives exchange, plans to introduce Europe’s first Bitcoin exchange-traded note futures to cater to rising demand from institutional investors. The action hasn’t been confined to Europe alone, as competing U.S. financial services giants race to fulfill client interests in Bitcoin and related products.

Citigroup (C) has applied for Bitcoin futures trading approval to address the recent rise in demand for bitcoin exposure among its clients. Additionally, one of the oldest American banks, Wells Fargo (WFC), has teamed up with New York Digital Investment Group to register a new pooled investment fund that offers its clients indirect exposure to Bitcoin.

Meanwhile, a new regulatory filing by Neuberger Berman, a $400 billion asset manager, indicates that the Neuberger Berman Commodity Strategy Fund is eyeing an investment in Bitcoin futures and Canada’s Bitcoin exchange-traded funds. Not to be left out, filings submitted by BlackRock highlight that the firm has made huge investments in two publicly traded BTC mining firms, owning a 6.71% stake in Marathon Digital Holdings and 6.61% of Riot Blockchain.

In adoption news, Substack, an email subscription platform with over half a million users, has announced an integration with Bitcoin Lightning payments and OpenNode to power both on-chain and off-chain BTC payments on its platform. Finally, PayPal (PYPL) has launched new services in the United Kingdom, representing the first expansion of its Bitcoin trading services outside the U.S. This will allow UK customers to buy, hold, and sell Bitcoin and other cryptocurrencies via the platform.

Whales Of The Week

- August 20: 10,000.000 BTC moved from multiple addresses to an unknown wallet

- August 20: 15,000.000 BTC moved from multiple addresses to an unknown wallet

- August 21: 5,328.611 BTC moved from multiple addresses to an unknown wallet

- August 23: 15,000.000 BTC moved from multiple addresses to Binance

- August 23: 6,000.000 BTC moved from multiple addresses to an unknown wallet

- August 24: 8,433.000 BTC moved from multiple addresses to an unknown wallet

- August 25: 10,222.269 BTC moved from multiple addresses to an unknown wallet

The Technical Take

Since crossing $50,000 and reaching its highest point since May, Bitcoin is back on the retreat below the key psychological level, despite the ongoing bullish bias. This bias is underscored by Glassnode’s recognition of a golden cross formation in Bitcoin’s hash ribbon, as the 30-day moving average crosses the 60-day moving average to the upside, further underlining the potential for another near-term BTC bull run.

In the meantime, BTC-USD has returned 7.05% over the last week, trailing the 24.50% return in ADA-USD while outpacing Ethereum’s (ETH-USD) more modest 3.91% climb. Bitcoin is trading above both its 50-day and 200-day moving averages, which are acting as support. Should the 50-day moving average continue its ascent and overtake the 200-day moving average, it could be an even stronger sign of a bullish golden cross pattern emerging. Nevertheless, the 200-day moving average is acting as support just above $46,000.

As far as technical patterns are concerned, the BTC-USD pair is trading near the lower line on an intact upward trending equidistant channel. While a potentially solid entry point for bulls, a break below the lower channel could signal a breakout reversal lower, if accompanied by higher-than-average volumes. With volumes still muted compared to earlier in the month, any spike higher in volume would confirm a directional breakout from a recent range between $47,000 and $50,000.

With the relative strength index (RSI) back below overbought levels and trending towards the midpoint of the range, the near-term direction bias remains relatively neutral as BTC-USD consolidates under $50,000. On the upside, resistance is sitting at $48,450 and $49,900. On the downside, support rests at $46,900, $46,000, and $44,600 if a deeper pullback materializes.

Disclosure: At the time of publication, Reuben Jackson did not have a position in any of the securities mentioned in this article.

Disclaimer: The information contained in this article represents the views and opinion of the writer only, and not the views or opinion of Tipranks or its affiliates, and should be considered for informational purposes only. Tipranks makes no warranties about the completeness, accuracy or reliability of such information. Nothing in this article should be taken as a recommendation or solicitation to purchase or sell securities. Nothing in the article constitutes legal, professional, investment and/or financial advice and/or takes into account the specific needs and/or requirements of an individual, nor does any information in the article constitute a comprehensive or complete statement of the matters or subject discussed therein. Tipranks and its affiliates disclaim all liability or responsibility with respect to the content of the article, and any action taken upon the information in the article is at your own and sole risk. The link to this article does not constitute an endorsement or recommendation by Tipranks or its affiliates. Past performance is not indicative of future results, prices or performance.