By Kate George

Relypsa Inc (NASDAQ:RLYP) is up nearly 6% to $29.40 in pre-market trading due to speculation that the company may be in M&A talks. Recent reports rumor that AstraZeneca is looking to acquire the company for $46 per share, while other reports point to Merck and Sanofi as potential buyers. Relypsa’s primary commercial product is Veltassa, a drug to treat elevated potassium levels in blood. According to TipRanks, 8 analysts are bullish on the biotech company while one is bearish. The average 12-month price target between these 9 analysts is $45.44, marking a 63% potential upside from where shares last closed.

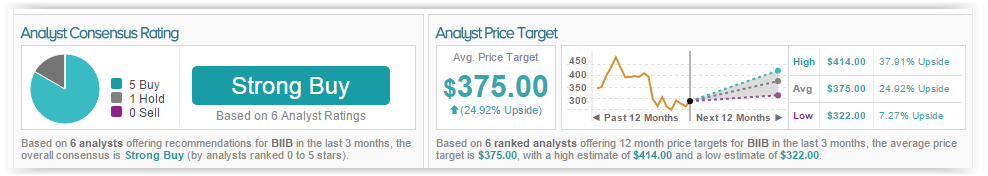

Biogen Inc (NASDAQ:BIIB) fell over 5% in pre-market trading this morning after hedge fund Gerstein Fisher disclosed to the SEC that it reduced its position in the company by 0.4%. The fund sold $847,000 worth of Biogen shares. Yesterday, ING Groep N.V. also sold $17,533,000 worth of Biogen shares. According toTipRanks’ statistics, out of 6 analysts who have rated Biogen in the last 3 months, 5 gave a Buy rating while 1 remains on the sidelines. The average 12-month price target for the stock is $375, marking a 25% upside from where shares last closed.

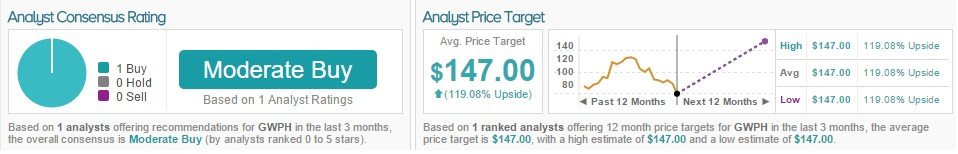

GW Pharmaceuticals PLC- ADR (NASDAQ:GWPH) is up more than 7% in pre-market trading to $72 afterThe Lancet Neurology published data on Epidiolex, GW’s pipeline drug that aims to fight a rare form of childhood epilepsy. The Lancet reports that Epidiolex successfully decreased the amount of seizures and was well-tolerated by patients. Overall, the data is promising and bodes well for the future approval and success of the drug. According to TipRanks, one analyst is currently bullish on GWPH with a $147 price target, marking a 119% upside from where shares last closed.

SolarCity Corp (NASDAQ:SCTY) is down a slight 1.6% in pre-market trading to $50.66 after the company announced it will halt sales in Nevada. Due to a rate increase that will take place over the next five years, SolarCity will “effectively shut down” all sales in the state. The company expressed disappointment that the state made this choice to hike rates, despite the peoples’ decision to choose clean energy. According toTipRanks, 7 analysts are currently bullish on the solar energy company, 1 is bearish, and 3 remain neutral. The average 12-month price target between these 11 analysts is $56.44, marking a nearly 10% potential upside from where shares last closed.