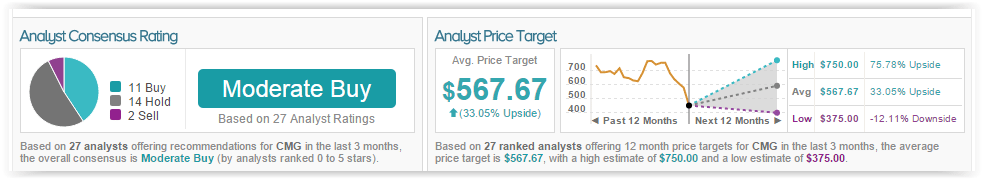

Chipotle Mexican Grill, Inc. (NYSE:CMG) is falling close to 5% after the company disclosed in a SEC filing that it received a subpoena for a norovirus outbreak that occurred last fall at one of its Simi Valley, CA restaurants. The virus affected 189 customers and 18 employees of the particular restaurant, which briefly closed following the incident. Shares of Chipotle have been hit hard the past few months from the company’s infamous E-Coli scandal, which sickened dozens of people over several states. According to TipRanks’statistics, 27 analysts have rated the company in the past 3 months. Of those 27 analysts, 11 gave a Buy rating, 2 gave a Sell rating, and 14 remain on the sidelines. The average 12-month price target for the stock is $567.67, marking a 33% upside from where shares last closed.

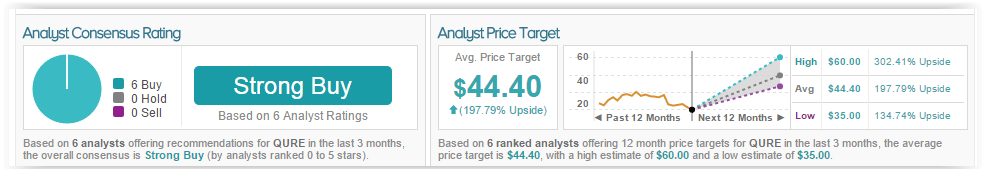

Uniqure NV (NASDAQ:QURE) is up 18% in pre-marking trading after the company released positive top line data from the low-dose cohort of its Phase 1/11 trials of gene therapy AMT-60, used to treat adult hemophilia b, a genetic disorder in which blood does not clot properly. The disease is marked by a lack of functional human Factor IX. The results indicated that the therapy is well-tolerated by patients and successfully transduces the liver, which results in clinically meaningful levels of FIX. According to TipRanks’ statistics, 6 analysts have rated the company in the past 3 months, all with a Buy rating. The average 12-month price target for the stock is $44.40, marking a 198% upside from where shares last closed.

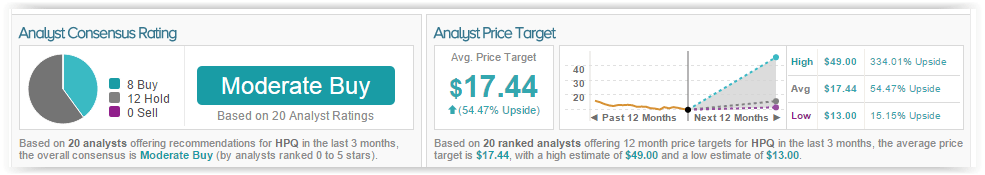

HP Inc (NYSE:HPQ) is down close to 3% in pre-market trading following a downgrade by analyst Maynard Um of Wells Fargo. The analyst downgraded the stock to Market Perform from Outperform, citng a “lack of material catalysts in FY16.” After meeting with company management at the Consumer Electronics Show in Las Vegas, Um cited several “underappreciated aspects” of HPQ, however states, “more material growth is unlikely until FY17 while pressures in the traditional PC and printer segments are likely to continue in FY16.” According to TipRanks’ statistics, out of the 20 analysts who have rated the company in the last 3 months, 8 gave a Buy rating while 12 remain on the sidelines. The average 12-month price target for the stock is $17.44, marking a 55% upside from where shares last closed.

Dynavax Technologies Corporation (NASDAQ:DVAX) is up close to 9% in pre-market trading after reporting positive top line results from HEPSILAV-B, its Hep B vaccine. In its late stage study, the vaccine met both primary endpoints for safety and effectiveness. The company reported that HEPSILAV was found to be more effective than Engerix-B, Glaxo Smith Kline’s vaccine currently on the market. The company plans on resubmitting the HEPSILAB-B Biologics License Application by the end of March and expects a 6 month review by the FDA on issues that came up in February of 2013 .