Unlike traditional automobile manufacturers, the Tesla, Inc. (NASDAQ:TSLA) story has always revolved around CEO Elon Musk’s futuristic visions. The premium valuation that investors have often been willing to pay to own TSLA shares requires a belief that the company is paving its own distinct path forward.

And yet, real-world realities have an annoying tendency to intrude. While Musk’s tales of robotaxis and robots might enthrall some investors, EV deliveries have slowed down in the here-and-now.

However, it is not just weakening delivery numbers, which decreased year-over-year in 2024, but shrinking margins that are also raising concerns. Indeed, the company’s Q4 GAAP gross profit margins of 16.3% were down from the 19.8% figure TSLA posted in the previous quarter.

Shares have fallen by double-digits in the two weeks since the company posted its Q4 numbers. Could the Musk magic be wearing off?

Top investor James Foord – who is among the top 3% of TipRanks’ stock pros – is ready to give Musk, and Tesla, one last chance.

“2025 is make-or-break time for Tesla. I’m happy to hold the stock for the next two quarters, to see if any of Musk’s ambitious plans can begin to materialize,” explains Foord. “If not, I’ll be out the door and won’t look back.”

The investor identifies a number of growth catalysts coming up. This includes the launch of the more economic Model 2 that is designed to appeal to lower-income buyers. In addition, the company is set to revamp its best-selling Model Y vehicles.

Foord also cites the ramp up of Tesla’s Cybertrucks, scheduled to reach full production capacity during 2025.

“With Cybertruck, a refreshed Model Y, and a cheaper Model, we should see some growth in Tesla in Q2 and Q3. If we don’t, then we’re really in trouble,” continues Foord.

Of course, robotaxi developments add an interesting angle to any discussion about Tesla. The investor is intrigued by this prospect, noting that the company’s existing fleet of vehicles could allow it to rapidly deploy robotaxis at scale once the technology is ready and regulatory approvals are secured.

In addition, Foord believes that TSLA is one of the few companies possessing the capacity to build the Physical AI that could make humanoid robots a reality. Though the investor does not expect this to be a catalyst in 2025, it is an opportunity that is on the horizon.

“Every breakthrough in AI technology is a boon for Tesla, since it gets us closer to full self-driving and Physical AI. At the rate the breakthroughs have been coming, who knows, maybe Elon Musk will for once meet his timeline,” adds Foord, who is rating TSLA a Buy. (To watch Foord’s track record, click here)

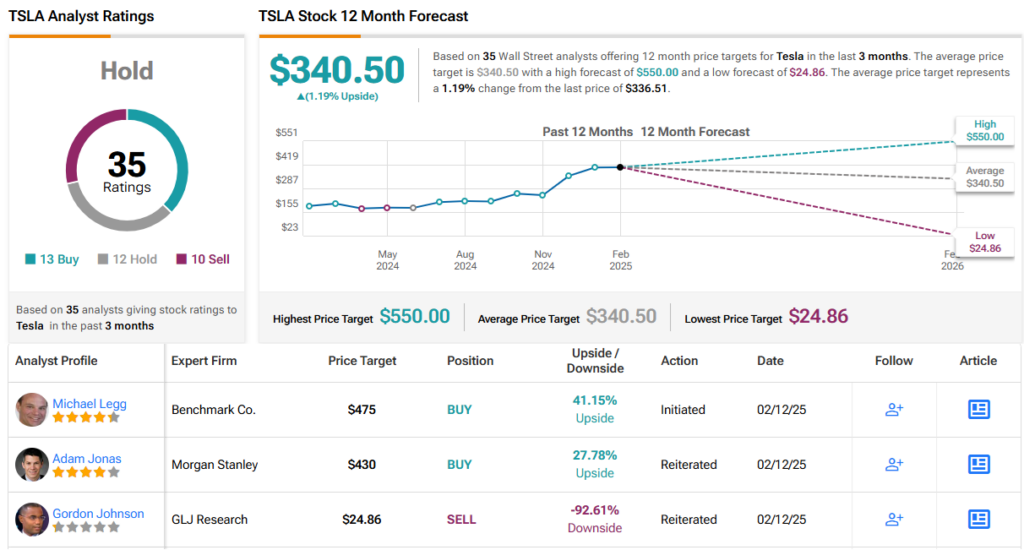

Wall Street is a bit divided, though most analysts seem willing to stick around for the time being. With 13 Buy, 12 Hold, and 10 Sell ratings, TSLA has a consensus Hold (i.e. Neutral) rating. Its 12-month average price target of $340.50 implies minimal movement in the year to come. (See TSLA stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.