The last 12 months have seen a combination of volatile trading and a relentlessly downward trend in the stock market. The end result, in this last week of the year, is broad based losses – a 21% ytd drop in the S&P 500, and 35% in the NASDAQ – that have hurt investors and cut into portfolio returns. But even in a bearish year, investors can still find islands of opportunity.

The key here is to recognize those stocks that are oversold, that have seen worse losses than they should have. These are the equities that are primed to gain as we head into the New Year. While their share prices are down for now, a closer look reveals that they have solid sound fundamentals in their underlying businesses, giving reason to believe that investors have overreacted and will come back around to buy.

In the meantime, all three of the stocks we’re about to look at present share prices at low levels, following losses of 60% to over 90% for the year. That makes these stocks deep underperformers compared to the overall markets – but also gives investors a chance to buy in at discounted prices and take maximum advantage of potential gains. We’ve opened up the TipRanks database and pulled up the latest details on three oversold stocks to take a closer look at them, along with the analyst commentaries.

Signature Bank (SBNY)

We’ll start with Signature Bank, a New York-based company that sits in the Top 25 of the US regional banking industry. Signature operates in the NYC metropolitan area, mostly, but also has offices in California and North Carolina. The bank has 40 private client offices and $114 billion in total assets.

This bank has seen the bottom line increase steadily over the past couple of years, with the last reported quarter – 3Q22 – showing a bottom-line net income of a record $358.5 million, up 48.5% year-over-year. This came to $5.57 per diluted share, for a 43.5% y/y EPS increase.

The company reported a quarterly decline in total deposits, which slipped by $1.34 billion to $102.78 billion. A $3 billion drop in digital asset banking drove this decline, which was partially offset by an increase of $1.7 billion in deposits from other businesses.

The decline in digital asset banking is a key point for investors to consider. Signature was an ‘early adopter’ in the crypto craze, and has invested heavily in crypto assets over the years. The sharp declines in Bitcoin and other cryptocurrencies this hear have hit Signature Bank hard, and are, at least in part, responsible for the sell-off in the bank’s stock. SBNY shares are down more than 64% this year.

Michael Diana, 5-star analyst with Maxim Group, takes careful note of Signature’s crypto exposure, writing, “At an investor conference on 12/7, management indicated that it was strategically decreasing its crypto-related deposits by at least $8B in 4Q22/1Q23, with the intention of limiting its exposure to cryptorelated deposits to 15% of total deposits and limiting its deposit concentration for any one customer to 2% of total deposits. SBNY has been identified by certain investors and the media as subject to significant and material crypto risk: we do not share this perception.”

Diana goes to explain why he sees this stock as a gainer going forward, believing it is “oversold” on its crypto connection: “SBNY currently trades at only 5.4x our new 2024 EPS estimate. In our view, this large discount to best-in-class peers is unwarranted, given that credit quality is solid, accretive banking teams are being added, and our 2024 EPS estimate represents 22% growth over (our reduced) 2023E. Over the next four quarters, we expect stock price appreciation…”

Extrapolating from this position, Diana rates SBNY shares as a Buy, with a $250 target price to suggest an upside potential of 124% in the next 12 months. (To watch Diana’s track record, click here.)

Of the 11 recent analyst reviews on Signature Bank, 8 are Buys against 3 Holds – for a Moderate Buy consensus rating. The stock is selling for $111.69 and its $174.40 average price target indicates a 56% gain on the one-year horizon. (See Signature Bank’s stock forecast at TipRanks.)

Omnicell (OMCL)

Next up is Omnicell, a healthcare firm based in California. The company develops automated medication management systems for use in a variety of healthcare provider settings, particularly hospitals and pharmacies. The systems include medication packaging, regulatory compliance, and patient engagement tools. This is an often overlooked field, but a vital one, as medication distribution errors can have serious repercussions on patient health. Omnicell is a leader in its field, with thirty years’ experience.

Healthcare firms were among the companies that benefited from the COVID pandemic era, as demand for their products generally increased. And Omnicell is no exception. The company has seen increased revenues in every quarter over the past two years, with the last reported quarter, 3Q22, showing a top line of $348 million. That result was up more than 17% y/y, and over 63% from the same quarter in 2020. This pharmacy management expert has been seeing a steady gain in sales over an extended period of time. Adj. Earnings in Q3, at $1 per share, beat the 95-cent expectation.

Nevertheless, the shares are way down. OMCL has dropped 73% this year, with a particularly noticeable slip coming right after the earnings report. While the top line showed growth, it fell short of the $363 million forecast. In addition, the company pared back on its total bookings guidance for the fiscal year 2022. These misses clearly worried investors.

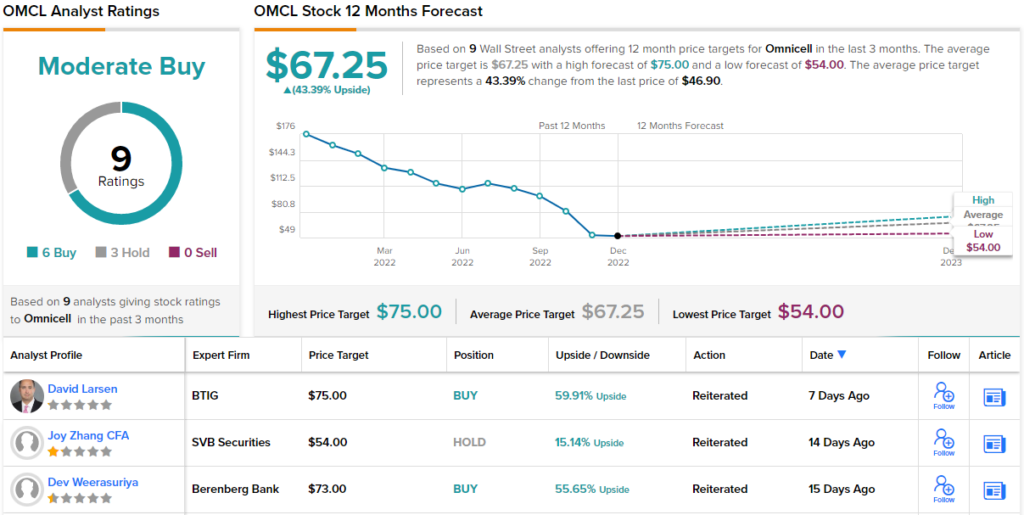

Berenberg Bank analyst Dev Weerasuriya sees the current drop in Omnicell’s share price as an opportunity for investors, saying the shares are “oversold” and to “buy the reset in expectations.” He also notes other favorable aspects.

“Pharmacy directors and CIOs continue to view pharmacy automation as a long-term priority and reiterated that OMCL’s positioning in the duopoly market remains unchanged,” Weerasuriya explained. “In our view, although the outlook somewhat diminished, the sell-off is overdone, presenting a resounding buying opportunity… We also believe that OMCL remains an attractive buyout candidate, providing downside protection for long-term investors as well.”

Weerasuriya goes on to give OMCL shares a Buy rating and sets his price target at $73, implying a one-year upside potential of 56%. (To watch Weerasuriya’s track record, click here.)

This stock has 9 recent reviews from the Street’s analysts, including 6 Buys and 3 Holds, for a Moderate Buy consensus rating. Shares are selling for $46.90 and their average price target of $67.25 suggests that the stock has a gain of 43% lying ahead. (See Omnicell’s stock forecast at TipRanks.)

Special end-of-year offer: Access TipRanks Premium tools for an all-time low price! Click to learn more.

Surgalign Holdings (SRGA)

Last on our list is Surgalign, a medical device firm that designs and markets a line of devices for surgical and non-surgical treatment of spinal ailments and damage. The company has a global reach, with offices in Illinois and Germany.

Surgalign has been facing a long-term decline in revenues, tracing back to the start of the COVID pandemic. Social distance restrictions imposed at that time, along with other anti-COVID precautions, depressed demand for elective surgeries and in-patient surgical procedures. The top-line drop-off remains visible, and the company showed $20.2 million in revenues in 3Q22. This total was down almost 2% from the year-ago period. Surgalign also lowered its full year 2022 revenue outlook,

The company’s earnings fared somewhat better. Surgalign typically posts a net loss, but the 3Q22 adj. loss, of $1.78 per diluted share, represented a 36% y/y improvement over the $2.81 net EPS loss from one year prior.

Over the course of 2022, Surgalign has been burning cash. The company reported $51.3 million in liquid assets at the end of 2021, but that was down to $29.3 million as of June 30 this year, and was down further to $13.8 million as of September 30.

The bears have been out in numbers for this name in 2022; the shares have lost 93% of their value throughout the year. Swayampakula Ramakanth, who covers this medical device firm for H.C. Wainwright, is careful to point out the reasons that the stock is down so far: a combination of high leverage and results that missed the forecasts. Yet he also believes the stock is now “significantly undervalued and provides an attractive entry point for long-term investors.”

“We believe the stock is oversold,” Ramakanth went on to say. “On December 16, SRGA was trading at a forward enterprise value-to-sales (EV) ratio of only 0.2x compared to an industry average EV-to-sales ratio of approximately 3.0x. Furthermore, we believe that the market has yet to appreciate the changes brought about by Surgalign’s management or recognize the growth opportunity the revamped company has in the high-growth spine market. We believe that with ongoing restructuring and positioning the company could become one of the leading digital health solution providers in the growing spine surgery market. In our view, Surgalign has a solid foundation to turn the business around and SRGA is a value Buy with near-term growth opportunity.” (To watch Ramakanth’s track record, click here.)

This is an upbeat take, and it backed up the analyst’s Buy rating. His price target, of $3.50, implies a robust one-year share appreciation of 136%. It has been rather quiet on the SRGA review front over the past 3 months; currently, Ramakanth’s is the only recent analyst review on file. (See Surgalign’s stock forecast at TipRanks.)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.