The fact is, investors get into the game to make money. But let’s get one thing straight: finding the right investment is not an easy task. Recognizing the right investment is the hard part. Ask three investors what defines a top stock pick, and you’ll get three different answers. After all, everyone interprets the data in their own way.

This is where the TipRanks Smart Score comes in. The Smart Score tool analyzes 8 separate data factors for every stock and combines them into a single number, based on the likelihood that the stock will outperform in the coming year. The higher the Smart Score number, the better the stock’s prospects. It’s a tool that will help you find the shovel ready stocks, the ones that will for you right away.

We’ve taken the first step. Setting the filters on the Smart Score tool to show us only those stocks likely to outperform, and refining the search to keep only those with a ‘Strong Buy’ analyst consensus rating, we found three stocks that are good to go. Let’s take a closer look.

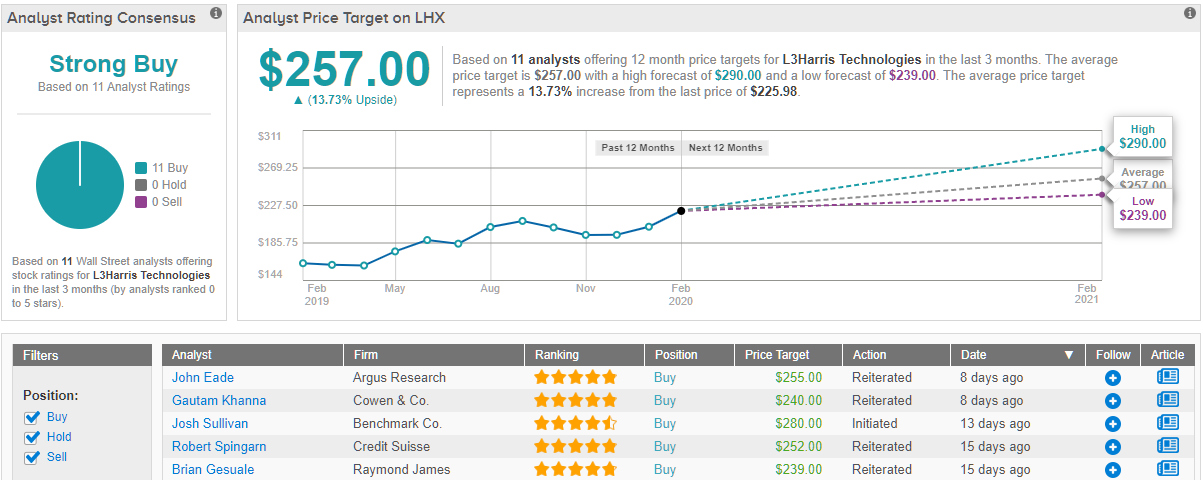

L3Harris Technologies (LHX)

Our first pick is a large-cap defense stock. The defense industry never lacks for contracts, and defense stocks have long been considered safe portfolio additions. L3Harris is fair example of the breed. Shares have gained 41% over the past 12 months, and for shareholders, the company supplements those gains with a modest 1.31% dividend.

LHX started trading as an independent ticker in July 2019, after forming through the merger of L3 Technologies and Harris Corp. The move has put the company in a strong position. Starting 2020, the company showed $824 million in available cash, up 240% from the end of 2018. Looking ahead, management guides toward a 5 to 7% revenue growth from last year’s levels, and projects non-GAAP EPS of $11.35 to $11.75 for the current year.

Finishing 2019, LHX reported $2.85 in EPS, 3.6% over the estimates, and up 28% year-over-year. Revenue, at $4.83 billion, was a more modest half-percent over the forecast. The strong quarter was supported by 12% gains in the Space and Airborne Systems segment, and 10% gains in Communications Systems.

On the Smart Score, LHX earns its 10 with strong showings from the financial bloggers and the news sentiment. In both factors, the stock scores 100%, indicating that financial commentators and journalists are bullish on the company. The simple moving average, a ratio of the 20-day to 200-day averages, is trending positive.

LHX’s strength prompted 5-star analyst Josh Sullivan, of Benchmark, to initiate coverage earlier this month with a Buy rating. Sullivan gives the stock a $280 price target, implying a 22% upside potential.

Supporting his upbeat outlook on the stock, Sullivan writes, “In the first six months of the LLL/HRS merger, revenues grew 10% y/y, margins increased ~220 basis points, working capital days decreased by 8, and merger integration delivered $65M of net synergies ($15M higher than expected). All of which puts LHX on a path to achieve $180M net savings by 2020, and likely exceed long-term goals of $300M.” (To watch Sullivan’s track record, click here)

LHX has built its Strong Buy consensus rating on solid performance which has attracted 11 buys in the last three months. This stock is selling for $225.98, so the $257 average price target implies an upside of 14%. (See L3Harris stock analysis at TipRanks)

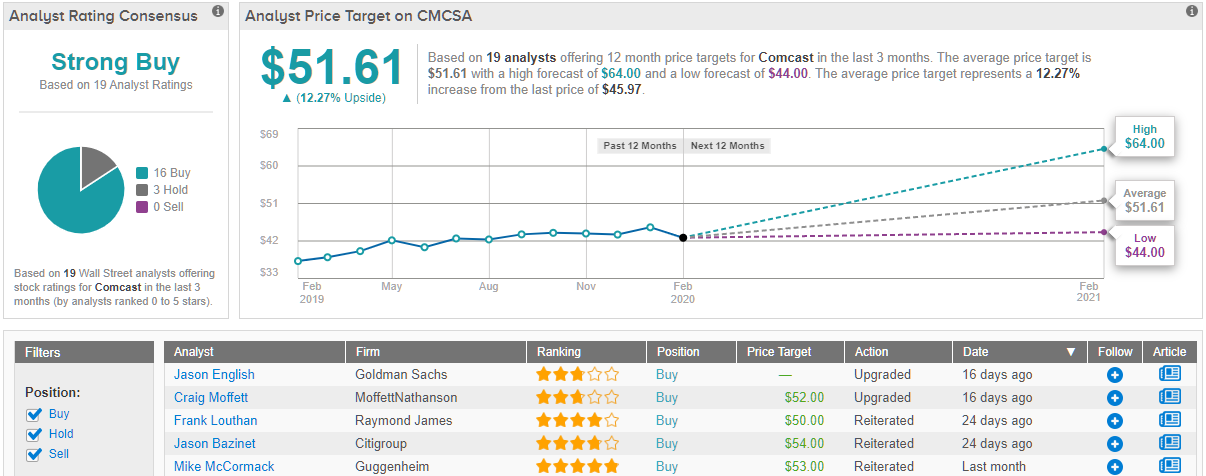

Comcast Corporation (CMCSA)

Comcast is a giant of the cable TV industry, a dominant telecom player with a $210 billion market cap and over $94 billion in annual revenues. The size is based on is solid position in the industry – Comcast is the second largest broadcast and cable company in the world, and the US’ largest internet and cable provider.

The company holds a solid 9, indicating outperformance in the coming year, from the Smart Score, with strong positive signals form hedge activity, technical, and fundamentals. Hedge funds have been increasing their purchases of CMCSA in the past quarter, to the tune of 2.05 million shares. Technical factors, such as the 24.59% 12-month momentum, and fundamentals like the 16.92% return on equity, also point to CMCSA as a buying proposition. Adding to the stock’s allure, shares are up 24.5% in the past 12 months.

The fourth quarter was strong for CMCSA in earnings and revenues. Both indicators beat the market expectations. EPS came in at 79 cents, compared to a forecast of 76 cents. Revenues were $28.398 billion, about 1% better than expected. Better yet, the company added significantly more high-speed internet customers than had been projected for the quarter.

A sharp drop in the NBCUniversal segment pushed the stock down after the quarterly release. That segment saw the flop of the much-hyped ‘Cats’ movie at the box office, along with a tepid unveiling of NBCUniversal’s Peacock streaming service. The online streaming segment is getting crowded, with entrants from Apple, Disney and HBO joining Peacock in challenging Netflix.

On a bright note for investors, CMCSA raised its dividend in Q4, from 21 to 23 cents per quarter. This marks the third increase in the past three year for CMCSA’s dividend payment. The new annualized payment, 92 cents, gives a yield of 2%, in line with the market average. The payout ratio is only 29%, indicating that the company can easily sustain the payment based on current corporate income.

Looking at Comcast’s prospects going forward, 4-star Benchmark analyst Matthew Harrigan sees reason for optimism. He writes, “2H 2020 NBCUniversal results will benefit from i) Olympic and political advertising at broadcasting, ii) film product that includes Minions: The Rise of Gru and a new Fast and Furious installment, and iii) the new Super Nintendo World attraction opening following 1H20 pre-opening costs at Universal Studios Japan.”

Harrigan reiterates his Buy rating, based on the projected strength of 2H20. His $64 price target indicates a strong 38% upside. (To watch Harrigan’s track record, click here.)

Benjamin Swinburne, 5-star analyst with Morgan Stanley, sees fundamental strength in Comcast, and cites the company’s core business in recent note: “Comcast cable wrapped up a strong ’19, delivering YoY acceleration in broadband net adds with cable FCF up nearly 20% YoY. This momentum should continue in ’20 with mobile growth also accelerating.”

Swinburne also maintains his Buy rating here, and sets a $53 price target. His target implies room for 14% upside growth. (To watch Swinburne’s track record, click here)

With a $45.97 current share price, and a $51.61 average price target, CMCSA has an 11% upside potential. The stock’s Strong Buy analyst consensus is based on no fewer than 16 Buy ratings, against just 3 Holds. (See Comcast stock analysis at TipRanks)

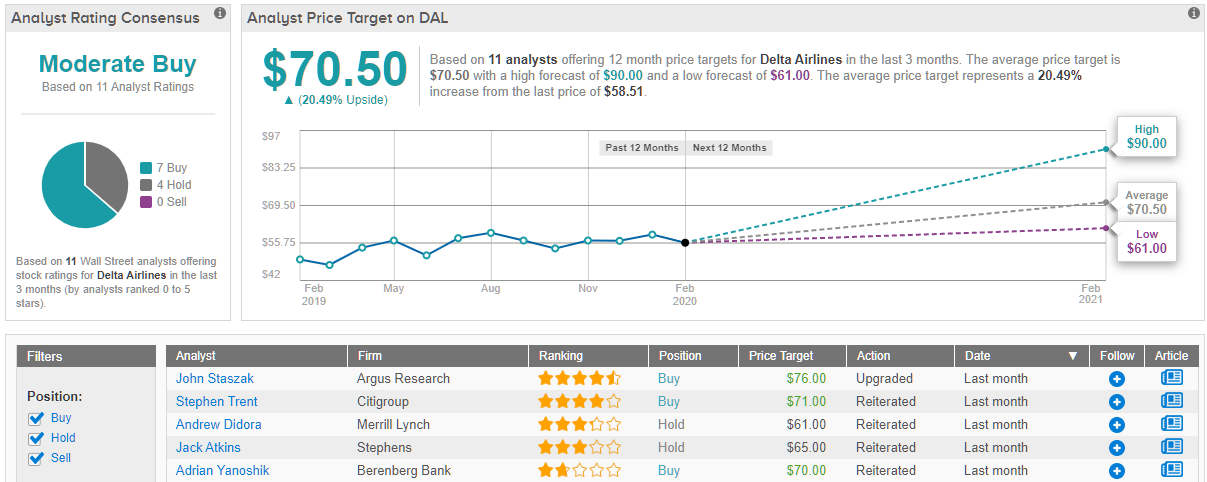

Delta Airlines, Inc. (DAL)

We’re writing about corporate giants here, and Delta is no exception. This $37 billion company is the world’s second largest airline, operating out of nine hubs, with the chief being in Atlanta, Georgia. Including its subsidiaries and regional feeder airlines, Delta operates of 5,400 daily flights to 325 destinations in 52 countries. The company saw $47 billion in revenue for 2019.

Delta offers investors a 17% share return over the past year, underperforming the general markets, but a solid 2.76% dividend yield, higher than the average among its S&P 500 peers. The quarterly payment was last raised in mid-2019, to 40.25 cents per share. The company has a 20-year history of dividend reliability, typical among index stalwarts.

In Q4 2019, DAL reported $1.70 EPS, up 31% year-over-year. Revenue was $11.44 billion, for a 6.5% year-over-year gain. A 6% gain in passenger revenues helped power the strong quarter, despite a 4% increase in operating expenses. The company credited overall trends of cheaper fuel and high demand for improving top- and bottom-line trends in the quarter. Delta also benefits by not having any Boeing 737 MAX aircraft in its fleet; the MAX has been grounded since March, for safety reasons.

Delta’s perfect 10 Smart Score rests mainly on blogger opinions, news sentiment, and positive hedge activity. The first of these three are strongly positive, 91% for the financial bloggers and 83% from the journalists. Delta has been getting very good press in recent weeks. At the same time, a set of 20 major hedge funds has increased holdings of the stock by 1.69 million shares in Q4. All three of these indicators point toward growing investor confidence in the shares.

Reviewing DAL for Berenberg, Adrian Yanoshik writes, “Delta Air Lines gave investors worried about its unit costs and overall industry overcapacity in 2020 some reassurances. We still believe the shares trade at a compelling entry point into a US airline that generates a top-tier ROIC in the mid-teens and robust free cash flow…”

Yanoshik gives the stock a $70 price target, suggesting an upside of 20% and supporting his Buy rating. (To watch Yanoshik’s track record, click here)

The stock’s Moderate Buy consensus is based on 7 Buys and 4 Holds given in recent weeks. Shares sell for $58.51, and the $70.50 average price target suggests an upside of 20%. (See Delta stock analysis at TipRanks)