While countries are taking different approaches in combating the rapid spread of the coronavirus, the disruption is everywhere, and is permeating almost all aspects of daily lives. The markets have plunged alarmingly, with businesses and industries reeling from the fallout. This, naturally, begs the question: Is a recession on the way?

While the circumstances are entirely different from the previous recession – in 2008, the recession was brought on by a banking and housing crisis, as opposed to today’s unforeseen coronavirus pandemic – the results could ultimately have the same impact on the economy.

With this in mind, RBC’s Mark Mahaney has been assessing the effect a recession could have on the names under the investment firm’s coverage. While some are already feeling the financial impact, the 5-star analyst tells investors that there are three stocks in a particular that are set up well for such a scenario.

We ran Mahaney’s favorite stocks through Tipranks database to see if the rest of the Street’s take aligns with the 5-star analyst’s. The data revealed that in addition to boasting Buy ratings, all three have the potential for double digit upside in the next twelve months. Let’s take a deeper look.

Amazon (AMZN)

Internet retail behemoth Amazon is under pressure these days, but not because its business is under duress due to the outbreak’s negative effect. On the contrary, it is in extra demand. In a macabre sort of way, people staying in is a good turn of events for Amazon. As shoppers are reluctant to venture out into crowded spaces, and as stores find it increasingly difficult to provide concerned consumers with adequate supplies, the public is turning to a company extremely well set up to deliver product on time, with one day delivery services and an almost unrivalled logistics infrastructure.

You could even make the case that should the dreaded scenario of a global lockdown occur, Amazon could further benefit. Mahaney thinks so, too, and reckons Amazon should be one of the companies to come out unscathed from a recession as it is more resilient than ever before.

The analyst expounded, “Amazon maintained one of the most consistent Revenue growth rates throughout the period of 2007 to 2009 (see later exhibit). We would argue that Amazon may be more recession resistant today than during the GFC for three reasons: i. AMZN’s retail sales have skewed materially away from consumer discretionary spend towards consumer staples; ii. Its well-established Prime subscription plan likely translates into more consistent customer spend; iii. The material rise of AWS over the last decade has substantially reduced it cyclical exposure – given the technology / cost advantage of Cloud computing.”

With this in mind, the 5-star analyst stayed with his Outperform rating on Amazon. From current levels, investors could be taking home a 60% gain if Mahaney’s $2,700 price target is reached within 12 months. (To watch Mahaney’s track record, click here)

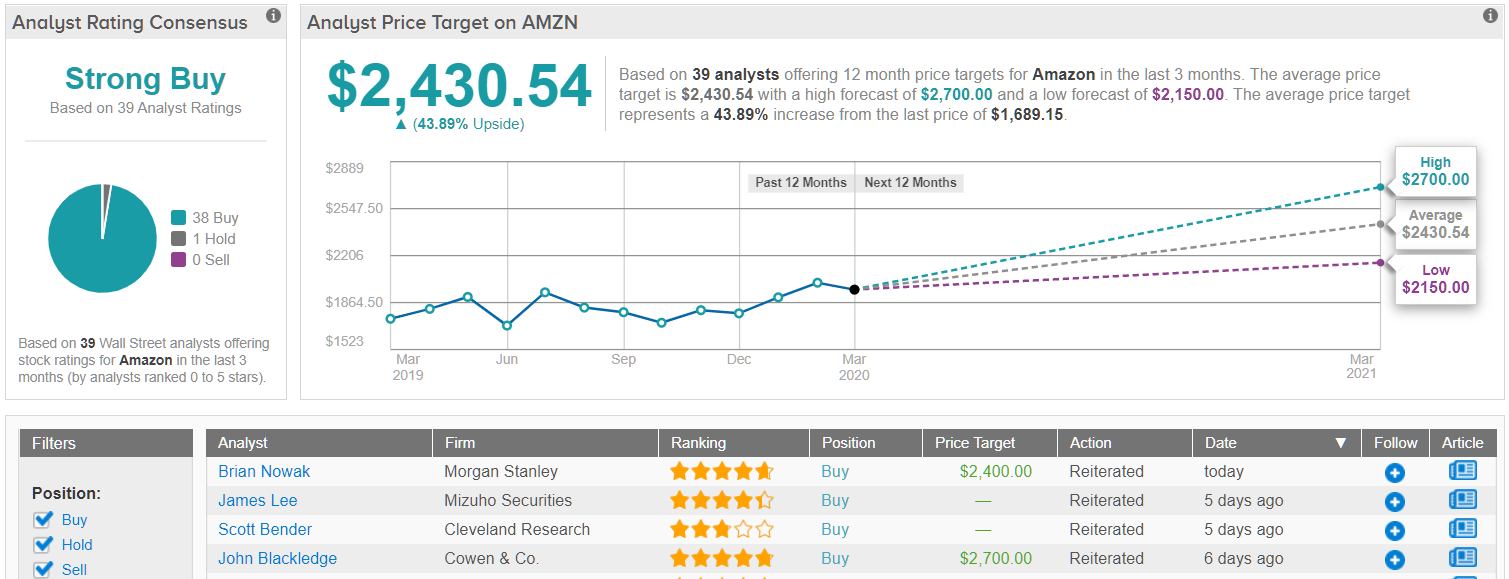

The Street concurs. Out of the 39 analysts tracked over the last three months, 1 recommends a Hold, while the rest say Buy, making the consensus rating a Strong Buy. The average price target hits $2,430.54, and suggests upside potential of nearly 44%. (See Amazon stock analysis on TipRanks)

Netflix (NFLX)

From the A in FAANG, we move one step forward to the N. In a similar manner to Amazon, Netflix has outperformed the broader market since the outbreak began. While the streaming giant is down by 9% year-to-date, it has taken less of a beating than the S&P 500’s 26% drop.

The case for Netflix’s recession proof status is a simple one. Netflix’s army of global subscribers number 167 million, paying a combined $20 billion for the service, way more than for any one of its rivals. This paved the way for a $15 billion outlay on content last year, with more to come in 2020. The heaps of new content should increase the amount of subscriptions, leading to more revenue which gets reinvested in new offerings, leading to additional subscribers and round it goes. It’s a simple, yet very effective formula that has worked so far.

While other analysts have pointed out that due to Netflix being a subscription based service, it won’t benefit from people staying in, Mahaney begs to differ. “Netflix offers safe at-home entertainment amid public concerns about physical exposure to large groups, such as at movie theaters,” he commented.

The analyst added, “Netflix’s high-value, low-cost value proposition and subscription-based model likely sets the company up for a relatively stable revenue stream. Netflix’s revenue growth was one of the most stable throughout the 2007-2009 Great Recession… Our long thesis remains very much intact with strong Global Sub Adds, robust ex-FX Global Streaming growth, rapidly ramping Op Margins, and improving FCF.”

Based on all of the above, the 5-star analyst kept his Outperform rating as is, along with a $420 price target. The implication? Possible upside of a further 40%.

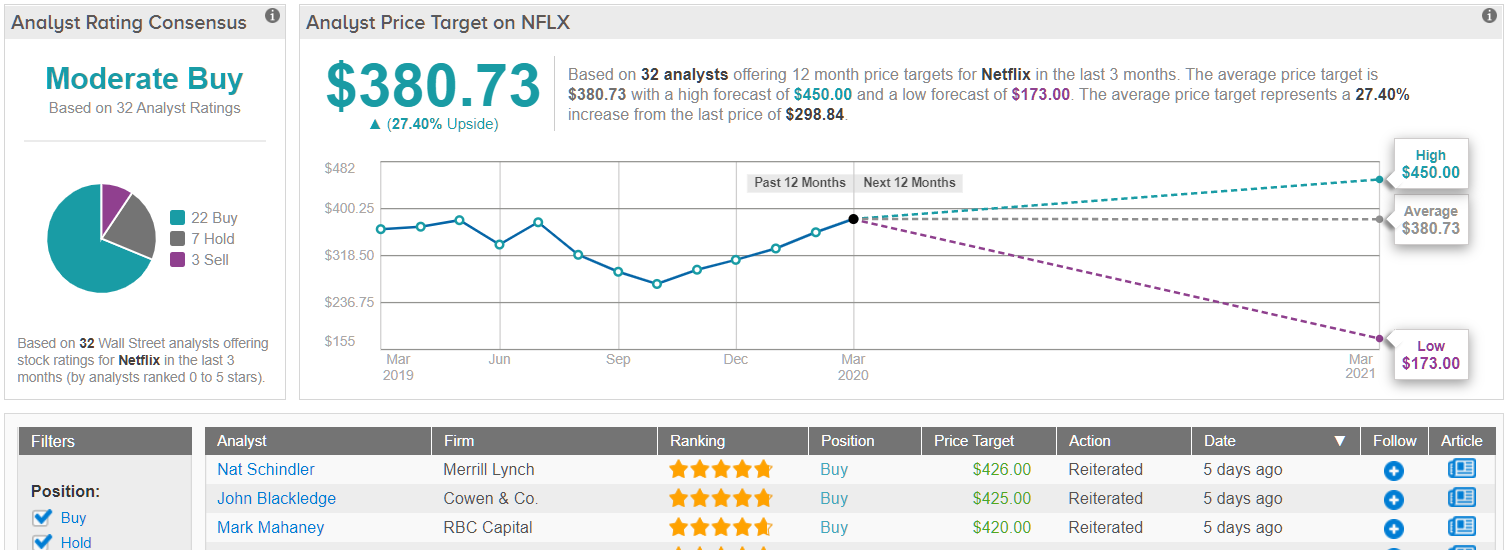

Looking at the consensus breakdown, 22 Buys, 7 Holds and 3 Sells add up to a Moderate Buy analyst consensus. The potential upside comes in at 27%, should the average price target of $380.73 be met in the months ahead. (See Netflix stock analysis on TipRanks)

Spotify Technology (SPOT)

In a similar vein to Netflix, Spotify’s ascent has disrupted a whole industry. As the music business belatedly came to grips with the impact of the internet and mp3 file sharing, the music streaming service’s almost bottomless offerings of new, old and rare music has been a complete game changer.

The company’s latest quarterly report, though, was a mixed affair. Revenue of €1.86 billion came in 2% below the Street’s estimate, with the shortfall blamed on lower than expected ARPU (average revenue per user). The bottom line disappointed, too, as EPS of -€1.14 missed by €0.78. On the other hand, gross margins of 25.6% landed ahead of the Street’s call for 25.2%, and total MAUs (monthly average users) grew 31% year-over-year to 271 million, outperforming the high end of the company’s guidance.

Mahaney notes that 90% of Spotify’s revenue comes from premium subscriptions. The company posted a record-high 28 million premium subsriber net adds in FY19 and a record-low 4.0% churn in Q4, which the analyst thinks “underscores the robust growth and quality of its revenue.”

Additionally, Mahaney recently hosted Spotify CFO Paul Vogel at the company’s virtual Rally in the Alley. According to the analyst, Spotify management believes that most likely, consumer demand for music streaming will not be adversely impacted by COVID-19. In fact, the company may possibly benefit from people staying away from outdoor activities and opting instead to stay home and stream

Therefore, Mahaney is convinced and remains with the bulls. “Our view is unchanged. User/Subscriber metrics are strengthening (thanks to product improvements & Podcasting), Gross Margin remains stable/stagnant, and Op Losses are growing because of Podcast investments. We view these investments as wise and see accelerating MAU/Sub metrics as leading indicators,” the top analyst said.

Unsurprisingly, Mahaney reiterates an Outperform rating on Spotify whilst staying with his $195 price target. Investors will be pocketing gains to the tune of 66, should the figure be attained in the coming year.

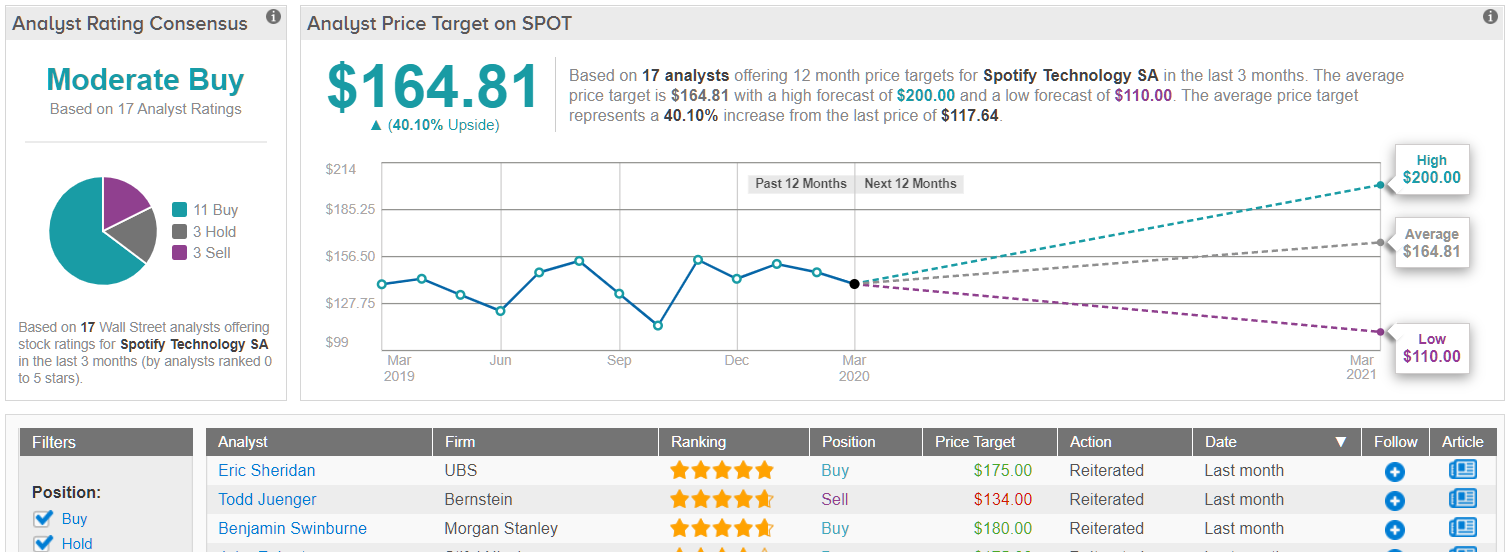

Overall, the bulls currently have the edge; 11 Buys, in addition to 3 Holds and 3 Sells, coalesce into a Moderate Buy consensus rating. It doesn’t hurt that its $164.81 average price target puts the potential twelve-month rise at 40%. (See Spotify stock analysis on TipRanks)