If you thought the digital payments giant was about to slow down on its global shopping spree, then you are sorely mistaken.

Yesterday, PayPal (PYPL) announced its biggest acquisition yet, with the purchase of discount discovery tool Honey Science Corporation, for $4 billion. This continues an ongoing trend, as the digital payment processor has been gobbling up new companies over the last couple of years. A quick, though inconclusive, list includes European fintech start up iZettle, artificial intelligence start-up Jetlore, payment distribution company Hyperwallet and recent acquisition, Chinese payments provider GoPay. We could go on…

The new addition of Honey to its set of ever-expanding tools, puts Paypal alongside consumers’ shopping trolley/basket way before the checkout queue.

Honey is mostly known for its add-on browser and mobile app that help consumers make savings in online purchases. By downloading the free browser extension, it immediately searches the web for the best online offers while you shop. Alongside the browser, Honey also offers a growing number of products and services, including price tracking tools, an offers and rewards program, and a virtual shopping assistant. With roughly 30k merchant brands on board (i.e. Amazon), the company has generated over $1 billion savings for its users over the last year.

4-star Rosenblatt analyst Kenneth Hill was caught off guard by the recent announcement, noting, “We had been expecting some M&A activity on the consumer side but were a little surprised by the size and online focus of the transaction. That said, this makes strategic sense to us… finding increasingly differentiated ways to monetize all sides of a robust ecosystem through innovative technology. More specifically, we note that Honey’s $100mn in revenue for 2018, growing at 100%, is a nice building block as Honey joins the PayPal ecosystem.”

The purchase resonates with Hill, who reiterated a Buy rating on PayPal stock, along with a 128 price target, which implies about 25% upside potential from current levels. (To watch Hill’s’s track record, click here)

Further adding to the bulls’ charge is 5-star Nomura analyst Bill Carcache, who believes PayPal has “the greatest optionality in payments.” The analyst points to PayPal’s recent acquisition of GoPay as a move which opens up opportunities in cross border retail, and further positions PYPL for more partnerships with other Chinese financial and technology companies. Carache said, “PYPL’s share of payment network volumes has quadrupled over the past decade, and we expect these share gains to persist with PYPL’s TPV (third party verification) (excluding Venmo and EBAY) growing >2.5x faster than the payment networks.”

With this in mind, Carache reiterated a Buy rating alongside a price target of $139, implying a surge of more than 33% over the next twelve months. (To watch Carache’s track record, click here)

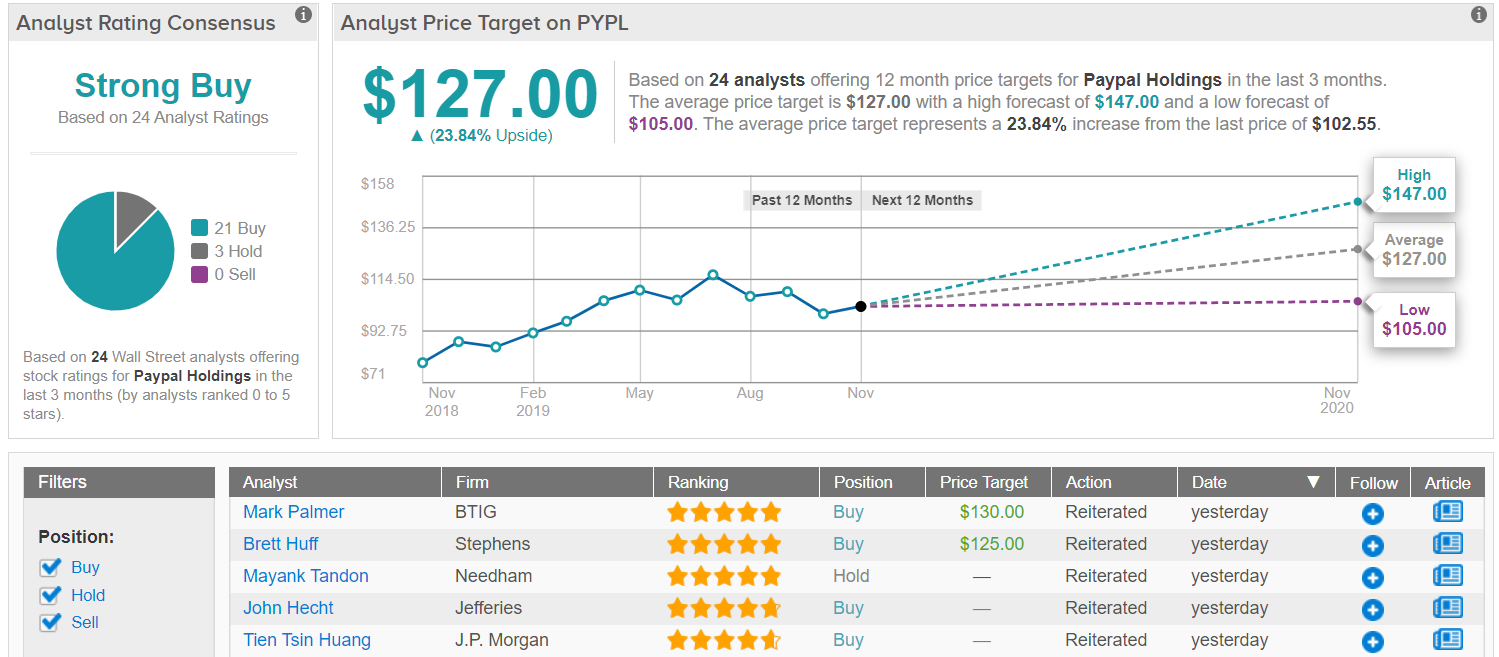

Overall, the Street thinks PayPal stock is trading at a discount right now. With 21 Buys and 3 Holds, the consensus among analysts is that the fintech leader is a Strong Buy. Its $127 average stock-price forecast implies 24% upside potential from its current price of $102.55. (See PayPal stock analysis on TipRanks)

Discover new investment ideas by visiting TipRanks’ Daily Stock Ratings, and follow the latest buy and sell recommendations of top Wall Street analysts. Try the Daily Stock Ratings tool here >>