Twitter Inc. (TWTR) reported a first-quarter loss after a profit last year, while revenue beat market expectations and user growth soared.

The stock dropped 6.6% to $29.04 in early U.S. trading. Twitter posted a $8 million loss in the first quarter, or a penny per share, and above market expectations of two cents per share.

Total revenue increased 3% to $808 million, above analysts’ estimates of $776 million, as more people than ever logged on to Twitter to learn about the coronavirus pandemic, the social media company said. Average monetizable daily active usage surged 24% in the first three months of the year, compared with the same period last time, representing the highest year-on-year growth rate to date.

“Revenue was up reflecting a strong start to the quarter that was impacted by widespread economic disruption related to COVID-19 in March,” said Ned Segal, Twitter’s CFO. “We are shifting resources and priorities to increase focus on our revenue products and reduce expense growth, ensuring our resources are allocated against our most important work. Revenue product has been elevated to our top company priority, as the current environment validates and creates even more urgency around delivering more direct response ad formats.”

Total advertising revenue in the quarter increased by about $3 million to $682 million compared with the same period last year. However, between March 11 and March 31, advertising revenue fell by about 27% year-on-year.

“The downturn we saw in March was particularly pronounced in the US, and advertising weakness in Asia began to subside as work and travel restrictions were gradually lifted,” Twitter said.

The San Francisco-based company said it won’t be able to provide quarterly revenue or operating income guidance for the second quarter, citing the unprecedented uncertainty and rapidly shifting market conditions of the current business environment.

However, Twitter disclosed some information on its expenses plans. Full-year 2020 total expense growth is projected to be “considerably” less than the 20% forecast at the beginning of the year, the company said. Second-quarter expenses are set to be meaningfully below the year-on-year growth experienced in the first quarter, and are likely to be closer to a year-on-year percentage growth rate in the low teens.

In addition, Twitter said that while it remained committed to building its new data center, recent developments and current IT supply chain constraints are likely to affect its timing. Furthermore, stock-based compensation expenses are expected to grow sequentially by 25% or more in the second quarter.

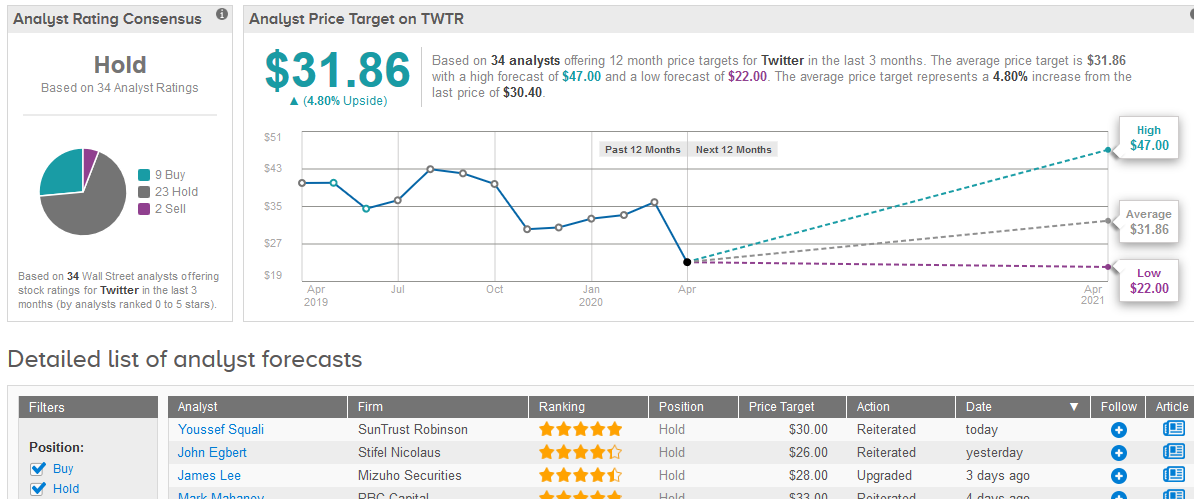

Wall Street analysts are sidelined on Twitter’s stock assigning a Hold consensus rating based on 23 Holds, 9 Buys and 2 Sells. The $31.86 average price target projects 4.8% upside potential in the coming 12 months. (See Twitter stock analysis on TipRanks) .

Twitter ended the quarter with about $7.7 billion in cash, cash equivalents, and marketable securities. This included gross proceeds of $1 billion from a convertible note issuance in March related to its recent partnership with Silver Lake, which it will use in part to finance a stock repurchase of up to $2 billion over time, the company said.

Related News:

Facebook Shares Lifted by ‘Signs of Stability’ in Ad Revenue

Tesla Spikes as Quarterly Profit Takes Investors By Surprise; Musk Says Lockdown is ‘Key Risk’ to Biz

Boeing to Axe 16,000 Jobs as Coronavirus Throttles New Plane Demand