After a gloomy and restless year of investing in 2022, investors are looking to diversify into different markets to get some peaceful sleep in 2023. Even though the overall macro headwinds will continue during the next year, there are still hidden opportunities in different markets that can provide some cushion to investors.

Considering this, the TipRanks’ tools come in handy to choose stocks from different markets. One of its most reliable tools is the Smart Score, which measures the potential of the stocks to outperform the market.

Here, we have used this tool to pick two Australian stocks, Macquarie Group Limited (AU:MQG) and Woodside Petroleum Limited (AU:WDS). Both the stocks have high scores on the Smart Score tool and have Buy ratings from analysts.

According to this tool, stocks with a score of eight or more have a higher potential to outperform the market. Some of the parameters used to assign a score to the stock are analyst ratings, technical analysis, hedge fund activities, corporate insider transactions, and more.

Let’s have a closer look at these stocks.

Macquarie Group Limited

Macquarie Group is a multinational financial services group based in Australia. The group’s businesses include banking and financial services, asset management, commodities, and global markets, and capital markets solutions.

The company’s stock has been on a volatile journey in 2022, with negative returns of 16%. The downfall in stock prices is mainly due to narrow margins on net interest income for Australian banks. Also, rising inflation and tougher conditions in the housing market pose headwinds for the bank. However, for long-term investors, the share has given a return of almost 40% in the last three years. The overall business fundamentals remain stable, and the stock provides a good entry point at this level.

Macquarie Group reported a 13% increase in net profit of AU$ 2.3 billion in its half-year results for 2022. The group has also been able to drive more business outside Australia, as its international income contributed 72% of the total income in the first half.

The group has entered the second half with a positive outlook, as its financial metrics are well above the minimum requirements. The Group also remains committed to generating returns for its shareholders and declared an interim dividend of AU$3.0 per share with a yield of 4.07%.

Macquarie Group has a score of nine on the Smart Score tool. It implies that the stock is more likely to outperform the market.

Is Macquarie Stock a Good Investment?

According to TipRanks’ rating consensus, Macquarie stock has a Moderate Buy rating, based on six Buy and three Hold recommendations.

The average MQG target price is AU$194.07, which shows a change of almost 13% from the current price level.

Woodside Petroleum Ltd.

Woodside Petroleum is among the largest oil and gas companies in Australia, dealing in the production and exploration of petroleum.

Woodside’s stock is enjoying a gala time, driven by higher revenue and production numbers since its merger with BHP’s petroleum business was completed in June 2022. It has been trading up by almost 70% YTD. The company has also benefited from rising oil and gas prices globally.

In its third-quarter results announced in October 2022, the company posted 52% growth in its production and 70% growth in its revenue. It also increased its full-year production targets to 153–157 million barrels of oil as compared to the previously forecast range of 145–153 million barrels of oil.

The company’s positive outlook for its production, combined with merger synergies with BHP, still makes an attractive case for investors.

Woodside enjoys a ‘Perfect 10’ on the TipRanks Smart Score rating system.

Is WDS a Good Stock to Buy?

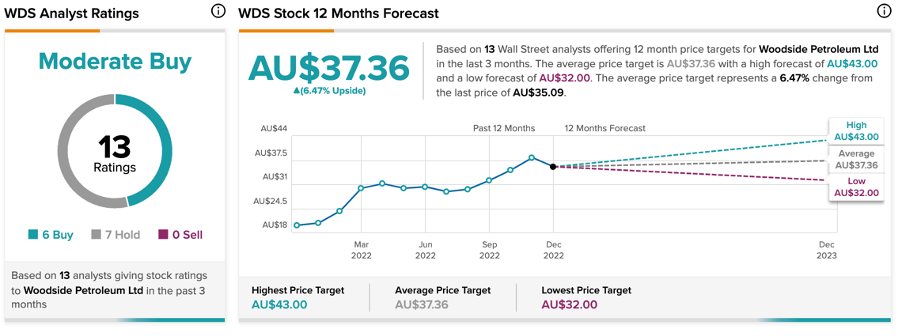

On TipRanks, WDS stock has a Moderate Buy rating, based on six Buy and seven Hold recommendations.

It has an average target price of AU$37.36, which shows a slight change of 6.5% from the current price level. The target price has a high forecast of AU$43 and a low forecast of AU$32.

Conclusion

The ongoing volatility in the stock markets has shaken investors’ confidence. Tools like Smart Score can guide investors during these tough times to compare stocks and choose a suitable one for their portfolio.