Utility stocks have always been known as safe investment options. These stocks are generally considered recession-proof as their product demand remains stable. Even though the industry is highly regulated, it has the benefits of profitability and higher dividends.

Today, we discuss two utility stocks from the UK market. Centrica (GB:CNA) and Shell (GB:SHEL) are among the leading players in the UK’s utility sector. These two companies have recently declared their results, and analysts remain bullish on their commitment to increasing shareholders’ returns.

Let’s have a look at the details.

Centrica PLC

Centrica is a leading utility company that provides electricity and gas solutions in the UK and Ireland.

The stock has been on an upward trajectory in the last year, with a return of 45.5%. The share price was well-supported by a solid operational performance during the year.

Last week, the company reported its preliminary results for 2022. The company posted higher adjusted earnings of £3.9 billion compared to £1.8 billion in 2021. Earnings were driven by higher gas and electricity production combined with rising commodity prices. The adjusted EPS per share jumped to 34.9p from 4.1p in the previous year.

Post-results, analysts have reiterated their Buy ratings on the stock, considering the company’s strong balance sheet and higher cash flow. Analysts were also impressed by the higher returns for shareholders, with a dividend of 3.0p in 2022 and an increase in the share buyback program to £550 million.

Is Centrica a Good Stock to Buy?

According to TipRanks, CNA stock has a Strong Buy consensus rating based on 11 Buy and one Hold recommendations.

The average target price is 131.5p, with an upside potential of 26.2%.

Shell PLC (UK)

Shell is a UK-based exploration company dealing in energy products such as fuels, oils, LPG, lubricants, etc. The company caters to 10% of the UK’s oil and gas needs. It also has a presence in more than 70 countries.

In early February, the company announced its Q4 results for 2022. The adjusted earnings for the quarter were $9.8 billion, pushed higher by the LNG trading portfolio. The LNG demand was boosted after Russia decided to cut off natural gas supplies in Europe. Overall production numbers were higher in this quarter due to reduced maintenance activities. The free cash flow for Q4 more than doubled to $15.5 billion compared to $7.5 billion in the third quarter.

Talking about shareholder returns, the company increased its dividend by 15% in the quarter and announced a $4 billion share buyback. The total dividend for 2022 was $1.04 per share.

What is the Prediction for Shell Stock?

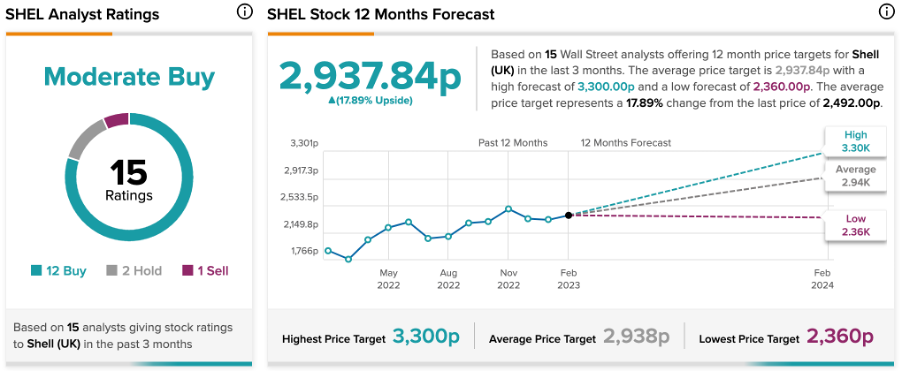

SHEL stock has a wide coverage on TipRanks, with a total of 15 recommendations, out of which 12 are Buy. Overall, the stock has a Moderate Buy rating.

The average target price for the stock is 2,937.84p, which shows an upside potential of nearly 18% from the current price.

Conclusion

Analysts are impressed by the strong results delivered by Centrica and Shell, along with the visible growth prospects. The dividend payments and newly announced share buybacks show that these stocks could be attractive additions during uncertain times.

Both CNA and SHEL have Buy ratings from analysts, with further upside potential in their share prices.