With so many variables in the company’s data, picking the right dividend stock is an arduous task. Well, we certainly make it easy for you with the help of TipRanks’ tools and database.

Modest dividend yields, stable dividend growth, and affordability to sustain the dividend payments are the three most important factors for a potentially safe stock. The yield is an important parameter but also a tricky one. It should be high, but not so high that the company is not able to sustain it.

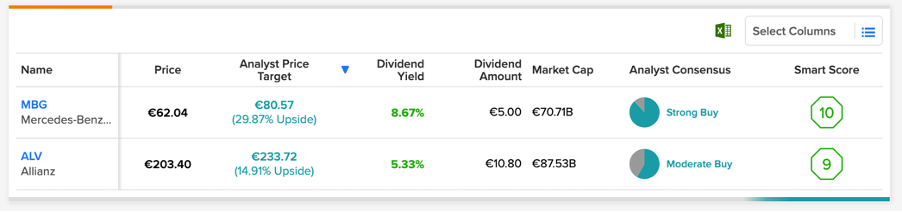

Therefore, we have picked up two German companies, Allianz (DE:ALV) and Mercedes-Benz Group (DE:MBG), that have dividend yields in the range of 5-10%.

Let’s discuss the stocks in detail.

Allianz

Allianz is a multinational financial institution, serving around 126 million customers worldwide. The company deals in products and services in insurance and asset management.

Based in Germany, Allianz is a market leader in the insurance space with a global presence. The company has a market capitalization of €86.6 billion.

Last month, the company declared its third-quarter results for 2022. The operating profit of €3.2 billion was 7.4% higher, driven by its property-casualty segment. The performance of the life and health business was less impressive. But the overall net income attributable to shareholders grew by almost 17% to €2.5 billion. The company is confident about its full-year results and has confirmed its guidance numbers. The operating profits for the full-year 2022 are expected to be around €13.4 billion.

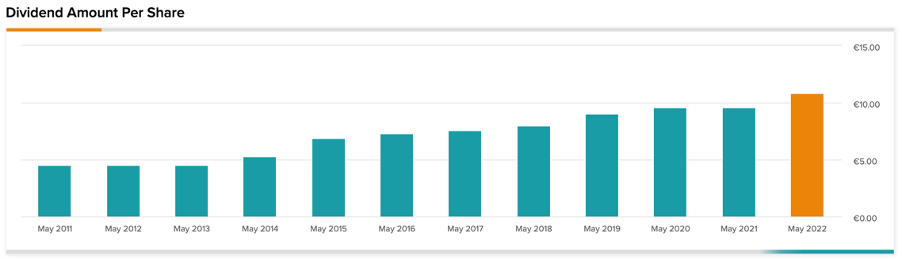

The dividend consistency and growth over the years have proved Allianz to be a gem for income investors. With the pandemic recovery and higher earnings growth, the company will continue to shell out such lavish dividends. The company has a dividend yield of 5.3%, much higher than its competitors.

Is Allianz Stock a Good Investment?

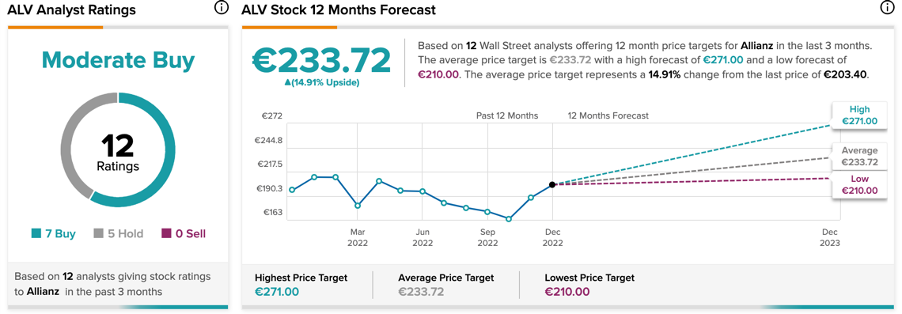

According to TipRanks’ analyst consensus, Allianz stock has a Moderate Buy rating, based on seven Buy and five Hold recommendations.

The ALV target price is €233.72, which represents a 15% change in the price from the current price level of €203.4. The price has a low and high forecast of €271 and €210, respectively.

Mercedes-Benz Group

Mercedes-Benz, the owner of well-known luxury cars, is among the most powerful automobile companies in the world.

Mercedes’ dividend yield of 8.67% makes it a winner stock for those looking for an extra boost of income. The company has increased its dividend payments five times in the last 10 years. The company believes in carefully planning its dividends so they can be consistent and stable over the long term.

The company’s focus on improving its margins rather than its sales volumes had driven its profitability in the last few years. This strategy has given an edge to the company against its competitors like BMW (DE:BMW). This was seen in its third-quarter results for 2022, where its earnings increased by 83% to €5.2 billion, supported by cost control measures and an effective pricing policy.

The stock has been trading down by 2.43% YTD. The stock has a low and positive P/E ratio of 2.8, which shows it is generating stable earnings but is undervalued.

Mercedes-Benz Stock Price Forecast

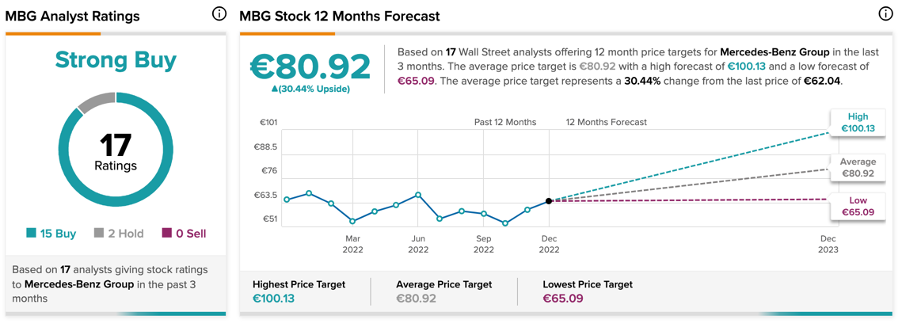

According to TipRanks’ analyst consensus, Mercedes-Benz stock has a Strong Buy rating, based on 15 buy recommendations.

The MBG price target is €80.92, which has an upside potential of 30.4% from the current price level. The price has a high forecast of €100.13 and a low forecast of €65.1.

Conclusion

Both Allianz and Mercedes-Benz stand tall on the three important pillars of a good dividend stock: a modest yield, consistent payouts, and earnings growth.

Special end-of-year offer: Access TipRanks Premium tools for an all-time low price! Click to learn more.