Manufacturing company Venture (SG:V03) and investment firm Keppel REIT (SG: AJBU) from Singapore are on an upward journey in their stock prices. Venture has gained 9%, and Keppel has grown by 18% since the beginning of January 2023. These stocks even surpassed the STI, the benchmark index of Singapore, which grew by 4.09% during the same period.

Here, we have used the TipRanks Stock Screener tool to list these based on certain criteria. Using this tool, investors can select the stocks of their choice based on different factors in seven different markets.

Let’s see what makes them the analysts’ favorites.

Venture Corporation Limited

Venture is a technology company that designs and manufactures products and solutions for various industries.

The company’s stock has been on a quite stable journey for the last three years and has gained 31%. This was mainly supported by the company’s operational performance, which was clearly reflected in its results.

In the last released results for the first nine months of 2022, Venture’s revenues grew by 28% to S$2.8 billion. The net profit of S$271.1 million also increased by almost 25%. The growth across all its domains helped it post such a solid performance. Moreover, the company’s diversified portfolio provided much-needed cushioning against geopolitical tensions.

Another highlight for the company is its healthy financial position with zero debt. This allows the company to grab strategic opportunities and expand to new heights.

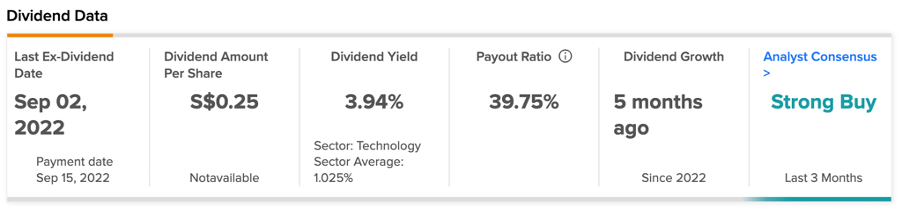

This also supports the company’s stable dividend payments at a yield of 3.9%, against the industry average of 1.02%.

Venture Share Price Target

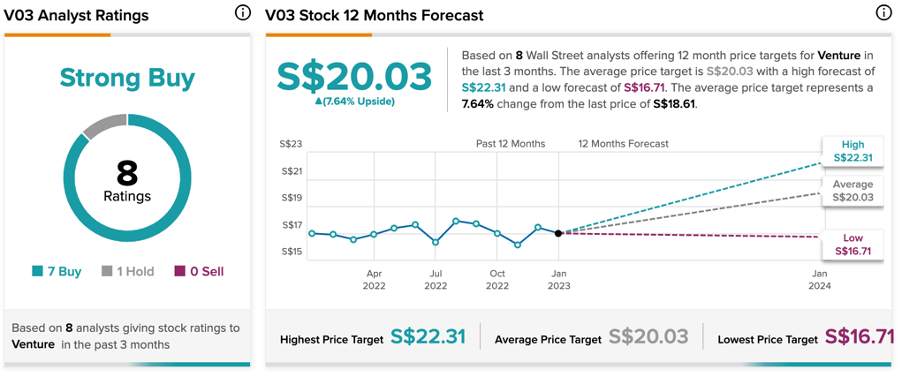

The average share price target for Venture is S$20.03, which is 7.6% higher than the current price level.

According to TipRanks’ rating consensus, the stock has a Strong Buy rating, with seven Buy recommendations.

Keppel DC REIT

Keppel is the first data center REIT in Asia. The company has a portfolio of real estate focused on data centers. The company’s primary objective is to generate healthy returns for its shareholders along with long-term growth from its investments.

After being almost flat in the last year, Keppel’s stock has gained 18.4% so far this year.

Last week, the company announced its annual results for 2022, with portfolio occupancy at 98.5%. The company’s data centers are in high demand as new supply remains tight due to government regulations. For the fiscal year 2022, the company’s revenue increased by 2.3% to S$ 277.32 million. The net property income also grew by 1.8% during the year.

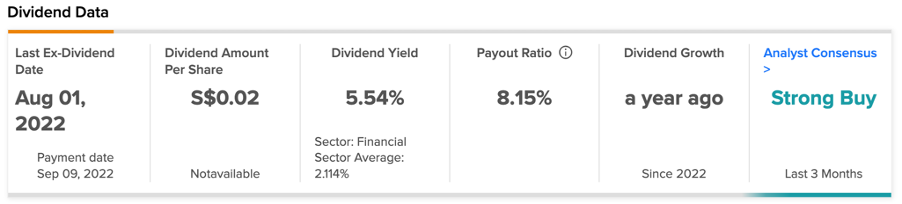

While analysts don’t forecast any significant upside in the share prices, the company’s higher dividends make up for it. The company has a dividend yield of 5.54%, compared to the sector average of 2.1%.

Keppel DC REIT Share Price Target

The stock has a Strong Buy rating on TipRanks, based on three Buy and one Hold recommendations. The target price of S$2.06 is lower than the current trading level.

Post its results, analyst Dale Lai from DBS has reiterated his Buy rating on the stock at a target price of S$2.35, with an upside of 11%.

Conclusion

Both Venture and Keppel have started the year on a happy note for their shareholders. Keppel’s has already posted good numbers in its annual results and is starting to gain more confidence from analysts.

Venture, on the other hand, is due to report its next earnings by the month’s end, and analysts are bullish for the same.