France-based Ubisoft Entertainment SA ($FR:UBI) announced that it has enlisted new advisors to explore various strategic alternatives to maximize value for its stakeholders. According to its update, the independent members of the board of directors will oversee this process. The company is implementing bold measures to transform the company amid growing investor concerns. In 2024, Ubisoft shares declined by over 40%.

Ubisoft is a video game publisher, famous for hit franchises like Assassin’s Creed, Far Cry, and Rainbow Six.

Ubisoft Explores Future Path

Ubisoft is exploring its future path to restructure the company, aiming to provide top-tier player experiences and improve operational efficiency.

In terms of operations, the company plans to implement substantial cost reductions. It now expects to reduce its fixed cost base by over €200 million by FY2025-26 compared to FY2022-23 on an annualized basis. Overall, the company expects net bookings of €1.9 billion for Fiscal 2024-25, marking a decline from €2.32 billion in the previous year. For Q3 FY2024-25, net bookings are expected to reach around €300 million, primarily due to weaker-than-expected holiday sales.

Additionally, the company delayed the release of Assassin’s Creed Shadows again, pushing it to March 20. The launch, originally scheduled for mid-November 2024, was first postponed to February 2025 in October. The company stated that this extra time will enable it to integrate valuable player feedback collected in the past few months and create optimal conditions for the launch.

Is Ubisoft a Good Stock?

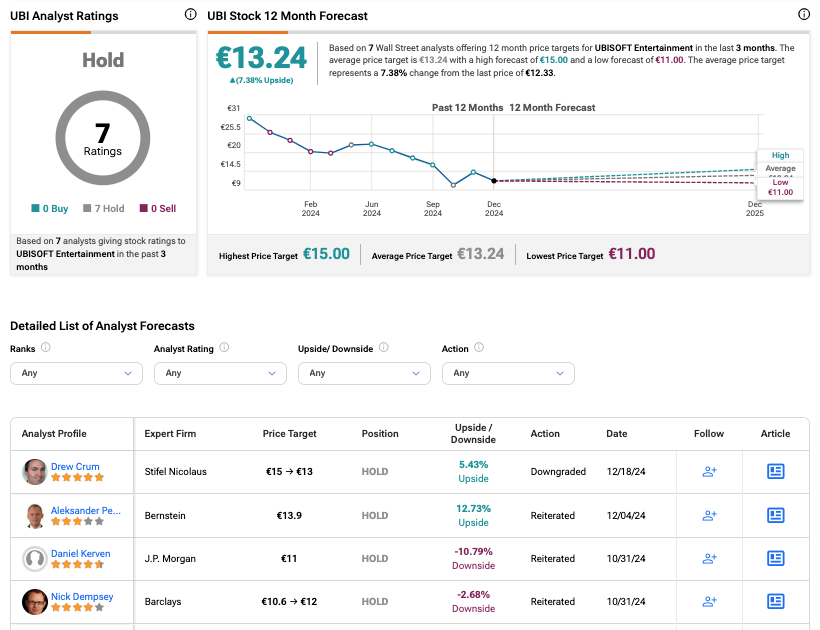

According to the TipRanks consensus, UBI stock has received a Hold rating based on seven Hold recommendations. The Ubisoft share price target is €13.24, which is around 7.4% above the current level.