UBS cut its rating on Expedia (EXPE) stock on Friday to Hold from Buy on concerns that the COVID-19 pandemic could have a lasting impact on consumer demand. Shares of the world’s largest online travel agency by bookings fell by 2.6%.

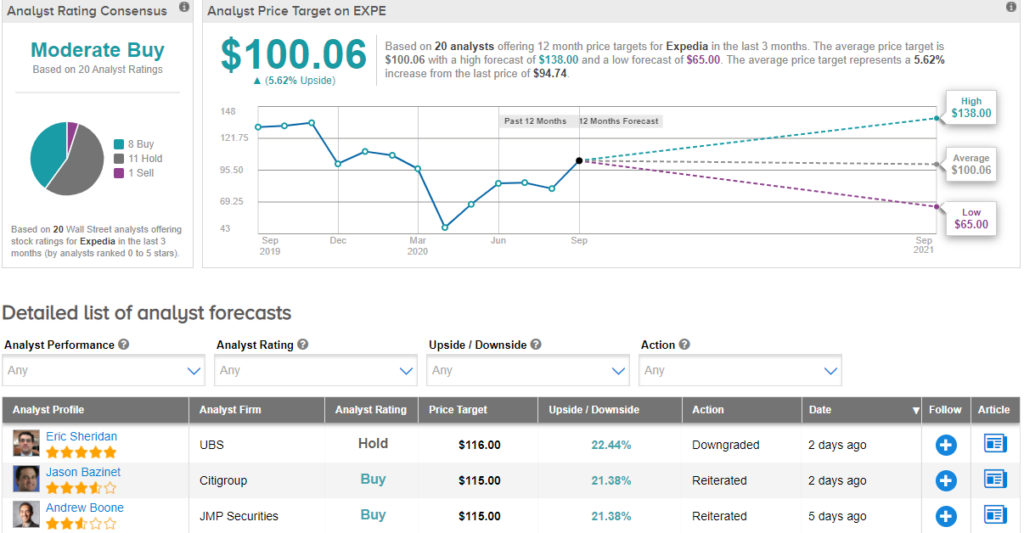

UBS analyst Eric Sheridan believes that Expedia’s risk/reward is not compelling at current price levels. In a note to investors, Sheridan cautioned that a second wave of the coronavirus and a delay in the vaccine could derail the normalization in demand. Despite the bearish view, the analyst raised his price target on the stock to $116 (22.4% upside potential) from $84.

Travel restrictions imposed by the governments across the world to contain the COVID-19 spread have been severely hurting online travel agencies. On July 30, Expedia reported that its 2Q revenues plunged 82% to $566 million and missed analysts’ expectations of $577 million.

The company posted adjusted loss per share of $4.09, significantly wider than the Street estimates of $3.40. Bottom-line results also compared unfavorably with the year-ago quarter’s adjusted EPS of $1.77. (See EXPE stock analysis on TipRanks).

Currently, the Street has a cautiously optimistic outlook on the stock. The Moderate Buy analyst consensus is based on 8 Buys, 11 Holds, and 1 Sell. With shares down 12.4% year-to-date, the average price target of $100.06 implies an upside potential of about 5.6% to current levels.

Related News:

Dave & Buster’s Drops In After-Hours As Sales Plunge 85%

GameStop Sinks 15% In Pre-Market On 2Q Miss

United Airlines Lowers 3Q Revenue Forecast As Travel Demand Fails To Return