Swiss banking giant UBS ($UBS) is close to a settlement with U.S. authorities over a legacy tax evasion case dating back to 2014, according to a Wall Street Journal report.

UBS is set to pay hundreds of millions of dollars to settle violations by Credit Suisse, which it acquired in 2023 as part of a state-backed rescue deal, in a case relating to American customers who evaded tax, the WSJ reported.

The news comes as Swiss regulators consider introducing stricter banking regulations to prevent a repeat of Credit Suisse’s demise.

UBS Wants to End Decade-Long Case

Credit Suisse pleaded guilty to aiding tax evasion in 2014 and agreed to pay $2.6 billion to settle a Department of Justice investigation that stretches back even further.

The Wall Street Journal notes that Credit Suisse promised to supply the Justice Department with details about the accounts it closed and where the money went next.

However, a 2023 Senate report said the bank had violated the terms of the 2014 plea bargain.

UBS set aside $4 billion for legal provisions as part of its rescue of ailing lender Credit Suisse to settle unresolved probes.

It wants to put an end to any outstanding issues relating to Credit Suisse, which includes reportedly having more Nazi-linked accounts during World War Two than it had previously disclosed, which the WSJ reported as an exclusive.

Analysts See UBS Upside

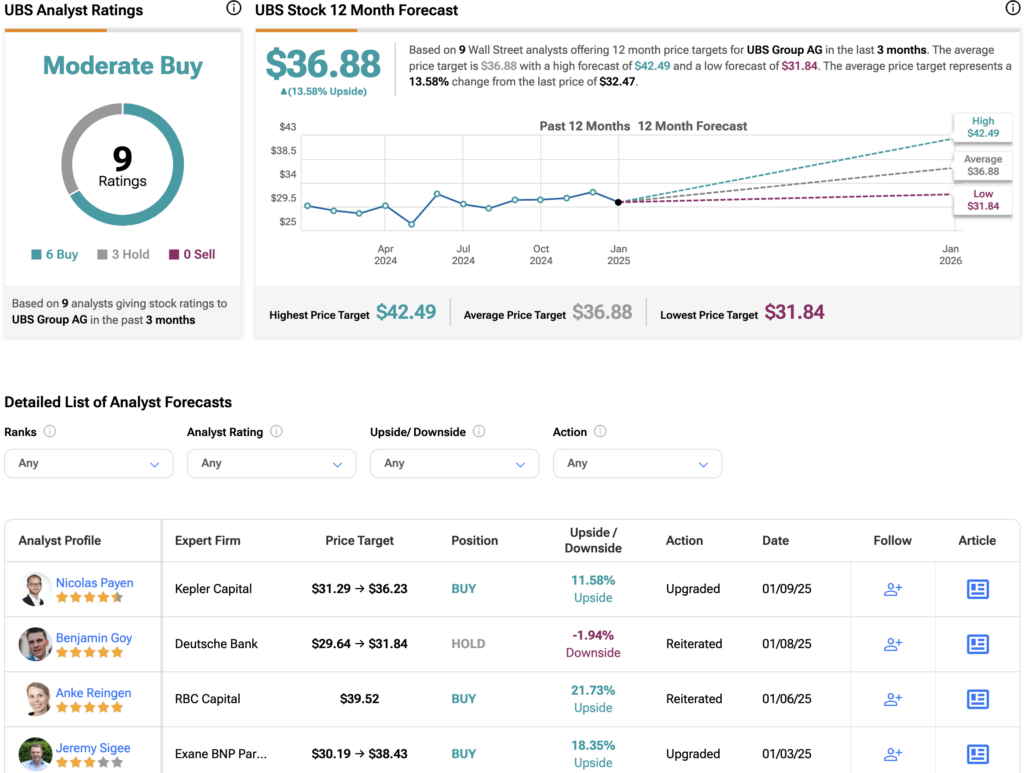

Drawing a line under legacy issues may be positive for the stock, and UBS has seen a number of upgrades from analysts at the start of the year. Kepler Cheuvreux analyst Nicolas Payen upgraded the stock to Buy from Hold, while Deutsche Bank analyst Benjamin Goy pushed his price target higher.

Meanwhile, Exane BNP Paribas analyst Jeremy Sigee upgraded the stock to Buy (Outperform) from Hold (Neutral), arguing that market worries about revisions to Swiss capital rules are overdone.

The release of capital from the bank’s foreign subsidiaries would “neutralize the most threatening element of the proposal”, the analyst said in a note.

Is UBS a Buy or Sell?

Overall, Wall Street has a Moderate Buy rating on UBS stock, based on six Buys, three Holds and no Sells. The average UBS price target of $36.88 implies over 13% upside potential from current levels. Shares of UBS have risen by more than 12% over the past year.