Specialty retailer Ulta Beauty (ULTA) has suspended its planned expansion into the Canadian market given the challenging business environment resulting from the pandemic.

Last year, the company announced its intentions to expand internationally starting with Canada. Even in July 2020, Ulta Beauty reiterated its plan to enter Canada in mid-2021 with a number of stores.

The company continues to see long-term growth prospects beyond the US market. However, it has decided to prioritize the growth of its US operations currently. Ulta Beauty now says it will invest in several initiatives to support the continued profitable growth in the domestic market.

These initiatives include expansion of its omnichannel capabilities, improvements to enhance guest experience and discovery, market share growth in key merchandising categories, increased loyalty and personalization efforts and further expansion of its store network.

Ulta Beauty stated, “Investments to support the expansion into Canada have largely been limited to early-stage infrastructure buildout and lease obligations for a small number of stores.” It expects to incur costs between $55 million to $65 million due to the suspension of its Canada growth plans. A majority of these costs will be recognized in the current fiscal year.

Yesterday, the company also disclosed that it repaid the $800 million of outstanding borrowings under its revolving credit facility. The company availed this credit facility in March as a precautionary measure and to enhance financial flexibility amid the COVID-19 outbreak.

Temporary store closures and weak traffic impacted Ulta Beauty’s performance in the fiscal second quarter (ended Aug. 1) and caused a 26.7% decline in comparable sales.

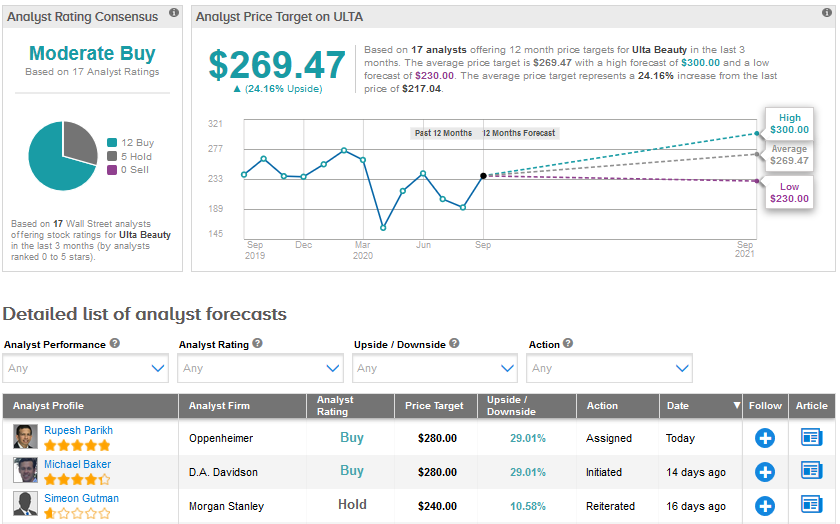

The Street is cautiously optimistic about Ulta Beauty and has a Moderate Buy consensus based on 12 Buys, 5 Holds and no Sell ratings. The stock has declined 14.3% so far in 2020. The average analyst price target $269.47 suggests a possible upside of 24% in the months ahead.

In reaction to the company’s decision to halt its Canada growth plans, Oppenheimer analyst Rupesh Parikh commented, “We believe the suspension of international growth is prudent in the current backdrop and could help the company better navigate profitability headwinds associated with e-commerce growth.”

“Consistent with our playbook, we believe investors should take advantage of pullbacks with ULTA shares and not chase strength. With second wave fears now taking hold of the US beauty trade again, we rank EL as our top pick and ULTA/SBH as appropriate for longer-term players.” Parikh has a Buy rating for Ulta Beauty with a price target of $280. (See ULTA stock analysis on TipRanks)

Related News:

Dollar Tree Resumes $800M Share Repurchase Program

Lululemon Resumes Share Buyback; Shares Rise 3%

KKR Snaps Up $755M Stake In Reliance’s Retail Unit; Street Is Bullish