Biopharma Ultragenyx (RARE), which focuses on rare and ultra-rare diseases, has announced a key strategic partnership with Japanese global pharma Daiichi Sankyo.

The deal grants Daiichi a non-exclusive license to RARE’s HeLa PCL and HEK293 mammalian cell AAV manufacturing system. Ultragenyx’s HeLa producer cell line (PCL) platform is intended to enable large scale AAV-based gene therapy product manufacturing that is highly reproducible, more consistent, and less expensive than other gene therapy manufacturing platforms.

In return, RARE will receive $125M cash and $75M equity (at $60/ share) upfront, $25M upon completion of tech transfer, and single-digit royalties on net sales of future products. The company is currently trading at $44/ share.

Crucially, RARE retains an option to co-develop and co-commercialize Daiichi’s rare disease candidates and retains the exclusive right to use its manufacturing system for current and future targets.

“We view this last night’s deal with Daiichi Sankyo for non-exclusive rights to RARE’s mammalian AAV manufacturing system as a positive by further validating the company’s gene therapy platform and helping to further bolster the balance sheet” cheered JP Morgan analyst Cory Kasimov on April 1.

According to the analyst’s estimates, the $200 million upfront extends the company’s cash runway all the way into 2022, taking any near-term dilutive financing off the table. Plus he is reassured that the non-exclusive nature of the deal does not pose a competitive risk to RARE’s current or future targets.

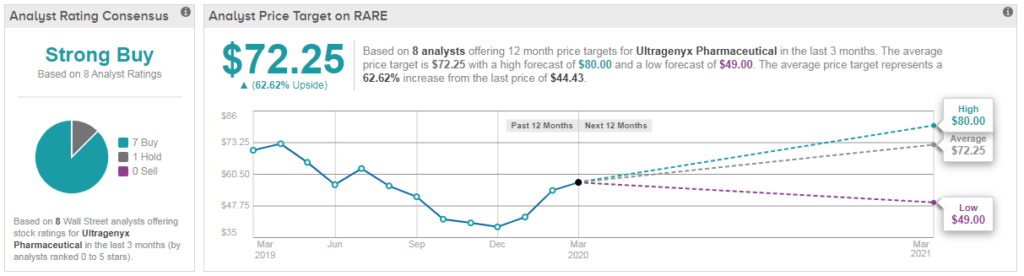

As a result, the analyst reiterated his buy rating on the stock with a $76 price target (71% upside potential). This isn’t the only analyst singing RARE’s praises- overall TipRanks shows that Ultragenyx holds a bullish Strong Buy consensus from the Street with a $72 average analyst price target. (See RARE’s stock analysis on TipRanks)

Related News:

Battered Cruise Operator Carnival Seeks $6 Billion To Deal With Covid-19 Fallout

Verint Systems Misses Profit Estimates, Sees Growing Cloud Demand Momentum

Facebook’s User Engagement and Business Interaction Make It Unstoppable, Says Top Analyst