Over the last five days, Aurora Cannabis (ACB) shares have blasted off to the tune of 158%. But the extent of the company’s struggles is reflected by the fact that even after these mercurial gains, shares are still down by 34% year-to-date. Nevertheless, sentiment has changed recently, which begs the question: has the tide finally turned for the beleaguered Ontario cannabis producer?

It’s too early to tell, but following last week’s much better-than-expected fiscal Q3 earnings results, there was another promising development.

Yesterday, Aurora disclosed it had agreed to an all-share $40 million deal to acquire Reliva, a U.S. CBD retail brand. Reliva is the number one topical brand and number two overall CBD brand in the U.S. (based on IRI data calculating in-store purchases only).

The deal is expected to close in June and will mark Aurora’s entry into the U.S. CBD market. The company, unlike some of its bigger rivals, had been reluctant to do so until now.

Reliva was founded in 2018 and over the past 12 months, has generated revenue of C$14 million, is EBITDA positive and its hemp-derived CBD products (such as topicals and ingestibles) retail in roughly 20,000 stores.

Although BMO analyst Tammy Chen notes Reliva has a good distribution network, there currently isn’t enough clarity regarding the nascent U.S. cannabis industry when considering Aurora as an investment.

Chen said, “We believe distribution will play a key role in brand development as we expect the hemp-derived CBD category to evolve similarly to other health and wellness CPG verticals. However, it is currently difficult to fully assess Reliva’s growth trajectory and longer-term value given the significant uncertainties in competitive dynamics (the industry is still very fragmented and early stage) and regulations (no clarity from FDA yet).”

To this end, Chen maintains a Market Perform rating on Aurora, along with a C$10 ($7.14) price target. Expect further downside of 59%, should the analyst’s forecast materialize over the coming months. (To watch Chen’s track record, click here)

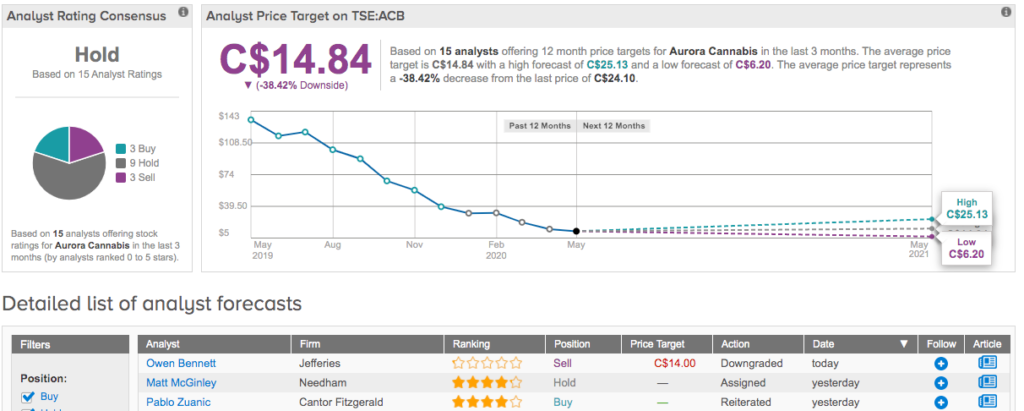

The rest of the Street is reading from the same page as the BMO analyst. The analyst consensus rates ACB a Hold based on 3 Buys, 3 Sells and 9 Holds. With an average price target of C$14.84 ($10.60), the analyst fraternity sees shares declining by 38%. (See ACB price targets and analyst ratings on TipRanks)