United Airlines Holdings Inc (UAL) expects to post a $2.1 billion loss in the first quarter as the fast outbreak of the coronavirus pandemic has led to a standstill in domestic and international travel.

The cash-strapped U.S. airline recorded a pre-tax loss of $2.1 billion in the first three months of the year after a profit of $367 million in the same period last year. Total revenues dropped 17% to $8 billion year-on-year. The results are preliminary and final results for the first quarter may be subject to change, the airline said.

As a result of the worldwide lockdown orders in many countries aimed at containing the spread of the coronavirus disease, United Airlines has cut about 80% of its April capacity and for now expects to cut 90% of its capacity in May, with similar cuts expected for June 2020.

In the last two weeks of March, the airline suffered a revenue loss of about $100 million a day, on average, compared to the prior period.

Looking ahead, it will evaluate and cancel flights on a rolling 60-day basis until it sees signs of a demand recovery.

As of April 16, the company had $6.3 billion of cash, cash equivalents, short-term investments and undrawn amounts, including $2 billion under its undrawn revolving credit line.

To improve its financial situation, United Airlines has borrowed an aggregate of $2.75 billion under new secured term loan facilities each of which must be repaid in a single installment on the applicable maturity date, which, in each case, is twelve months from the borrowing date.

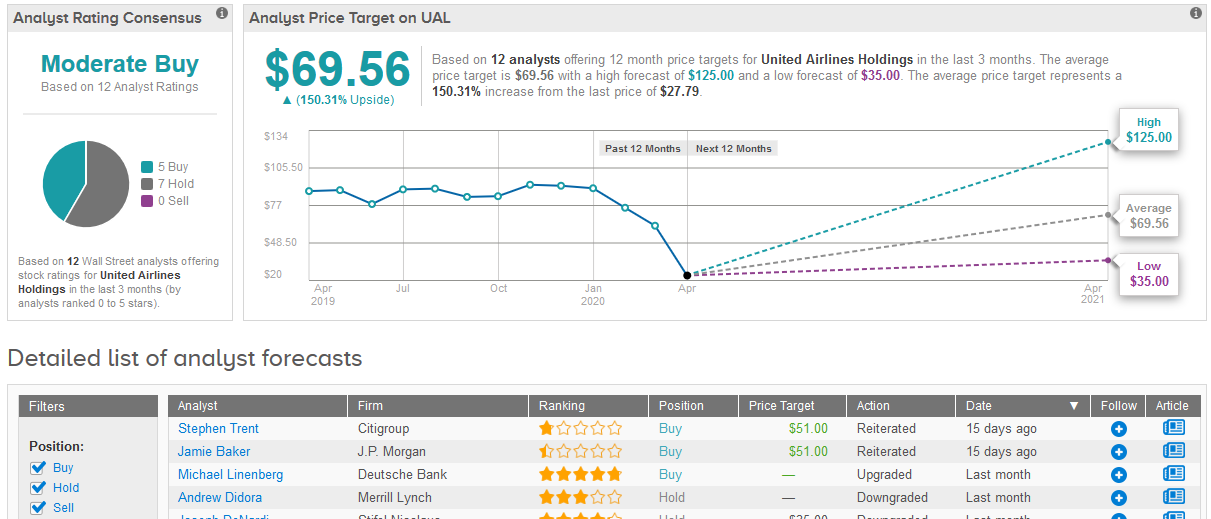

Jamie Baker, an analyst at JP Morgan, this month maintained the airline’s Buy rating with a $51 price target. Since the beginning of the year, the company has seen two-thirds of the value of its shares shave off. On Monday, the stock declined 4.4% to $27.79.

Overall, Wall Street analysts have a Moderate Buy consensus rating for United Airlines based on 6 Buys and 7 Holds. The $69.56 average price target implies 150% upside potential, should the target be met in the coming 12 months. (See United Airlines stock analysis on TipRanks).

Moreover, the U.S. airline informed investors that it recorded $63 million in special charges, mainly due to a $50 million impairment charge accounting for the suspension of flights to China. In addition, the airline announced a $697 million expected credit loss allowance for the BRW Aviation Holding LLC and BRW Aviation LLC (BRW) term loan and the related guarantee.

Turning to government support programs, United Airlines said that it expects to borrow as much as about $4.5 billion from the U.S. Treasury Department for a term of up to five years. Furthermore, the ailing airline will receive about $5 billion from the U.S. Treasury Department to pay for the salaries and benefits of tens of thousands of its employees.

Related News:

U.S. Air Force Selects Raytheon For Long-Range Nuclear Cruise Missile

Risk-Takers Have a Reasonable Shot With American Airlines Stock

GE Enters Into $15B Credit Facility, Stock Plunges Over 40% YTD