United Airlines Holdings Inc (UAL) will sell and lease back 22 planes to Bank of China (BOC) Aviation, for an undisclosed sum.

The deal comprises six Boeing 787-9 aircraft and 16 Boeing 737-9 MAX aircraft from United Airlines, according to a Bank of China Aviation statement filed to the Hong Kong Stock Exchange on Sunday. According to the terms of the transaction, the planes will be leased back to United Airlines on long-term agreements. The deal is expected to close some time this year. Singapore-based BOC Aviation is a global aircraft operating leasing company with a fleet of 567 aircrafts as of 31 March 2020.

As a result of the coronavirus-related lockdowns across many countries around the world, United Airlines flew less than 200,000 people in the first two weeks of April, a 97% drop from the more than 6 million people it flew during the same time in 2019. Since the start of the year, the U.S. airline has seen as much as 70% of its stock value drop. Shares traded up 3.1% on Friday to close at $29.08.

Last week United Airlines said it had cut its flight schedule in May by 90% and expects similar cuts for June due to the coronavirus pandemic. At the same time, the U.S. airline also announced that it will receive about $5 billion from the U.S. federal government to be used for the support of employees’ paychecks. In addition, the airline confirmed that there would be no forced furloughs or pay rate cuts for U.S. employees at least until September 30.

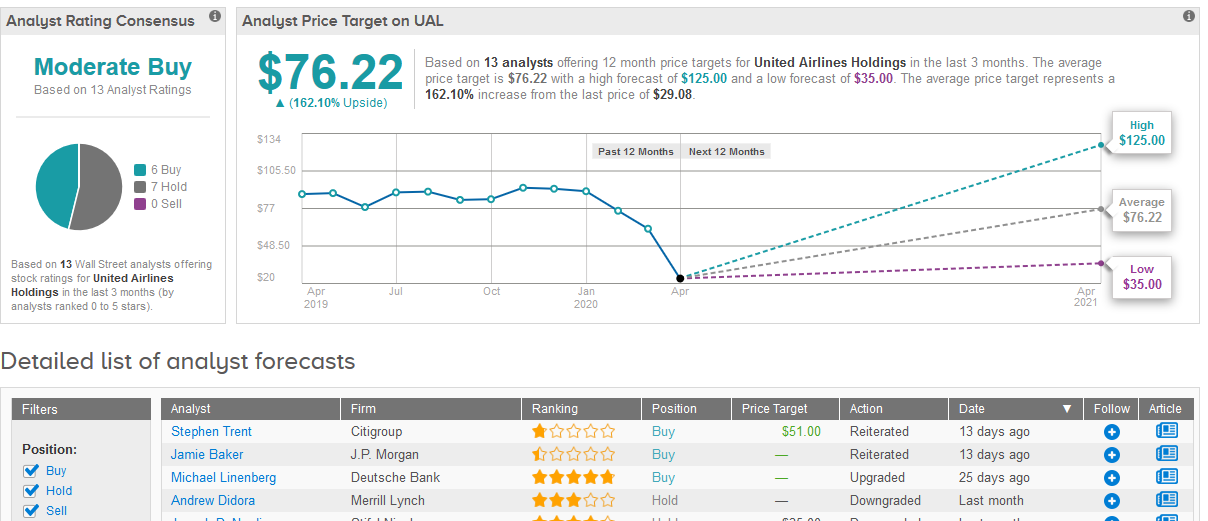

Citigroup analyst Stephen Trent this month lowered the U.S. airline’s price target to $51 from $87 but maintained a Buy rating on the shares. While Trent expects airline capacity in the second quarter to be down 75% year-over-year, he sees demand declines stemming from the coronavirus pandemic outbreak starting to moderate in the third quarter.

Overall, Wall Street analysts have a Moderate Buy consensus rating for United Airlines based on 6 Buys and 7 Holds. The $76.22 average price target implies 162% upside potential, should the target be met in the coming 12 months. (See United Airlines stock analysis on TipRanks).

Related News:

Boeing Shares Spike 15% on Plans to Resume Production Next Week

MC to Raise $500 Million in Debt Offer to Boost Cash Coffers; Shares Soar 31%

Got Guts? Get Tesla Stock at This High Valuation; This 5-Star Analyst Remains Sidelined