Marvell Technology ($MRVL) shares have surged 95% over the past year, raising the question of whether the data infrastructure solutions company has more room to grow. While the stock does appear somewhat overpriced at current levels, several compelling catalysts, including powerful AI-driven custom silicon demand, cloud partnerships, and its market-leading interconnect solutions—support a compelling investment case. In my view, these factors could sustain the company’s impressive trajectory for years to come, which is why I am bullish on MRVL stock.

Why Has Marvell Technology Captured Market Hype?

Since stepping into the spotlight only recently, I’m sure many investors remain unfamiliar with Marvell Technology and its position in the semiconductor landscape. To keep it short, Marvell delivers critical semiconductor solutions that power data infrastructure. They include custom silicon, optical modules, and Ethernet switches vital to data centers, cloud environments, and advanced AI systems. Given that all of these areas are currently thriving, it’s clear why investors have been attracted to Marvell stock.

The market has been especially intrigued by Marvell’s role in AI, where it supplies custom chips tailored for hyperscalers like Amazon Web Services (AWS). Last week, Marvell announced a five-year agreement with AWS, highlighting the surging demand for its solutions. In the meantime, Marvell’s investments in cutting-edge process nodes, such as 3-nanometer and 5-nanometer technologies, place it at the very front of performance and energy efficiency. You can, therefore, see how the broader demand for high-bandwidth, low-power chips in AI and cloud computing, along with the fact that Marvell is a prime beneficiary of these transformative trends, has fueled investor confidence in the stock.

How Marvell’s Results Demonstrate Market Hype

Marvell’s Q3 results showed why the excitement around the company is justified, strengthening my bullish perspective on the stock. Revenue for the quarter came in at $1.52 billion, up 19% quarter-over-quarter, exceeding the midpoint of its guidance by $66 million. Adjusted EPS also rose 43% sequentially to 43 cents. Driving this growth was substantial demand for custom AI silicon, which saw a rapid ramp-up into high-volume production. According to CEO Matt Murphy, this demand was fueled by Marvell’s ability to deliver “highly complex $100 billion-plus transistor chips” with exceptional efficiency.

Data center revenue stood out, accounting for 72% of total sales and marking a record $1.1 billion—a 98% year-over-year jump. The company’s interconnect products, mainly its 800-gig PAM DSPs and the emerging 1.6T PAM DSPs, saw strong uptake. In addition, Marvell’s enterprise networking and carrier segments began recovering, collectively growing 4% sequentially. Therefore, while I have noticed many investors questioning the sustainability of the stock’s massive rally, these numbers underscore Marvell’s ability to execute well, solidify customer relationships, and deliver needed solutions in a very competitive semiconductor market.

Why Marvell’s Momentum Could Sustain for Years

Now, will Marvell’s momentum keep going strong, or is it set to fade, leaving bullish investors, especially those buying the recent highs, disappointed? As I see it, Marvell’s momentum will endure thanks to its central role in enabling AI-driven infrastructure, and Wall Street seems to agree.

Specifically, the company is anticipated to post revenue growth of 4.3% this Fiscal year to $5.74 billion. This might appear modest, but this was only due to a weaker first half. Consensus estimates indicate a superb acceleration from next year, with revenues expected to grow by 41%, 20%, and 21% in Fiscal years 2025, 2026, and 2027, respectively. Adjusted EPS is predicted to follow a similar trajectory, rising from $1.56 this year to $4.66 by Fiscal 2027. But what is going to power these growth rates? Looking at recent developments, I think it all boils down to three key catalysts: the ongoing ramp-up of custom AI silicon programs, excellent demand for interconnect products, and the post-Q3 partnership with AWS.

So, while the stock’s current valuation of 12 times and 41 times this year’s expected adjusted EPS may seem steep when you look at these expectations, these multiples become easier to justify, assuming, of course, the company actually delivered on them. Therefore, I believe investors must weigh the near-term premium against the potential for long-term returns. In my opinion, the premium is likely worth it, thus indicating the stock may hold further upside potential.

Is Marvell a Good Stock to Buy Today?

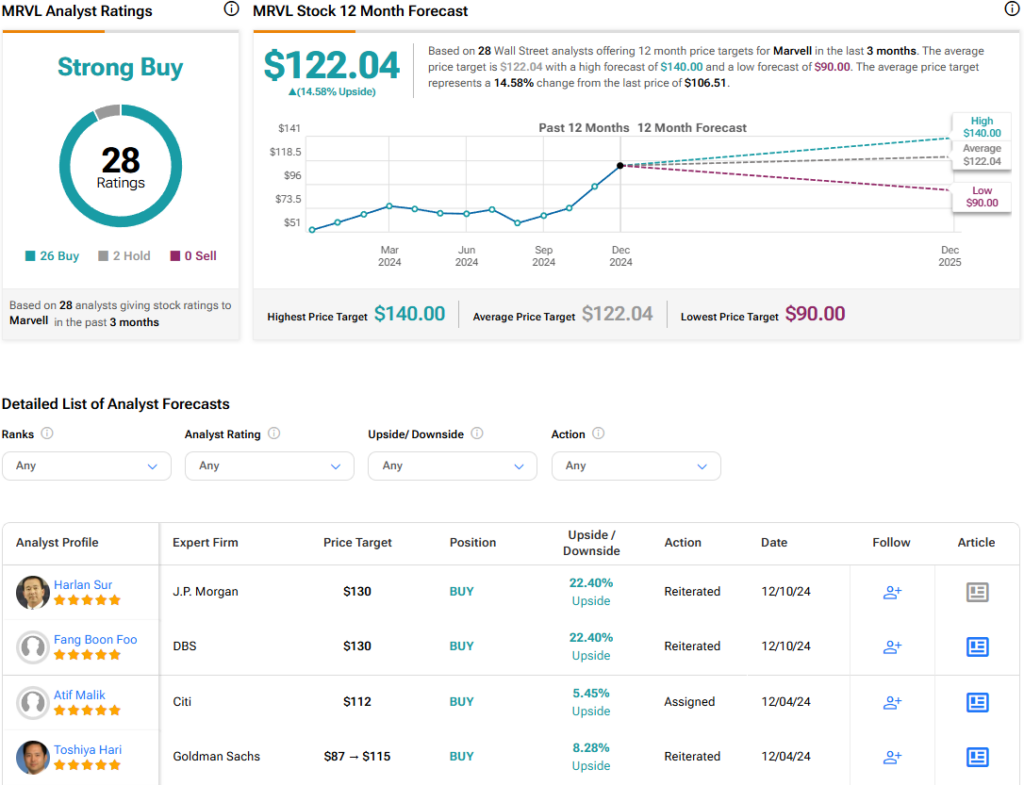

Despite the stock’s extended rally, Wall Street analysts appear quite upbeat about Marvell’s future prospects. Specifically, MRVL stock features a Strong Buy, with recent analyst ratings of 26 Buys and two Holds over the past three months. At $122.04, the average MRVL stock price target implies a 14.58% upside potential.

For the best guidance on buying and selling MRVL stock, look to Christopher Rolland. He is the most accurate and profitable analyst covering the stock (on a one-year timeframe), boasting an average return of 40% per rating and an impressive success rate of 85%.

Conclusion

Summing up, Marvell Technology’s momentous growth trajectory, driven by favorable tailwinds in the AI and semiconductor spaces, positions it well for sustained success. While the current valuation may appear steep, I believe the company’s ongoing growth and future outlook form a compelling case for long-term investment. It’s unlikely that these trends will phase out soon, as the recent developments in tech and AI are here to stay, making me confident in Marvell’s bullish case.