Uranium Energy Corp. ($UEC), a key player in uranium mining, could find itself in a favorable position under the new Trump administration. As the dust settles from the latest U.S. Presidential Election, one of the key questions on the market’s mind is what the future holds for the energy sector. Many investors may suspect a renewed focus on fossil fuels, such as nuclear energy, as the administration appears to be rolling back plans to revamp the renewable energy capabilities of the country. For UEC, this renewed focus on nuclear energy could boost its opportunities in the sector.

While the president-elect has at times questioned federal backing for large nuclear projects, many industry experts point to continuing bipartisan support for nuclear energy development, especially for advanced, smaller-scale reactor technologies. As a result, it may be worth taking a closer look at companies that might have been overlooked in the past. I’m particularly bullish on UES as it appears well-positioned with strong finances, notable insider buying, and recent expansion approvals.

UEC Builds Strong Financials amid Sector Uncertainty

With Elon Musk seemingly having significant involvement in the new administration, the next few years in the energy sector seem fairly uncertain. But to me, UEC brings substantial financial strength and appealing fundamentals to this changing landscape.

The company holds $87.73 million in cash with zero debt, providing essential flexibility as the sector adapts to new policies and shifting rhetoric. For investors, potential partners, and regulators alike, this clean balance sheet matters, as nuclear development requires patient capital and the ability to weather political cycles.

Insider Activity Boosts Confidence in UEC’s Future

In addition to the strong financials, the recent insider activity reinforces my confidence in UEC’s trajectory from here. CEO Amir Adnani purchased $245,880 worth of shares in September, while EVP Scott Melbye added $39,665 to his position.

Although such purchases can be entirely unrelated to any future performance or any specific change in the company’s prospects, many will see growing ownership from the upper management as a green flag of sorts, especially during turbulent times for the sector.

Making Progress Despite Headwinds

As history has shown us, companies working within the nuclear sector have consistently had challenges getting approval for new and increased production due to safety fears and regulatory barriers. Fortunately, UEC seems to be having plenty of success with this in recent months.

Building on this momentum, the company recently secured approval to boost production capacity at its Irigaray plant, showing momentum in expanding operations. This vital approval came as uranium prices continue rising, with spot prices reaching levels not seen in over a decade. Such a move to boost inventory is expensive in the near term, with property expenditures rising from $5.5 million to $9.5 million over the past year. However, it has the potential to enable the company to produce uranium well below the current market price.

In addition to this, industry experts are optimistic about the future. As Nuclear Energy Institute CEO Maria Korsnick recently stated, “We look forward to working with the new administration to advance policies that extend the lives of existing nuclear reactors and usher in advanced technologies,” reflecting the positive outlook from key players in the sector.

However, it’s not all rosy in the sector. UEC posted no revenue last quarter with a net loss of $19.7 million. While concerning at first glance, this potentially reflects the development stage of key assets rather than any specific operational problems. The company maintains a robust $156 billion project backlog.

Risk Factors to Watch

Despite my bullish views, there are plenty of reasons that the next few years could be bumpy for the company. The Trump presidency has shown in the past to change plans fairly suddenly, which could quickly see enthusiasm in the sector decline. If the new administration decides to back more traditional fossil fuel companies, then established and emerging technology in the nuclear space could see major drops in demand. I’d be particularly concerned about the high cost of such projects, especially in an environment where cuts to federal discretionary spending are possible.

Of course, the company isn’t entirely dependent on the U.S. for its market, but with China adding UEC to its “unreliable entities list,” there are justified concerns about the future of its project pipeline.

The Market’s Response to UEC’s Prospects

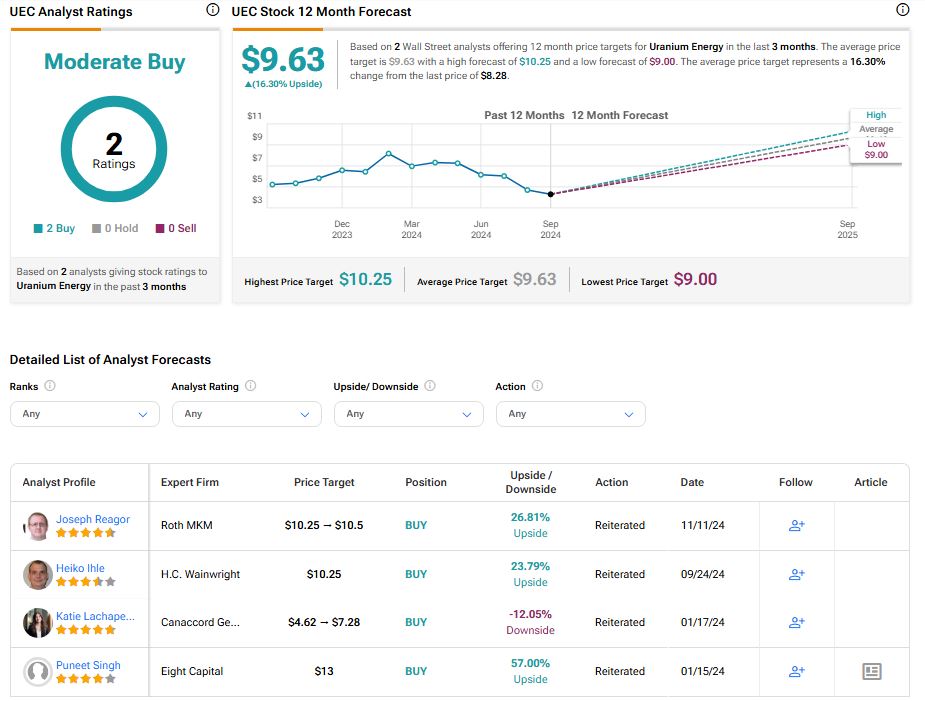

Generally speaking, markets appear to be as optimistic as I am about the company’s prospects under the new administration. UEC stock has gained about 29% over the past year, currently trading at $8.28.

Is UEC Stock a Good Buy?

Currently, UEC stock has a Moderate Buy consensus rating on TipRanks based on two Buy ratings. The average Uranium Energy price target of $9.63 implies 16.30% upside potential from current levels.

Summing up

To me, UEC presents an appealing opportunity as nuclear power potentially gains prominence in the U.S. energy policy. The company’s debt-free balance sheet, operational progress, and management confidence through insider buying provide a solid foundation for future growth.

However, would-be investors will need to understand the uncertainty of the political landscape, and of the sector in general, being sure to watch federal spending decisions closely. While nuclear may benefit from an “all-of-the-above” energy strategy, actual funding levels will prove crucial.

However, at a time where the overall requirement for reliable baseline energy is only going to increase, I believe that, given its flexibility, financial strength, and operational momentum, the company can succeed in the long term, even if there are a bumpy few years ahead for investors in the energy sector.