Utilities may not always steal the spotlight, but in Q3, they trounced tech stocks, delivering impressive gains that fueled their ongoing year-to-date rally. Vistra ($VST) stood out in this sector, with its shares soaring over 37% during the quarter, outperforming all of its sector peers. Vistra has, in fact, rallied 210% YTD, surpassing Nvidia ($NVDA) as the top-performing S&P500 ($SPX) stock. While key catalysts have driven this outstanding run, which we’ll discuss in this article, Vistra could face valuation headwinds following such a prolonged rally. Thus, I am neutral on Vistra.

Nuclear Expansion and Key Acquisitions

One of the primary reasons behind Vistra’s tremendous stock price rally this year has been its pursuit of expanding its nuclear footprint. Earlier this year, Vistra made headlines by acquiring the remaining 50% stake in Vistra Vision LLC, which controls various nuclear assets, including prominent facilities like Beaver Valley, Perry, and Comanche Peak. These plants have a combined capacity of around 6.4 gigawatts (GW) and thus have substantially increased the company’s generation capacity. That’s positive for the business, but I’m hesitant on VST stock right now.

Given that nuclear energy is becoming an increasingly critical part of the global energy mix thanks to its reliability and minimal carbon emissions, Vistra has positioned itself to capitalize on the growing demand for cleaner power. Lately, tech giants like Amazon ($AMZN) and Microsoft ($MSFT) are seeking long-term deals with energy providers for nuclear power to sustain their data center growth, particularly in light of surging AI-related energy consumption. Therefore, it’s easy to see, by increasing its nuclear capacity, how Vistra is positioned to cater to this growing demand from such players seeking reliable energy sources.

Moreover, nuclear energy is not just about cleaner power; it is about energy security. With global energy markets experiencing volatility due to geopolitical tensions and shifting supply dynamics, companies that can provide a stable power supply are set to enjoy a pricing advantage. This is where Vistra’s diversified portfolio comes in, which now includes more nuclear assets, making it more dependable in the face of fluctuating commodity prices, especially as coal and other fossil-fuel plants face pressure to shut down.

Power Price Hedging and Market Leadership

Another noteworthy factor powering Vistra’s extended rally has been its adept handling of power price volatility. The company has executed a robust hedging strategy that mitigates the impact of fluctuating power prices on its earnings. In fact, for the years 2025 and 2026, Vistra has hedged about 86% and 55% of its wholesale power exposure, respectively. The point is that such prudent management of price risk has given the company a high degree of earnings visibility, despite my neutral stock view right now. The hedging activity allow the company to capitalize on periods of market dislocation.

Specifically, in Q2 2024, Vistra posted adjusted EBITDA of $1.4 billion, a staggering increase of 40% year-over-year. This growth was partly fueled by its generation assets and retail businesses but also by its hedging, which allowed the company to offset lower wholesale prices. Vistra’s long-term outlook also remains promising, with guidance suggesting 2025 EBITDA could reach as high as $6 billion. Consensus EBITDA estimates for 2026 points to further growth to about $6.5 billion.

Finally, it’s worth mentioning that Vistra’s role in the build-out of dispatchable gas generation within Texas, including 500 megawatts (MW) of augmentation at existing facilities, shows its foresight in ensuring grid reliability in the long run. The company’s focus on switching coal plants to gas-fired plants will further solidify its standing as a leader in energy transition. I believe these moves, overall, have drawn significant investor interest. Unlike many of its sector peers, Vistra can be viewed as a utility stock that combines both defensive qualities and growth potential.

Is Valuation a Reason for Caution?

Despite Vistra’s tremendous performance and growth prospects, I would argue that investors may want to consider the potential risks of adding VST stock to their portfolios at today’s valuation. As is often the case with enormous rallies, Vistra’s stock has undergone notable multiple expansion in 2024. The stock’s current levels reflect much optimism surrounding the energy sector’s shift toward cleaner fuels. With VST shares up over 200% year-to-date, Vistra’s forward EV/EBITDA ratio (which I consider the better metric to value utilities) has expanded to over 12X, the highest it’s been in Vistra’s history and generally above the sector average.

Of course, a valuation expansion is not inherently bad, especially when it is powered by real catalysts. Yet, it raises questions about how much of the company’s future growth is already baked into the current stock price. The stock may in fact be prone to correction if Vistra’s EBITDA and earnings do not meet the market’s expectations in the coming quarters.

Is VST Stock a Buy, According to Analysts?

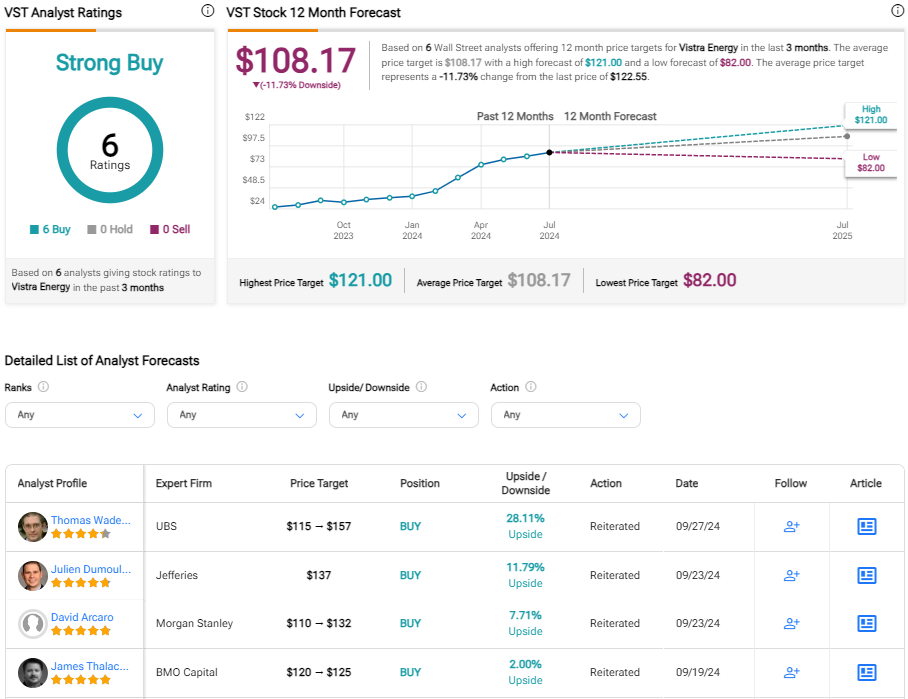

Wall Street’s 6 analysts who cover Vistra are optimistic, as evidenced by the current Strong Buy consensus rating stemming from six unanimous Buy ratings over the past three months. With that said, the average VST price target of $108.17 is more than 10% below the recent stock price. That consensus view is consistent with my concerns about the stock’s valuation.

Investment Takeaway

Vistra’s impressive rally, driven by nuclear expansion and a solid hedging strategy, has positioned it as the top-performing stock in the S&P 500 this year. The company’s focus on clean energy and reliable power supply seems to have attracted significant investor interest, and the business results have been excellent. Nevertheless, following a rally of more than 200%, Vistra stock may be overstretched right now. While Vistra’s growth potential seems quite strong, its elevated forward EV/EBITDA ratio merits caution, as any earnings shortfall could trigger a correction.