During the race for a long-term solution to the COVID-19 pandemic, biotechnology firm Vaxart (VXRT) had always been intriguing. While vaccine leaders Pfizer (PFE) and Moderna (MRNA) were researching and developing novel approaches using messenger RNA, Vaxart stuck to its method of oral recombinant vaccines, formulated as tablets.

Generally speaking, tablets are more palatable to the average person than an intramuscular injection. Additionally, the oral vaccine approach caters to the logistical demands of inoculating a large population base such as the U.S. Critically, public health officials enjoy the option of mass distribution without professional medical oversight, as would be needed for administering mRNA vaccines.

However, after new daily cases of COVID-19 peaked in the U.S. in early January of this year, the vaccine rollout got underway in earnest. Quickly, the tide turned, with daily infections dropping to lows not seen since the start of the pandemic. By then, several stakeholders of VXRT stock had shed their exposure, fearing a loss of relevance.

Yet the novel coronavirus has proven to be a miserable itch that just seems out of reach to be addressed. In mere months, the public health crisis rudely transitioned from the brink of closure to another wave of new infections. While that’s bad news for society, the revamped threat may provide a cynical catalyst for VXRT stock for three reasons. (See Vaxart stock charts on TipRanks)

A Palatable Incentive for Vaccination

According to the Centers for Disease Control and Prevention, 71.8% of Americans 18 years of age and older have received at least one dose of a COVID-19 vaccine, with 61.6% in this demographic fully vaccinated. Although an impressive performance, that still leaves millions of Americans who have yet to be inoculated.

As The Wall Street Journal reported, the rise of infections, combined with vaccine hesitancy, has frustrated medical doctors struggling to contain the disease in hospitals overrun by the delta variant of the SARS-CoV-2 virus. To help remedy this circumstance, Vaxart’s tablet solution could potentially come in handy.

First, tablets are known medical commodities — there’s nothing experimental or exotic about the format. Secondly and more importantly, tablets alleviate fears of needles. According to a University of Michigan study, approximately 20% to 30% of surveyed adults “cited concerns about needles, ranging from mild anxiety to a phobia strong enough to keep some from seeking medical care.”

Obviously, such fears will not be present with oral vaccines, making the case for VXRT stock more attractive.

Tablets Facilitate Easy Distribution

Although mRNA vaccines in the U.S. beat other approaches to the punch, the first-to-market victory has some vulnerabilities. Primarily, the two-shot regimen imposes significant logistical hurdles — and investors need to look no further than the disparities between single and two-dose vaccination rates.

While the gap closed considerably due to the threat of the Delta variant, it’s still wide enough to be conspicuous. With tablets, health officials don’t have to fret nearly as much. If worse comes to worst, agencies can distribute oral vaccines through the mail.

Moreover, this segues into another potential tailwind for VXRT stock: tablets cater to any infrastructural standard. Even in the U.S., several states scrambled to find ultra-cold freezers late last year, to accommodate the intense storage requirements of mRNA vaccines, particularly Pfizer’s solution.

Tablets don’t carry this liability, which also makes them appropriate for international distribution, whereas many emerging nations may not have robust physical infrastructures to accommodate ultra-cold storage.

Work From Home? Don’t Count on It

One underappreciated factor that may have prevented a more robust uptake of COVID-19 vaccines is the broader work-from-home initiative as a mitigation measure (ironically enough) for the pandemic. With millions of employees conducting operations from their living rooms and makeshift home offices, there was simply no overriding incentive to get vaccinated.

Further, the common assumption is that work from home is here to stay. Yet that might not be the case for one simple reason: this initiative is unproductive.

Data from the National Bureau of Economic Research indicates that relative to pre-pandemic levels, the number of meetings during the “new normal” increased, as did the number of people attending them. As well, email activity saw a short-term bump up. These findings, which show that working from home means more time spent on meetings and emails, translate to operational inefficiencies — and inefficiencies cost companies money.

Therefore, it’s reasonable to expect that companies will want their employees back in the office. Not only that, they’ll want them vaccinated. Per federal law, employers may demand a vaccination policy within established guidelines. As such, the vaccine-resistant may find that tablets offer a happy medium.

Wall Street Weighs In

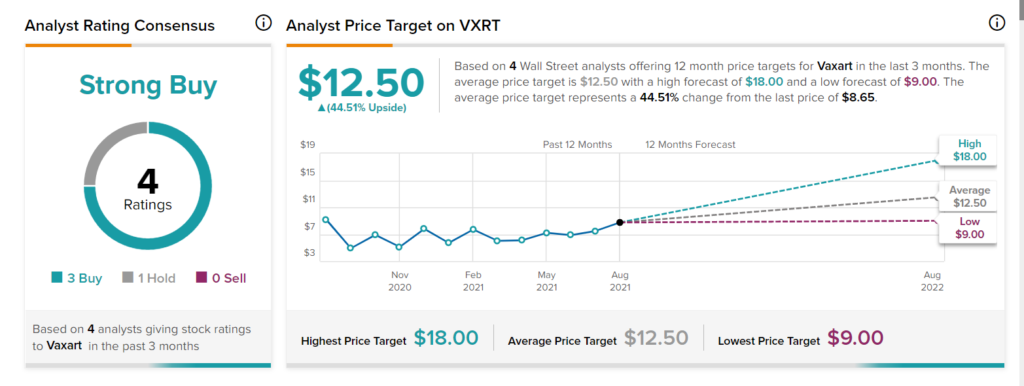

According to TipRanks’ stock forecast, Vaxart is a Strong Buy, based on 3 Buy and 1 Hold ratings. The average Vaxart price target is $12.50, implying 44.51% upside to the current price.

Stay Vigilant with VXRT Stock

While Vaxart certainly looks more appealing than it did a few months ago, investors should be careful about engaging this biotech play. For one thing, it wasn’t too long ago that VXRT was a literal penny stock.

Though its price tag has gone up dramatically since then, VXRT still carries the volatile profile of a speculative trade. As investors can see from its price chart, all it takes is one news item or rumor to send shares soaring — or tumbling down into the weeds. Therefore, if you do decide to partake, you should only do so with money you can comfortably afford to lose.

Disclosure: The author did not own any of the shares mentioned above.

Disclaimer: The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities.