Verizon is expanding its 5G Business Internet to 21 new U.S cities. An alternative to cable, the fixed wireless connectivity service leverages 5G Ultra-wideband technology to offer fast and reliable internet connectivity.

The fixed wireless offering comes with multiple pricing and service options with no data limits. Customers can sign up for 100, 200, and 400 Mbps plans. In a bid to safeguard its customer base, Verizon (VZ) is offering a ten-year price lock with no long-term contract required.

“We’ll continue to expand the 5G Business Internet footprint and bring the competitive pricing, capability, and flexibility of our full suite of products and services to more and more businesses all over the country,” said Verizon Business’ CEO, Tami Erwin, CEO.

After initially launching in Los Angeles, Chicago and Houston, the Verizon 5G Business internet is set to go live in multiple cities across the US, with additional cities expected to be announced on a rolling basis.

The expansion of the Verizon 5G Business offering to more cities comes on the heels of Verizon reporting impressive first-quarter financial results. The wireless career reported earnings per share of $1.27 for 1Q 2021 compared to $1.00 per share reported in the same period last year. Total revenue was up 4.7% to $22.8 billion as the company also posted a 25.4% increase in net income that totaled $5.4 billion.

Verizon shares are down about 1% year to date after a 4% slide in 2020. (See Verizon stock analysis on TipRanks).

In March, Tigress Financial Partners’ analyst Ivan Feinseth upgraded Verizon to a Buy from Hold, citing growing opportunities in wireless and broadband. According to the analyst, 5G Roll out should start to drive acceleration in Business Performance trends.

“Opportunities in 5G and online content delivery along with dividend yield have the potential to create an attractive long-term investment opportunity. VZ also outlined a very compelling growth story at its recent Analyst Day. VZ will start to benefit from the ongoing rollout of its transformative 5G network, “ Feinseth wrote in a research note to investors.

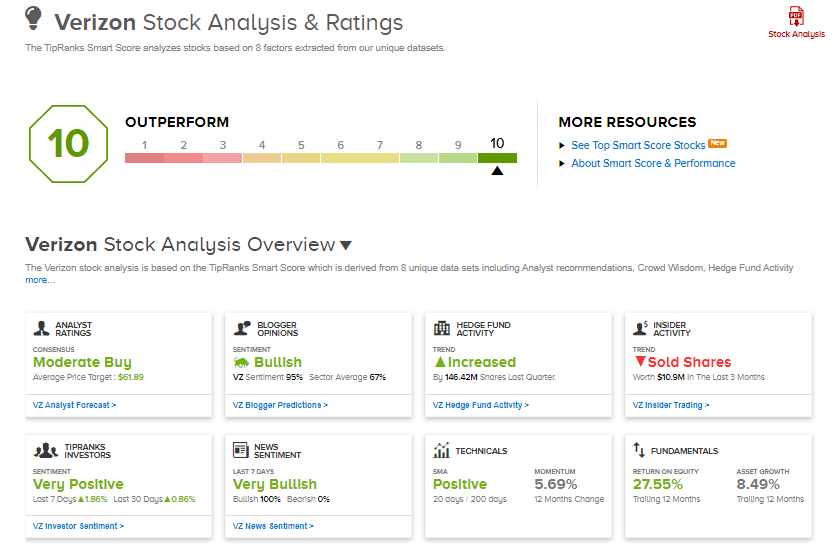

Consensus among analysts for Verizon is a Moderate Buy based on 6 Buys and 5 Holds. An average analyst price target of $61.89 implies 6.45% upside potential to current levels.

Verizon scores a “Perfect 10” on TipRanks’ Smart Score rating system, implying that it is likely to outperform market averages.

Related News

INVO Partners With Lyfe Medical To Expand INVOcell Solution In Northern California

Microsoft’s $10B Acquisition Of Discord Stalls – Report

Netflix Growth In New Subscribers Slows; Shares Plunge 7%