Verizon Communications Inc. (VZ) agreed to buy BlueJeans Network Inc., a video-conferencing company, for an undisclosed sum.

Under the terms of the agreement, the BlueJeans platform will be integrated into Verizon’s 5G roadmap product, providing secure and real-time video-conferencing solutions for high growth areas such as telemedicine, distance learning and field service work, the companies said in a joint statement. Verizon will pay between $400 million and $500 million for BlueJeans, the Wall Street Journal reported.

Stay-at-home orders during lockdowns in many countries around the world have ramped up demand for popular video-conference platforms such as Zoom Video Communications (ZM) , which has seen its daily active users soaring to 200 million from about 10 million before the coronavirus outbreak.

Following the transaction, BlueJeans employees will become Verizon employees. The deal is expected to close in the second quarter, subject to customary closing conditions.

“As the way we work continues to change, it is absolutely critical for businesses and public sector customers to have access to a comprehensive suite of offerings that are enterprise ready, secure, frictionless and that integrate with existing tools,” said Tami Erwin, CEO of Verizon Business. “Collaboration and communications have become top of the agenda for businesses of all sizes and in all sectors in recent months.”

Commenting on the deal, five-star analyst Brandon Nispel at Keybanc, who has a Hold rating on the stock, said he could see Verizon using the application to help its business group and potentially offer a telemedicine service. However, in his view, “telco’s are where applications go to die” and Verizon is buying “a second tier type of service” when it could have achieved a similar outcome by having reselling partnerships.

Moreover, Nispel does not view the deal to be material to near-term or future estimates and added that it “appears to be an expensive way to generate 5G publicity”.

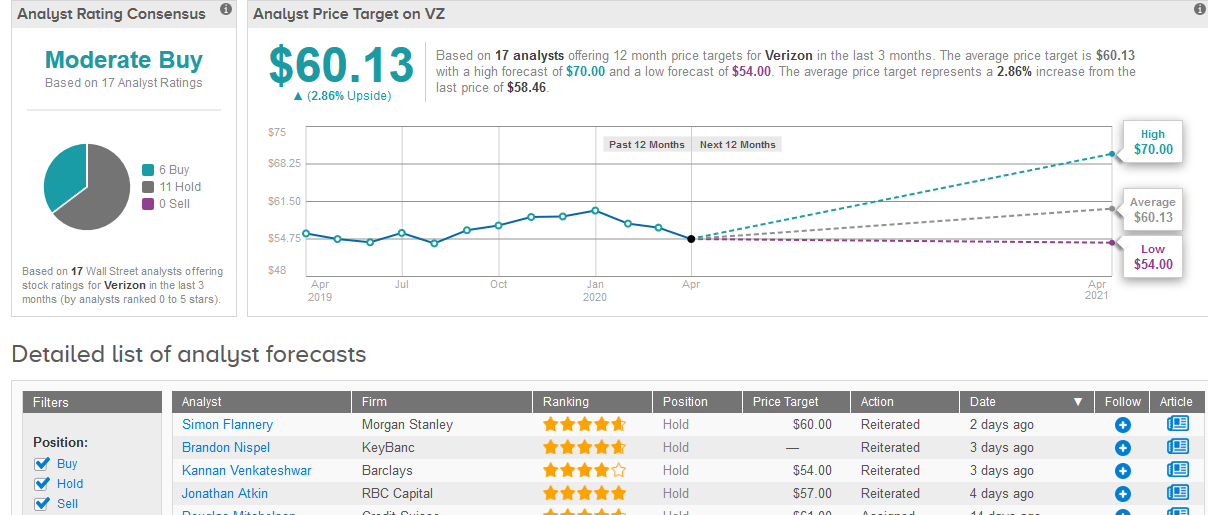

Turning to other Wall Street analysts covering Verizon in the past three months, 11 say Hold the stock and 6 say Buy adding up to a Moderate Buy consensus rating. The $60.13 average price target implies a mere 2.9% upside potential in the coming 12 months. (See Verizon stock analysis on TipRanks).

Evercore and Goodwin Procter served as advisors to BlueJeans, and Debevoise & Plimpton as advisor to Verizon, the companies said in a joint statement.

Related News:

Adaptive Biotechnologies’ Collaborations Could Be Vital in Fight Against COVID-19

Google Meet Turns Up The Heat With New Grid Layout

Moderna Wins $483 Million US Government Award To Develop Coronavirus Vaccine