In this piece, I used TipRanks’ comparison tool to evaluate two credit card stocks, Visa (NYSE:V) and Mastercard (NYSE:MA), to determine which is the better stock to buy. Upon closer analysis, both look great in the long term, but V stock may be the better pick for the short term due to its better technical momentum and key fundamental metrics.

Year-to-date, Visa is up nearly 7%, while Mastercard stock has gained only 1.4%. However, their longer-term returns are very similar, as you can see below.

With two companies that are basically a duopoly and so nearly identical in the types of services offered, a deep dive is in order. At first glance, Mastercard is trading at a meaningfully higher price-to-earnings (P/E) ratio, but there’s more to consider. So, let’s dive in.

Visa (NYSE:V)

While Visa and Mastercard share similar trajectories in their stock prices, Mastercard has more than doubled in the last five years, while Visa is up 90%. However, Visa’s near-term stock momentum, its robust margins and fundamentals, and its slightly lower P/E ratio suggest a bullish view may be appropriate.

Visa is trading at a trailing P/E of about 31.8 times, versus Mastercard’s current P/E of around 34.3. Visa’s five-year average P/E is about 36 times, suggesting meaningful room for near-term upside despite the recent run-up in the shares. Additionally, Visa’s mean price-to-sales (P/S) multiple over the same timeframe is about 17.4 versus the current P/S of about 15.2.

While both companies exhibit attractive fundamentals and have been untouched by the banking crisis, Visa appears to look slightly better in the near term. For example, Visa enjoys a higher operating margin of 67% and a higher net income margin of 50.3% for the last 12 months. The company also has a higher free cash flow margin of 58.8% for the last 12 months.

Visa is also much larger in terms of revenue, at $30.2 billion for the last 12 months. Visa’s debt-to-equity ratio of 55.5% is also far better than Mastercard’s 232%, which could be critical in the event of a recession.

What is the Price Target for V Stock?

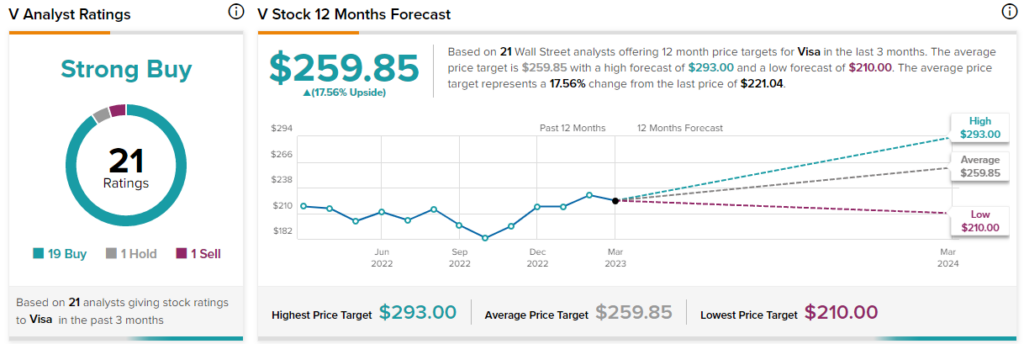

Visa has a Strong Buy consensus rating based on 19 Buys, one Hold, and one Sell rating assigned over the last three months. At $259.85, the average Visa stock price target implies upside potential of 17.6%.

Mastercard (NYSE:MA)

Although Visa beats Mastercard slightly in some areas, Mastercard’s fundamentals are still extraordinarily attractive. Additionally, Mastercard does outperform Visa in some ways, suggesting a bullish view may also be appropriate here, although its higher P/E ratio gives Visa a slight advantage.

Mastercard’s P/E multiple stands at 34.3, versus its mean ratio of 43.2 since April 2018, suggesting more room for upside. Further, its P/S multiple of 15.2 times compares to its mean multiple of 18 times over the same timeframe. Additionally, Mastercard enjoys an operating margin of 56.8% and a net income margin of 44.7% for the last 12 months, while its free cash flow margin is an attractive 48.4%.

In terms of its outperformance versus Visa, Mastercard’s gross margin is slightly higher at 100%, versus Visa’s at 97.6%. Additionally, Mastercard has issued more credit cards than Visa, and its cards grew at a much faster rate than Visa’s, at 25% versus Visa’s 4%. However, Mastercard has a larger mix of international credit cards, which might serve as a headwind due to the potential for slower growth in some of those markets.

What is the Price Target for MA Stock?

Mastercard has a Strong Buy consensus rating based on 21 Buys, two Holds, and zero Sell ratings assigned over the last three months. At $423.18, the average Mastercard stock price target implies upside potential of 20.35%.

Conclusion: Long-Term Bullish on V and MA

Over the long run, it’s unlikely that you could go wrong with either Visa or Mastercard, making them both look like long-term buy-and-holds. However, investors who can pick only one due to the size and required diversification of their portfolio may want to choose Visa in the near term.

There is one caveat for both. Investors may need to batten down the hatches, so to speak, as both stocks could face setbacks in the event of a recession. However, even after the depths of the Great Financial Crisis, Visa and Mastercard shares were both quick to recover.

As a result, one potential strategy for investors expecting a recession could be to wait for a more attractive entry price. Alternatively, some may want to buy shares now and add to those positions if a recession occurs. This second one may be slightly better because it isn’t banking on a recession bringing more attractive entry points for Visa and Mastercard.