DAX-40 listed companies Volkswagen AG (DE:VOW3) and Rheinmetall AG (DE:RHM) reported their first-quarter results for 2023 last week. Both companies have started the fiscal year 2023 on a positive note and posted solid numbers.

These stocks have garnered a positive outlook from analysts, who have rated them as “Buy.” Rheinmetall is predicted to have a potential upside of around 10%, while Volkswagen exhibits the potential for more than 30% growth in its share price.

Let’s dig deeper into the numbers.

Volkswagen AG

The German automobile manufacturer published its Q1 2023 earnings report on May 4. Volkswagen, the owner of brands like Audi, Bentley, Porsche, etc., witnessed a robust rise in revenues and underlying operating profit.

The company’s sales revenues were up 22% to €76 billion, up from €62.7 billion in Q1 2022. The revenues were driven by a recovery in volumes in Europe and North America coupled with improved pricing. The operating profit jumped by 35% to €7.1 billion for the quarter. The Group witnessed a robust level of demand, evidenced by an order backlog of 1.8 million vehicles in Western Europe alone.

On the flip side, deliveries were down by 14.5% in China as the company struggles to keep up with its domestic competitors in the BEV (battery-electric vehicles) segment. Moving ahead, the company expects the competition to further intensify in the second half of 2023. The company outlined its focus on margins over pursuing higher sales volume while maintaining its market share.

Considering its strong performance, supported by an order book of 1.8 million vehicles by the end of Q1, the company has confirmed its financial outlook for 2023.

Is Volkswagen Stock a Buy or Sell?

According to TipRanks, VOW stock has a Moderate Buy rating with a total of 10 recommendations, of which 5 are Buy.

The average target price is €163.2, which represents a 5% change from the current price level.

Rheinmetall AG

Rheinmetall is an integrated technology group dedicated to the development and sale of components, systems, and services for both the security and civil sectors.

Last week, the company released its first quarter results for 2023, with earnings surpassing analysts’ expectations. The company posted an EPS of €1.16 for the quarter, as compared to analysts’ forecast of €0.91. The company, however, missed operating earnings expectations by around €8.4 million. Despite this, Rheinmetall experienced a growth of 7.6% in consolidated sales, reaching €1.36 billion. Moreover, its order backlog increased by 8% year-on-year, reaching €28 billion in the first quarter.

The company remains positive for its full-year 2023 numbers, as it expects higher orders for the year. Rheinmetall stated that the shifts in defense policy have worked well for the company and have enhanced its capabilities regarding security-related products in both Germany and partner countries.

The company also revised its sales expectations for 2023, now projecting a range between €7.4 billion and €7.6 billion.

Is Rheinmetall a Good Buy?

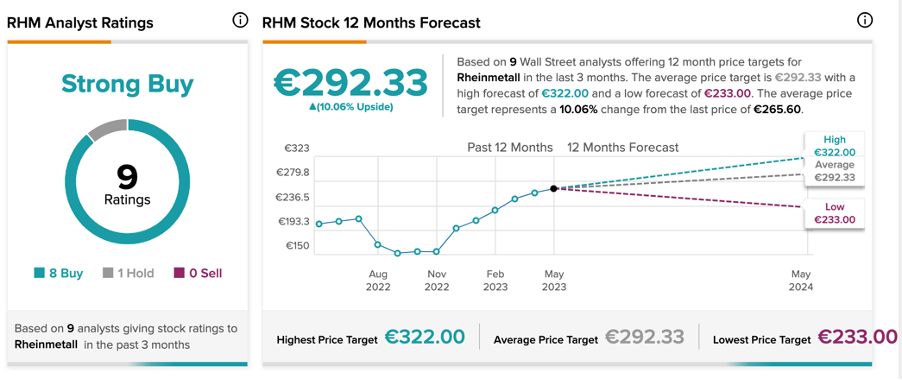

On TipRanks, RHM stock has a Strong Buy rating backed by eight Buy and one Hold recommendations.

The average stock forecast is €292.3, which has an upside potential of 10%. The target price has a high forecast of €322 and a low forecast of €233.

Conclusion

Both companies have exhibited strong performances in their recent results and have affirmed a positive outlook for the rest of 2023. Additionally, analysts continue to hold an optimistic view of their shares, projecting higher levels of anticipated growth.