Today is the day that decides the fate of a diabetes treatment created by biopharmaceutical company, Mannkind Corp. (MNKD). An FDA panel will meet today to review Afrezza, the inhaled insulin drug to treat diabetes, but there is fear that the drug will not be approved by the panel. The stock has already taken a 27.105% dive and analysts are making their recommendations even before the panel meets. Piper Jaffray analyst, and the number one ranked TipRanks analyst, Joshua Schimmer, recommends HOLD MNKD, noting that the company faces a “number of obstacles” in the review of the insulin inhaler. He also mentioned that “it is doubtful for the company to gain positive recommendation from the advisory panel,” and that the agency, “has enough concerns that only a cleanly positive vote will enable approval without additional requirements.”

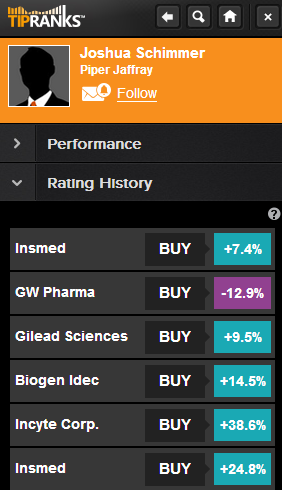

While Joshua will have to wait to hear the final decision from the FDA, he has already proven his success recommending other biopharmaceutical companies with high returns. With a medical background as a doctor, specializing in Internal Medicine and sub-specialized in Rheumatology, as well as an MBA from Harvard Business School, Joshua has an inside edge on the biopharm market. Joshua’s advice about Insmed (INSM) and Gilead Sciences (GILD) has helped earn him earn the number one spot out of 2748 analysts, with a +14.2% average return and a 75% success rate of recommended stocks.

Right before Joshua’s HOLD MNKD recommendation, he advised BUY Insmed (INSM), following a phase-two trial of its lung infection drug Arikayce. Even though the drug failed to meet its primary endpoint, it was able to meet its secondary endpoint, pleasing Joshua. According to Joshua, and several other analysts, the secondary endpoint was more important, “Although Arikayce did not show significance on the primary endpoint of bacterial reduction, we believe this is a less validated and sensitive measure and that success on the more stringent secondary endpoint of culture conversion to negative derisks the program significantly.” After recommending BUY INSM and raising his price point from $22 to $30, Joshua has earned +7.4% over S&P-500.

In November of last year, Joshua initiated coverage of Gilead Sciences (GILD) with a BUY rating, pointing out his confidence in the biotech sector for 2014. Joshua argued that, “long product cycles, attractive pipeline assets not reflected in valuations, new clinical data and commercial catalysts and potential for further increases to consensus, we believe biotech will still deliver attractive returns to investors.” Currently, Joshua has earned +9.5% over S&P-500 with this recommendation.

Around the same time, Joshua also initiated coverage of Insmed with a BUY rating and a $34 price target. Under the same argument that the biopharmaceutical industry is primed for 2014, Joshua has earned +24.8% over S&P-500.

So far this year, Joshua has experienced one loss, after recommending BUY GW Pharmaceuticals (GWH). Based on expert findings about the true power of the anti-seizure drug CBD, Joshua reiterated his overweight rating. However, sales growth of their other drugs was not strong enough to carry the stock and Joshua is currently down -12.9%. But, when Joshua initiated coverage of GWH with a BUY rating in November, he earned one of his highest returns of +71.9% over S&P-500!

Investors and analysts will be waiting to hear the panel’s final decision about MNKD’s drug Afrezza, but until then, you can follow Joshua’s recommendations by downloading TipRanks. With Tipranks, you can review Joshua’s recommendation history, as well as other analyst histories, so you can make informed financial decisions with advice you can trust.