Shares of Blackberry (BB) shot out of the gate this year, rising more than 40% in the first three months of 2019. But since then, the stock is down 32%, settling at a low not seen since January. Blackberry continues to look for its place in the tech world, as it was pushed out of consumer electronics and has shifted focus to enterprise software.

What’s next for the stock? The bulls argue that the worst is behind Blackberry as it still has multiple positive drivers, including continued expansion of QNX. The bears, on the other hand, argue that the bloodbath isn’t over just yet. 5-star Canaccord analyst Michael Walkley has found himself in the middle, as he reiterates a Hold rating on BB stock, with a $9.00 price target, which implies nearly 30% upside from current levels. (To watch Walkley’s track record, click here)

Walkley met with Blackberry management at the CG Global Growth Conference, where the company highlighted growth opportunities for its business segments and long-term cross-selling opportunities. Coming out of the meetings, Walkley is optimistic on some fronts, but hesitant on others.

To the company’s credit, Walkley believes the enterprise software and services (ESS) segment “is on track to return to year-over-year growth during F2020 and beyond,” while also being optimistic on Blackberry technology solutions (BTS).

Furthermore, the company has recently acquired cyber-security firm Cylance for $1.4 billion, which, at the time of acquisition was expected to be a major boon to the company. But many investors were left dismayed by Cylance’s results in the first-quarter, sparking concerns that the acquisition was not smart, after all. Nevertheless, Walkely believes Cylance has “potential for further upside.”

Walkley is also optimistic about the company’s patent portfolio. The analyst points to Blackberry’s “strong position in essential patents for wireless standards such as LTE and non-essential patents for key technology areas such as encryption, user interface, and security,” where he believes the “patent portfolio will continue to drive licensing revenue.”

Even though Walkley believes “management has created a cogent long-term strategy and the potential is compelling for longer-term oriented investors,” the analyst remains sidelined as the company is trading at similar levels to software comps.

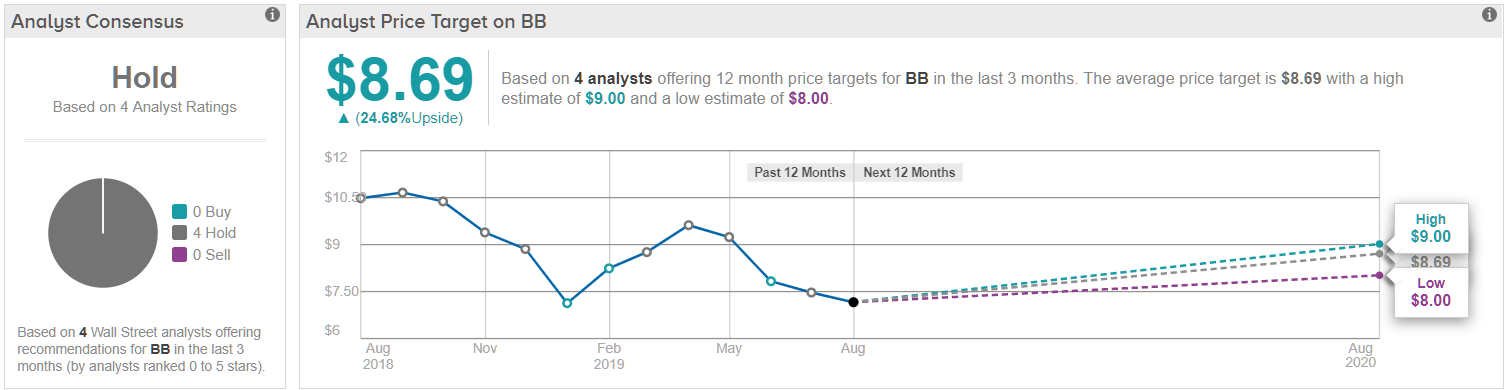

All in all, while Blackberry is essentially a new business compared to its founding, investors don’t look at it as a young startup that can burn through cash. Instead, the three decade-old company is looked as an established company that must turn a profit and find its place in the market. As a result, TipRanks analysis shows a consensus Hold rating, with all four analysts rating Hold. The average price target among these analysts stand at $8.69, which still implies about 25% rise from current levels. (See BB’s price targets and analyst ratings on TipRanks)