Top payment stocks have been under considerable pressure of varying degrees through most of 2022. High-tech digital payment firm PayPal (NASDAQ:PYPL) has crashed and burned. Meanwhile, the big two credit card behemoths Visa (NYSE:V) and Mastercard (NYSE:MA) have been steadier sailors through the choppy waters of the 2022 bear market. Both credit card kingpins have climbed back from their lows in recent weeks. With new highs in sight, the two blue chips seem like more prudent ways to play the payment space than a faltered fintech like PayPal. In this piece, we’ll compare each fintech stock and see which one Wall Street expects the most from in 2023.

PayPal (PYPL)

PayPal is a spicier payment play that’s struggled to sustain a rally in recent months amid the brutal tech sell-off.

While there’s a lot to be hopeful about after recent quarters (margins and growth appear to be getting on track), it’s clear that investors are no longer willing to pay such a premium multiple for a name that faces stiff competition from traditional financial firms, like credit card companies and the big banks.

Traditional financial firms already make bank (forgive the pun) from their traditional businesses, leaving them with deep pockets to splurge on forward-thinking payment tech in a higher-rate world. There’s still room to run in the digital payments scene for traditional firms and fintech disruptors.

PayPal’s robust ecosystem can help it keep and take market share. Venmo, in particular, is a standout that could help keep PayPal going strong as macro headwinds and competitive forces weigh.

Wedbush analyst Moshe Katri recently noted strength in Venmo through the Black Friday shopping season. Venmo is taking share and is quickly becoming a vital part of PayPal’s future.

Undoubtedly, PayPal overshot to the upside in 2021. Now, the tables are turned, and questions linger as to how much more investors should be willing to pay for a fintech that may stand to be challenged by the old-school financial firms it sought to disrupt.

I think there’s a good chance that PayPal stock has now overshot to the downside. Yet, shares still look expensive at 37.8 times trailing earnings.

What is the Price Target for PYPL Stock?

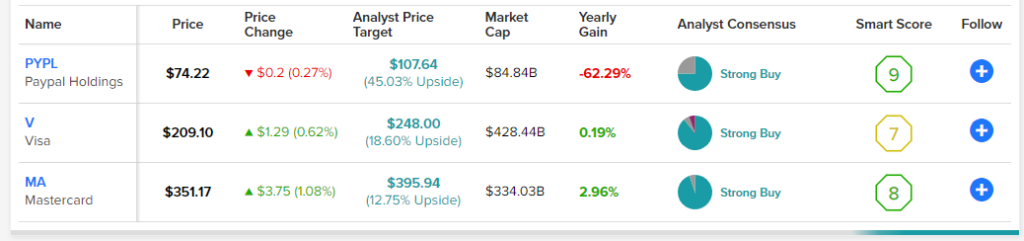

The average PYPL stock price target of $107.64 implies a whopping 45% in upside potential for the year ahead. PayPal’s push to capture a more significant share of e-commerce transactions could be key to hitting such a target.

Visa (V)

Visa stock has been such a steady blue chip through this bear market. With a decent fourth quarter (EPS of $1.93 vs. $1.87 consensus) in the books and a new CEO, Ryan McInerney, slated to take the helm in the first quarter of 2023, Visa looks incredibly intriguing as it looks to confront mounting macro headwinds.

Departing CEO Alfred Kelly hasn’t done a terrible job. Arguably, he’s done far better than most others in this hostile environment. Visa stock has held its own better than the broader markets. Still, McInerney’s wealth of experience could help Visa take its outperformance to the next level.

Like PayPal, digital payments represent a considerable opportunity for the firm. As a leader in the space, it’s tough to pass up on the name, even if bears think Visa’s EPS beat streak is poised to end.

What is the Price Target for V Stock?

The average V stock price target of $248.00 implies 18.6% upside from here. Wall Street stands by its “Strong Buy” rating based on 16 Buys, one Hold, and one Sell rating.

Mastercard (MA)

Mastercard is a credit card titan that makes a strong case for why it’s as innovative, if not more innovative, than your average fintech firm. Indeed, financial tech is one of the key pillars of the company’s long-term growth profile.

Like Visa, Mastercard reported remarkable strength in its latest quarter. With better profitability prospects than fintechs and more growth than Visa, Mastercard is a fine middle ground for investors seeking the best of both worlds.

The stock trades at 34.7 times trailing earnings – not cheap, but Mastercard is one of the names that doesn’t deserve to be cheap.

What is the Price Target for MA Stock?

Wall Street loves Mastercard, with the average MA stock price target of $395.94 implying 12.75% upside potential over the next 12 months.

The Bottom Line

Though payment volumes could slip further once a recession has the chance to strike (we’ll gain a better glimpse of the economic damage to come in a quarter or so), many Wall Street analysts aren’t willing to throw in the towel on this market’s top payment plays.

Indeed, many of the gloomy expectations for 2023 already seem to have been baked in for many months. If a recession proves mild (or if it doesn’t happen at all), Wall Street is wise to stick with the payment companies while they navigate headwinds and downbeat expectations.