With volatility likely to continue in the market, TipRanks brings you the latest analyst action on some of your favorite stocks to help you navigate through the ups and downs. Let’s take a closer look at the top bullish and bearish calls of the day and see what market pundits are recommending.

Upgrades

1. Sandfire Resources

Goldman Sachs analyst Paul Young upgraded Sandfire Resources (SFRRF) to Buy from Hold and increased the price target to A$7.60 from A$5.80. Young cited an expected increase in the copper price and the company’s “compelling valuation” at 0.72x net asset value and 1.2x expected EBITDA over the next 12 months as the reasons for the upgrade.

The consensus rating among analysts is a Strong Buy based on 3 unanimous Buys. The average analyst price target stands at $5.50 and implies upside potential of 32.9% to current levels.

2. Gran Tierra Energy Inc.

Scotiabank analyst Gavin Wylie upgraded Gran Tierra Energy (GTE) to Hold from Sell and maintained the price target of C$1.20 following the company’s 1Q operational update. In a note to investors, Wylie said that though the company’s 1Q production of 24,463 boe/d was “modestly” below consensus, it is “potentially more important” that the current production is “much more in line” with Gran Tierra’s reiterated guidance of 28,000-30,000 boe/d for 2021.

TipRanks’ Hedge Fund Trading Activity tool shows that confidence in Gran Tierra is currently Neutral, as 2 hedge funds decreased their cumulative holdings of the stock by 19.3 million shares in the last quarter.

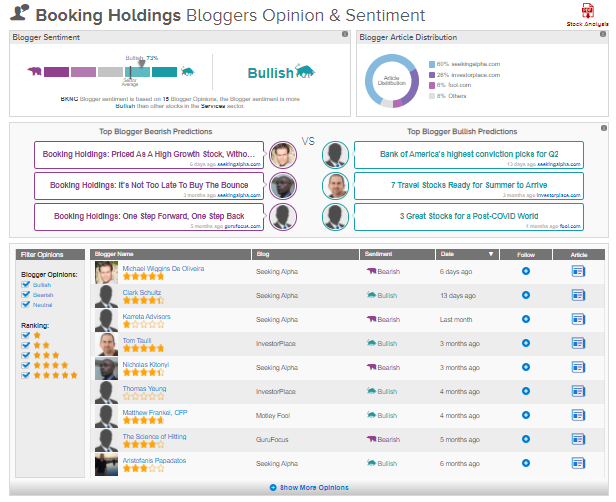

3. Booking Holdings

Jefferies analyst Brent Thill upgraded Booking Holdings (BKNG) to Buy from Hold and increased the price target to $2,800 from $2,300 following the company’s year-to-date underperformance compared to the broader travel space and indications of rising travel demand. In a note to investors, Thill said that he realizes the impact of increased uncertainty of COVID-19 on the company’s bookings and revenue, 85%-90% of which come from outside the US. Meanwhile, the analyst foresees the rest of the world catching up to US vaccination levels and a rebound in global travel by the latter half of this year.

TipRanks data shows that financial blogger opinions are 73% Bullish compared to a sector average of 65%.

4. Bristol-Myers Squibb

Truist Financial analyst Gregg Gilbert upgraded Bristol-Myers (BMY) to Buy from Hold and increased the price target to $74 from $66 following the FDA approval for Abecma and Breyanzi along with positive top-line Phase 3 results for deucravacitinib and relatlimab.

Bristol-Myers scores a “Perfect 10” from TipRanks’ Smart Score rating system, indicating that the stock has strong potential to outperform market expectations.

5. Spirit Airlines Inc.

Susquehanna analyst Daniel Mckenzie upgraded Spirit Airlines (SAVE) to Buy from Hold and maintained a price target of $50. Mckenzie prefers the low-cost model based on his belief that the company’s operational flexibility along with lower direct and indirect costs is likely to support better unit economics and increased resilient margins, with visibility of US domestic air travel recovery.

TipRanks data shows that financial blogger opinions are 94% Bullish, compared to a sector average of 66%.

Downgrades

1. Facebook

Wedbush analyst Ygal Arounian downgraded Facebook (FB) to Hold from Buy and decreased the price target to $340 from $375, as the analyst assumed coverage of the stock. Among Arounian’s coverage of mega-cap tech stocks, he believes Facebook is the “most exposed to privacy risks” though the social commerce initiatives that FB is building into its platform seems positive. Furthermore, the analyst considers Facebook to be the strongest digital ad platform in tracking and targeting users via the internet but believes such popularity gives the company “the most to lose” with the expected recognition of Apple’s (AAPL) App Tracking Transparency, which might limit Facebook’s tracking capabilities.

According to TipRanks’ Smart Score system, Facebook gets a 6 out of 10, which indicates that the stock is likely to perform in line with market averages.

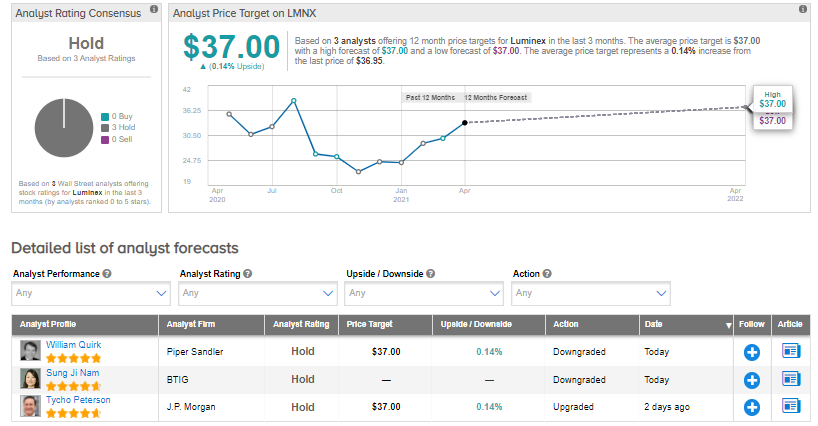

2. Luminex Corporation

Piper Sandler analyst Steven Mah downgraded Luminex Corp. (LMNX) to Hold from Buy and decreased the price target to $37 from $38 following the announcement of the company’s takeover by DiaSorin for $37 per share in an all-cash deal worth $1.8 billion. According to Mah, the deal will close as he believes there are “little to no concerns about regulatory approval.”

Overall, the stock has a Hold consensus rating based on 3 unanimous Holds. The average analyst price target of $37 implies that shares are almost fully valued at current levels.

3. Nuance Communications

Craig-Hallum analyst Jeff Van Rhee downgraded Nuance (NUAN) to Hold from Buy and decreased the price target to $56 from $58. Since the appointment of Mark Benjamin as CEO of Nuance, Rhee believes the company to be a “clear and convincing success and a multi-bagger”, but considers the takeout price of $56 per share, at which Microsoft is acquiring Nuance, to be “disappointing”.

TipRanks’ Hedge Fund Trading Activity tool shows that confidence in Nuance is currently Neutral, as 11 hedge funds increased their cumulative holdings of the stock by 5.5 million shares in the last quarter.

4. Fortescue Metals Group Limited

Goldman Sachs analyst Paul Young downgraded Fortescue Metals (FSUGY) to Sell from Hold and decreased the price target to A$18.90 from A$20.40 following its broader research on bulk miners. Young cited the company’s premium valuation relative to its peers, ongoing capex and timing risks related to the company’s Iron Bridge project, and Fortescue Future Industries diversification uncertainty as the reasons for the downgrade.

TipRanks data shows that financial blogger opinions are 100% Bearish, compared to a sector average of 66% bullish.

5. Golar LNG Limited

Merrill Lynch analyst Ken Hoexter downgraded Golar LNG (GLNG) to Sell from Buy and decreased the price target to $10 from $15. According to Hoexter, the company will face hurdles in moving forward strategically, as the sixth CEO in the last 10 years has resigned, with the most recent resignation being that of Iain Ross. Furthermore, the analyst believes continued senior management shuffling creates difficulties in executing new projects.

Additionally, TipRanks’ Stock Investors tool shows that investors currently have a Very Negative stance on Golar LNG, with 9.3% of investors decreasing their exposure to GLNG stock over the past 30 days.

Besides the above, you can also have a look at the following:

Nvidia: Latest Developments Are Breathtaking, Says Top Analyst

Amarin: Could the New CEO Help Vazkepa’s European Push?

Raymond James Predicts Over 60% Rally for These 2 Stocks

Dividend-Yield Calculator