Where do you turn when you need in-depth detail on a stock? To the experts of course – the Wall Street analysts who report on the markets for the major banks and investment firms. They bring the patina of authority and experience to their stock reports.

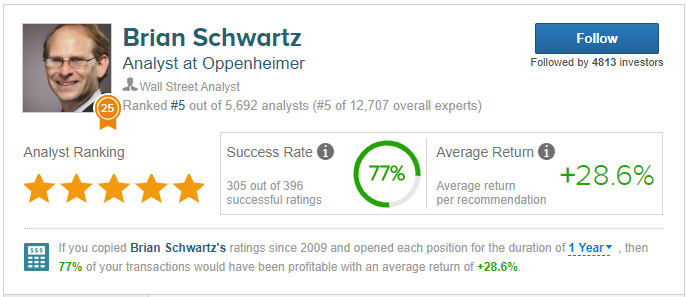

Of course, being human, the experts are not always right – but how can you know? TipRanks rates the analysts on Wall Street for you, so you’ll know who to trust. Using natural language algorithms, TipRanks sorts through the analysis reports from over 5,600 financial experts, checking their success rates and accuracy, to create a database that tell you who to trust.

Some analysts stand out in the TipRanks ratings. Today, we’ll look at three stocks recommended by Brian Schwartz, the top-rated analyst from Oppenheimer and the #5 analyst overall in the TipRanks listings. We’ll dive into the database to see the stocks’ current condition and what Schwartz has to say about them.

Yext (YEXT)

In the digital world, identity and information are everything. A company has to be certain – to know – that its image gets through to the customer. This is where Yext comes in. Yext puts online brand management and search engine syncing at your service, allowing business customers to control and coordinate the way their information appears online and, especially, in search engines.

The importance of digital brand management is clear from Yext’s revenue numbers. The company brought in $170 million in sales for fiscal 2018, and in the most recent quarterly report, from Q2, showed a 1% bump in revenues to $72.4 million. The revenue number was up 31.4% from the year-ago quarter. Heading into the Q3 report – due at the end of this month – Yext is expected to show a 31.6% year-over-year quarterly revenue gain.

At the end of October, Schwartz attended an Investor Day with Yext, getting a chance to meet with management and see their projections for the company going forward. In his note on the meeting, Schwartz wrote, “In aggregate, our checks suggest high satisfaction levels from customers, prospects, and partners with whom we spoke at ONWARD. Takeaways include: 1) good end-market demand; 2) Answers is topical for most customers and prospects; 3) Yext is viewed as mission critical by customers…”

At the bottom line, after reviewing the company’s offerings and plans, Schwartz stated, “We think the sales motion is working… we see the emerging products as potential growth catalysts over the next 12–24 months driving a growth acceleration that could result in a re-rating of YEXT’s valuation multiples higher.” His $26 price target on YEXT suggests an upside of 57% to the stock.

Wall Street anchor a bullish perspective on the chip giant, as TipRanks analytics showcase NVDA as a Moderate Buy. Based on 6 analysts polled by TipRanks in the last 3 months, 4 rate a Buy on Yext stock, one says Hold and one recommends Sell. The 12-month average price target stands at $24.40, marking a nearly 47% from where the stock is currently trading. (See Yext stock analysis on TipRanks)

LivePerson (LPSN)

While brand management is important to online business, so is direct customer contact. LivePerson fills that contact niche, offering chat platforms to business to communicate with customers directly online. The company’s main platform, LiveEngage, allows businesses to chat with customers via web browsers, mobile devices, and social media. The LP Insights product turns chat transcripts into usable, searchable data to provide insights for business action. LivePerson saw $250 million worth of sales in 2018.

Like many tech companies, LivePerson is currently operating at a loss – and the loss was worse in Q3 than expected. Where analysts had forecast a 6 cent EPS loss, the number came in at 41 cents. Shares fell after the news, but in the last two weeks have recouped the loss, as investors digested the good news in the quarterly report. Revenue, at $75.2 million, beat the forecast of $74.6 million, and the company revised the full-year revenue guidance upward to the $289.5 to $292.5 million range. CEO Rob LoCascio said, “Our revenue growth is inflecting as leading brands turn to LivePerson and our Conversational Commerce platform to profoundly change the way they deliver care, sales and marketing experiences to consumers.”

Schwartz was impressed by LivePerson’s results and forward plans. In his recent note on the company, he said, “LivePerson reported good 3Q results, in our assessment, and raised the 2019 growth guidance… On balance, management is accelerating investments for growth for the second straight quarter… Bottom line: We believe management’s go-to-market strategy is working, and we carry an upward bias that the business achieves its growth targets over the next 12-24 months.” Schwartz’s $45 price target implies an upside potential of 21% to LPSN.

The rest of the Street appears to echo Schwartz’s sentiment. As it has racked up 10 Buys and only 1 hold ratings in the past 3 months, the consensus is unanimous: LPSNis a Strong Buy. Adding to the good news, the upside potential lands at 23% based on the $45.45 average price target. (See LivePerson stock analysis on TipRanks)

Workday (WDAY)

Workday inhabits the Software-as-a-Service environment, offering business customers platforms for financial and human services management. Businesses have an urgent need to keep financial and personnel data organized; Workday fills that. The company exceeded $1 billion in revenue in 2016, and in fiscal 2018 reported a total of $2.14 billion in sales.

Workday will be releasing Q3 results on Thanksgiving Day, and if the company follows recent trends it will have plenty to be thankful for. The company’s subscriptions, revenues, and earnings have been growing steadily since 2017. In Q2 of this year, WDAY showed EPS of 44 cents, 9 cents better than the forecast. Revenues, at $887.8 million, beat the forecast by 1.8%. Shares gained almost 3% after the Q2 report, and are up 8.24% year-to-date. While underperforming the broader market, the stock’s gains are real and stand on a solid foundation.

Schwartz sees the company’s solid base as a net asset, and key to its continued success. He writes, “Workday is a well-established franchise, industry leader, and one of a few software vendors that provides a single-system, end-to-end, enterprise-scale HCM, financials, and analytics software suite. Because all elements of Workday’s application suite are fully integrated, customers can better manage their HR and financial management tasks in a single turnkey SaaS solution and without burdensome integration tasks.” Schwartz goes on to add that Workday’s product offers a solution for companies using obsolete legacy systems. His $225 price target suggests that WDAY has room for a 30% upside.

All in all, the analyst community is mixed on Workday. TipRanks analysis of 22 analyst ratings shows a Moderate Buy consensus, but an even split recommending Buy or Hold. The $208.19 average stock-price forecast implies about 20% from current levels. (See Workday stock analysis on TipRanks)