Walmart is launching a new fashion essentials brand – Free Assembly on its platform and will sell its products both online and in stores. Free Assembly is a private label which offers both men and women clothing. Shares are up 1.9% in pre-market trading on Monday.

On Sept. 21, Denise Incandela, the head of fashion of Walmart’s (WMT) US e-commerce business said that Free Assembly is “a modern fashion brand that offers elevated style essentials at an incredible value.” The company also said “Starting today, the Fall collection will include more than 30 items for women and 25 items for men, all priced between $9 and $45.”

The retailer has been diversifying its product assortments and is trying to increase sales of general merchandise, such as clothing, to boost its e-commerce business. Earlier in May, Incandela said that the company has “added nearly 1,000 brands to our online assortment, including national brands like Champion, Jordache and Levi Strauss.” The company also offers private label and elevated brands. (See WMT stock analysis on TipRanks).

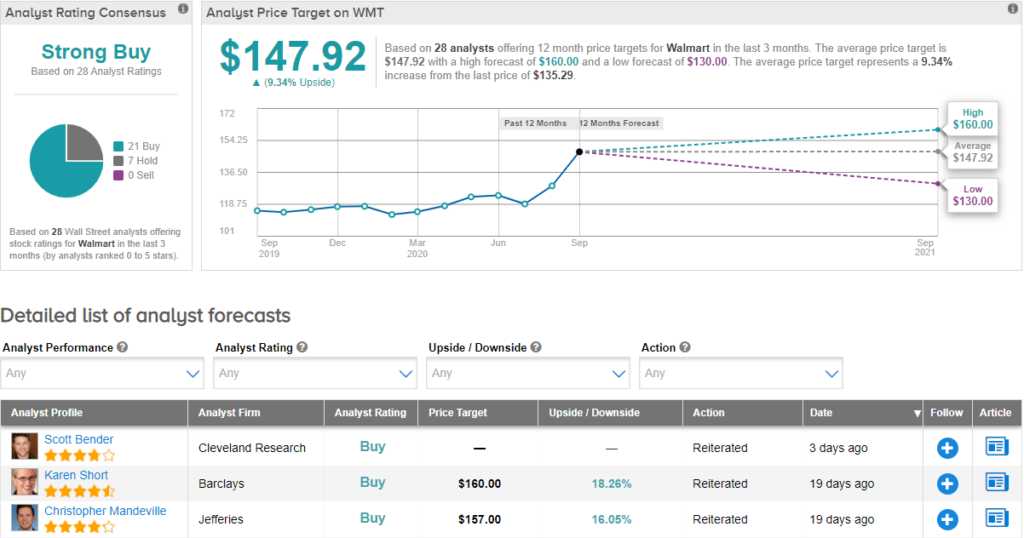

On Sept. 18, Cleveland Research analyst Scott Bender maintained a Buy rating citing improving US sales trends. He thinks that domestic sales trends at Walmart have turned slightly better directionally in recent weeks with improvement in back-to-school and traffic trends. The analyst noted that his 3Q Walmart US comp growth estimate of 4% is above the consensus forecast of 3.8% growth.

Currently, the Street has a bullish outlook on the stock. The Strong Buy analyst consensus is based on 21 Buys versus 7 Holds. The average price target of $147.92 implies upside potential of about 9.3% to current levels. Shares have gained 13.8% year-to-date.

Related News:

Oracle, Walmart To Invest In TikTok Global After Trump’s Approval

Westport Soars 39% As Weichai JV Gets Chinese Certification

Oasis Petroleum Drops 8% After Deferring Interest Payments