Billionaire Warren Buffett’s Berkshire Hathaway is planning to buy a stake in software company Snowflake’s IPO (initial public offering), which is expected to list at a price range of $75 and $85.

According to Snowflake’s SEC filing on Tuesday, Berkshire (BRK.B) and Salesforce Ventures, a unit of Salesforce.com, each have agreed to buy $250 million worth of Class A shares of Snowflake in a private placement at its IPO price. Berkshire has also agreed to buy around 4 million shares from one of the Snowflake’s shareholders in a secondary transaction, according to the filing.

On Sept 4, Berkshire Hathaway, the largest company in the U.S. as measured by shareholders’ equity, had slashed its stake in US lender Wells Fargo & Co to 3.3%. On Sept. 1, Buffett’s investment conglomerate bought slightly more than 5% in each of 5 of Japan’s leading trading companies.

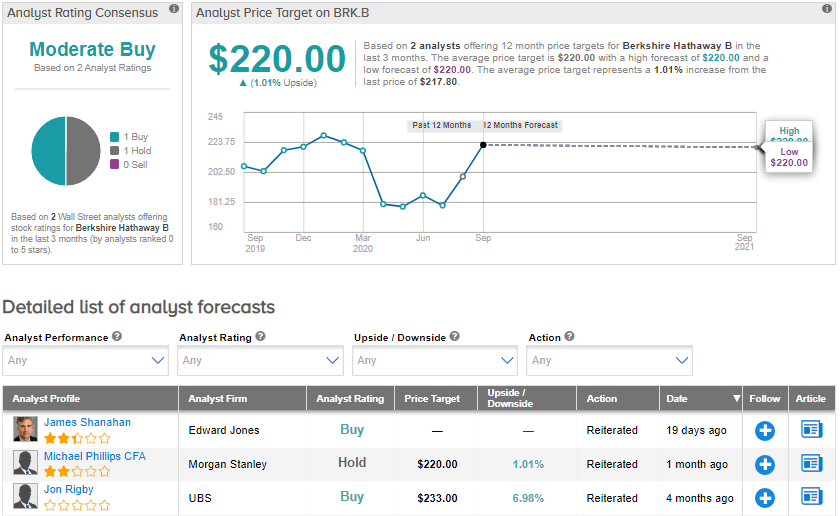

On Aug. 21, Edward Jones analyst James Shanahan maintained a Buy rating on the stock, saying that the “stock is cheap”. He wrote in a note to investors that “Some of the businesses that are struggling are poised to start performing better later this year and in 2021.” He added that the stock “gives clients broad exposure to the US economy – like a diversified mutual fund – at a low cost to own.” (See BRK.B stock analysis on TipRanks).

Currently, the two analysts covering the stock have a cautiously optimistic outlook on the stock with a Moderate Buy consensus. The average price target of $220 implies upside potential of 1% to current levels. Shares declined about 3.8% year-to-date.

Related News:

Buffett’s Berkshire Cuts Stake In Wells Fargo As Analyst Flips To Buy

Slack Tanks 19% In After-Hours As 2Q Billings Miss Estimates

Lululemon Skids 6% As 3Q Profit Expected To Drop