Markets have taken a pounding in recent sessions, with the S&P 500 losing nearly 8% in the last 6 days. Opinion is divided on the cause, with most pointing to the impact of the coronavirus outbreak on China’s economy and on global trade and travel patterns. It hasn’t escaped notice, however, that the sudden hit to the market has occurred just as Senator Bernie Sanders, an avowed socialist with a vigorous anti-Wall Street policy platform, has taken a commanding lead in the race for the Democratic Party Presidential election nomination.

Whatever the reason, markets have erased the gains they’ve posted so far in 2020, and fallen back to their December 2019 levels. It may not be a warning sign to get out of stocks, but it’s certainly a reminder that it’s never too late to buy into a defensive portfolio. And that will naturally bring dividend stocks to mind.

Any strong defensive investing strategy will include dividends. They ensure an income stream, even when markets turn down. Warren Buffett, certainly no stranger to smart investing, is long-term fan of dividend investing, as a look at Berkshire Hathaway’s holdings shows.

The Oracle of Omaha is bumping up his holdings when it comes to dividends, and he’s openly citing the coronavirus scare. While conceding in a recent CNBC interview that the viral outbreak is certainly “scary stuff,” Buffett adds that the long-term outlook remains strong. And when Warren Buffett says, ‘long term,’ he means just that: “We’re buying businesses to own for 20 or 30 years. We think the 20- to 30-year outlook is not changed by the coronavirus.”

We’ve looked into Buffett’s recent holding additions, and using the TipRanks Stock Screener tool, we’ve chosen three stocks with particularly high yield dividends and substantial upside potential – over 25% for the coming months. Let’s take a closer look.

Occidental Petroleum Corporation (OXY)

OXY’s dividend comes to $3.16, with the yield at a solid 8.7%. That’s more than 4x the average dividend yield among S&P-listed companies, but not enough to compensate for the stock’s 42% share price loss over the past 12 months. But remember that Buffett sees time horizons for investments in decades. And OXY has a strong foundation for the long term. With that in mind, Buffett bought up over 11 million shares of Occidental Petroleum in the fourth quarter.

The company is an energy player big-wig, operating oil and natural gas exploration and drilling rigs in the US, Colombia, and the Middle East, with a heavy investment in the petrochemical manufacturing sector. OXY has a market cap of $32 billion, and pockets deep enough to survive the low oil prices that slowed down the energy sector in 2019. Occidental completed the acquisition of competitor Anadarko late last year, and the resulting debt has been a weight on the company. Long-term, however, the move brings OXY access to $3.5 billion in cost efficiencies and savings.

The attraction for Buffett is clear, and it’s no wonder why he bought up those 11,465,546 shares in the company, bringing his total holding in OXY to 18,933,054 shares. That’s 2.5% of the company, and worth over $685 million at current prices.

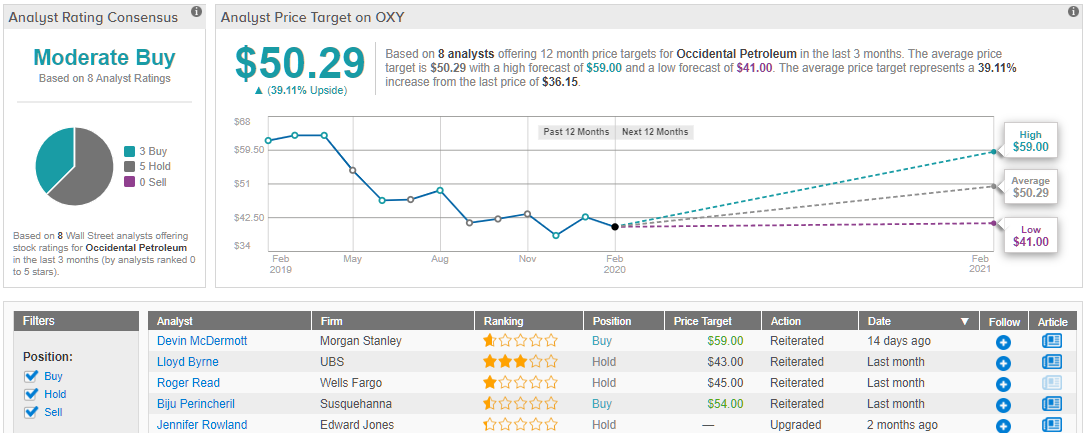

Morgan Stanley analyst Devin McDermott also sees the attraction in Occidental Petroleum. In his recent review of the stock, McDermott reiterated his Buy rating and gave the shares a $59 price target, implying room for a 63% upside. (To watch McDermott’s track record, click here)

McDermott wrote in his research note on OXY, “OXY attributed strong 4Q production results to reduced downtime, improved time to market, and strong base and new well performance. Relative to legacy APC operations, we had viewed reduced downtime and well performance improvement as key sources of upside to synergies […] We believe the dividend, which offers a best-in-class +8% yield, is safe with long-term growth under most scenarios.”

Overall, OXY shares get a Moderate Buy rating from the analyst consensus, based on a combination of 3 Buys and 5 Holds. Analysts express concern about debt levels – but that hasn’t stopped them form putting an average price target of $50.29 cents on the stock. That suggests a robust upside potential of 39% (See Occidental Petroleum stock analysis at TipRanks)

Suncor Energy (SU)

The second major Buffett acquisition we’re looking at is Suncor, a $45 billion player in the Canadian energy scene. Suncor is based in Calgary, Alberta, at the center of Canada’s oil sand region. The oil sands have made Alberta major producer of synthetic crude on the world markets, and are widely credited with bringing prosperity to the Plains province.

Suncor has shown remarkable resilience in weathering the low oil prices recently, and its volatility actually declined in 2019 compared to 2H18. In the most recent quarter reported, SU showed 39 cents EPS, below the 50 cents expected but still enough to keep up the 32-cent quarterly dividend with a payout ratio of 90%. The next dividend payment, set for March, will show an increase to 35 cents. The annualized payment, $1.40 per share, gives a yield of 4.8%, plenty high enough to attract attention from income-minded investors.

Income-minded investors like Warren Buffett. Buffett snapped up 4,261,031 shares in SU during Q4, and now owns more than 15 million shares in the company. It was a 39% increase of his holding, and a major commitment in the Canadian oil industry. Buffett’s full holding in Suncor is worth $437 million at today’s prices.

BMO Capital analyst Randy Ollenberger sums up the case for Suncor in his recent note: “Suncor reported Q4/19 financial results that were in line with expectations with stronger upstream performance offsetting weaker downstream results. Suncor increased its dividend 11% and has approved a renewal of its share buyback program… We believe that Suncor is uniquely positioned among its peers to deliver lower-risk returns to shareholders.”

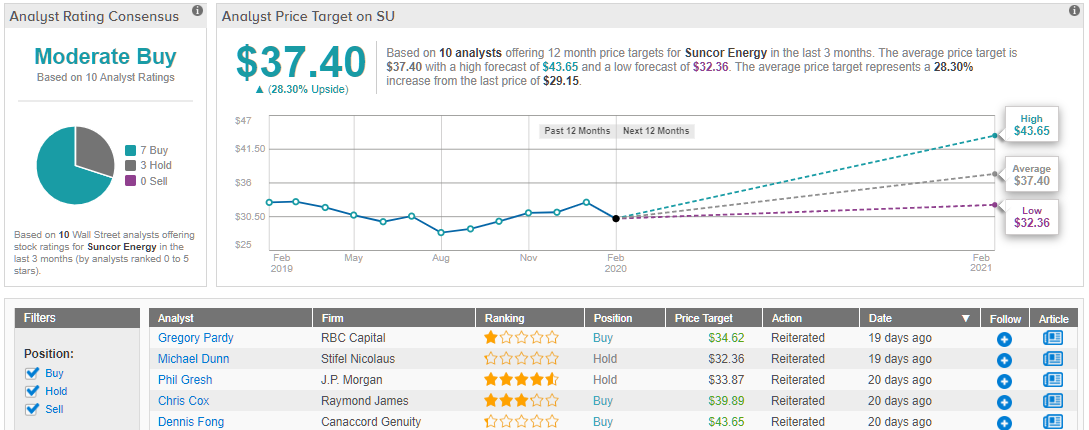

Ollenberger puts a Buy rating and a price target of $43.65 on the stock (C$58), suggesting a strong 50% upside. (To watch Ollenberger’s track record, click here)

Jon Morrison, writing from CIBC, is also bullish on Suncor. He says of the stock, “Upstream production largely matched our estimates and was at the mid-point of recently revised guidance, capex came in heavy and took the full-year cash spend above the high-end of Suncor’s guidance… we believe a portion of the overspend was driven by the company pulling a few things forward from a planned maintenance perspective…”

Along with his Buy rating, Morrison gives SU shares a $53 price target (C$70). This implies a tremendous upside potential of 82% to the stock. (To watch Morrison’s track record, click here)

Net net, Suncor’s Moderate Buy consensus rating is based on 6 Buy against 3 Holds. The stock is selling for $29.12 (C$38.71) and has an average price target of $37.13 (C$49.36), indicating room for 27% growth to the upside. (See Suncor stock analysis at TipRanks)

General Motors Company (GM)

The third big Buffett move we’re looking at today is General Motors, a long-time staple of the Detroit auto industry. GM is the largest of the American automakers, and includes storied names like Cadillac and Chevrolet. And Warren Buffet just increased his holding in the company by over 2.7 million shares. Buffett is on record saying that he prefers investing in companies with simple plans, and GM offers just that: Build cars, and sell them. Pretty basic.

GM’s dividend is similar to Suncor’s, at 4.7%. The payment is 38 cents quarterly, or $1.52 annualized. The company has a 6-year history of reliable payments, and has held the dividend steady at its current level since 2016. While Buffett likes dividends that grow steadily, he has no qualms with steady payments – in his view, the key factor is reliability. And GM meets that, making regular payments and beating the both the market average and Treasury notes on yield.

GM is taking a lead in the shift towards electric vehicles, and investing heavily in non-gasoline automotive powertrains. While expensive initially, some analysts see this as a path forward, noting that political winds and likely customer choices will favor electric and other non-gasoline vehicles in the mid- to long-term for the auto markets.

Morgan Stanley 4-star analyst Adam Jonas holds this view of GM, and writes of the stock, “In our opinion, there is a significant opportunity for a major OEM to show a substantial rate of change through the full electrification of their fleet, in addition to other actions. We believe GM has a chance to be a global leader in this regard. We also see the timing as opportune, with many investors increasingly taking a more assertive role in allocating capital across companies that are making the greatest true efforts to reduce CO2.”

Jonas also sees GM in an strong position regarding more tradition financial benchmarks: “GM’s free cash flow profile is one of the most impressive, if not the most impressive, of any global auto stock under our coverage at more than 15% yield on average through 2022. The company’s ability to generate free cash is matched by its proven track record in allocating and returning capital efficiently to investors.”

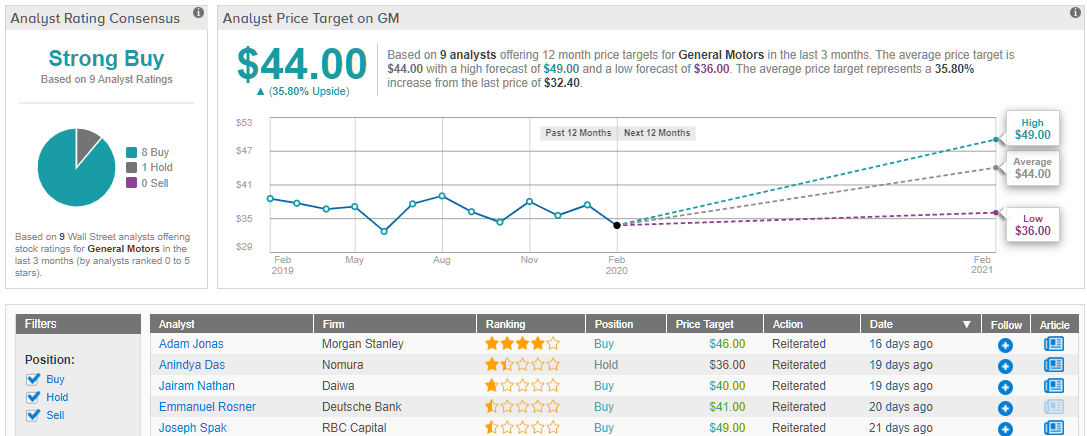

Unsurprisingly, given his bullish outlook on the company, Jonas puts a Buy rating on GM shares along with a $46 price target indicative of a 45% upside potential. (To watch Jonas’ track record, click here)

All in all, General Motors’ Strong Buy analyst consensus rating is based on a lopsided split of 8 Buys and a single Hold. The shares are priced low for a blue-chip company, at $31.75, and the $44 average price target suggests an impressive upside potential of 38%. (See GM stock analysis at TipRanks)