Wedbush maintained a price target of $15 (12.4% downside potential) and a Hold rating on Nordstrom, ahead of the company’s 2Q results next week.

While Wedbush analyst Jen Redding expects Nordstrom (JWN) to miss 2Q EPS by 10 cents or greater miss versus analysts’ estimates, the analyst forecasts that the company will beat the consensus for revenues. Redding believes any upside will likely be offset by a greater-than-expected decline in gross margin.

The analyst views Nordstrom’s “sophisticated and powerful omni-channel platform, as well as the company’s localized market strategy, and unique limited distribution brand growth as potential key drivers of growth over the long-term.” Nonetheless, she remains cautious amid the current challenging environment.

Nordstrom reported grim results in 1Q. Its net revenues of $2.12 billion missed analysts’ expectations of $2.42 billion. The retailer also recorded a loss per share of $3.33 in 1Q, as compared to the Street expectations of a loss of $1.07 per share.

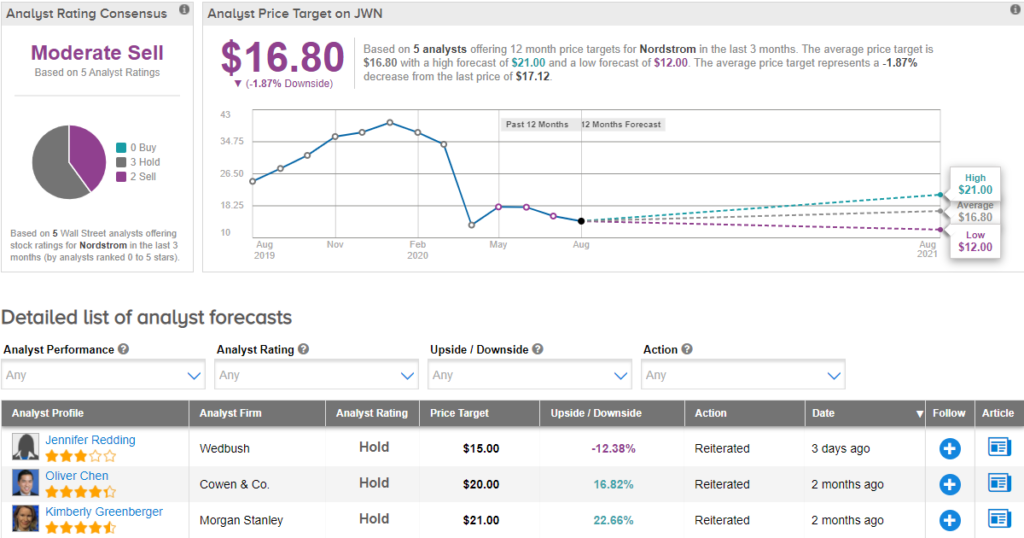

Currently, the Street has a cautious outlook on the stock. The Moderate Sell analyst consensus is based on 2 Sells and 3 Holds. The average price target of $16.80 implies downside potential of about 1.9% to current levels. (See JWN stock analysis on TipRanks).

Related News:

Nordstrom Delays Annual 11-K SEC Filing, Reopens 90% Of Stores

Nordstrom’s Shares Drop 12% on Difficult Quarter

Wedbush Lifts Nvidia’s PT Ahead Of 2Q Results