U.S. stocks gained about 1% on Friday, as the S&P 500 and Nasdaq Composite kicked off the month of November with record highs. Energy and Industrial names led the way higher this week, while the Real Estate and Utility sectors lagged.

Ideal Economic Situation

Bulls were encouraged by an upbeat October employment report on Friday. The U.S. economy added 128,000 non-farm payrolls in the month, which exceeded expectations. In addition, results from the August and September were both revised higher.

Just 48 hours earlier, the initial reading of third-quarter GDP growth came in ahead of the consensus analyst estimate. Also on Wednesday, the FOMC voted to cut interest rates for the third consecutive meeting.

Earnings Parade Marches On

Almost lost in the sea of “Goldilocks” economic data is that we just ended the busiest week of the third-quarter earnings season. Apple (AAPL) and General Electric (GE) were the big earnings-related winners this week.

On the other hand, Internet names like Etsy (ETSY), Grubhub (GRUB), Pinterest (PINS) and Wayfair (W), all experienced sizable declines, after disappointing investors with their profit outlooks.

Of the 356 S&P 500 companies that have reported so far, 76% have exceeded earnings expectations. This is well above the historical average, although aggregate profit remains on track to decline fractionally in the third quarter.

Knowing what and when to buy can be challenging for any investor. However, the fact remains that attractive investments are out there, if you’re willing to dig a little deeper.

One such real estate name with a solid dividend and strong earnings momentum is worth a closer look and is our Stock of the Week below…

Stock of the Week: VICI Properties (VICI)

The company operates as a real estate investment trust (REIT), with over 22 entertainment properties, casinos and hotels, including Caesar’s Palace.

The stock gained nearly 4% this week, as management delivered a better-than-expected quarterly profit this past Wednesday.

Looking ahead, these gains should keep on coming. Here’s why:

VICI earned $0.35 a share in the third quarter, as revenue fell 4% from the previous year, to $222.5 million. Management noted the upside was driven by higher leasing revenue in the period and boosted full-year profit guidance by 4%.

The higher guidance was also influenced by the $843 million cash acquisition of the JACK Cleveland Casino and Thistledown Racino the company announced earlier in the week.

VICI will lease the property back to JACK Entertainment for an initial term of 15 years, at an annual rent of $65.9 million. The deal is expected to close in early 2020 and be immediately accretive to the company’s earnings.

Following the acquisition news and guidance boost, Deutsche Bank analyst Carlo Santarelli boosted his price target of the stock on Friday, citing:

“We continue to like VICI’s aggressive style and its ability to leverage relationships and expand its tenant base. Further, VICI has done a very nice job accessing the capital markets at opportune times to solidify their capital structure and promote accretion. We think the growth pipeline remains a competitive advantage. As such, we remain favorably inclined and we reaffirm our Buy rating. Our price target goes to $28 from $27.”

In addition to its growth potential, VICI also rewards investors with steady income. Management pays a quarterly dividend of $0.2975 a share (4.85% yield) that it boosted back in September. The next payout will likely be declared in December.

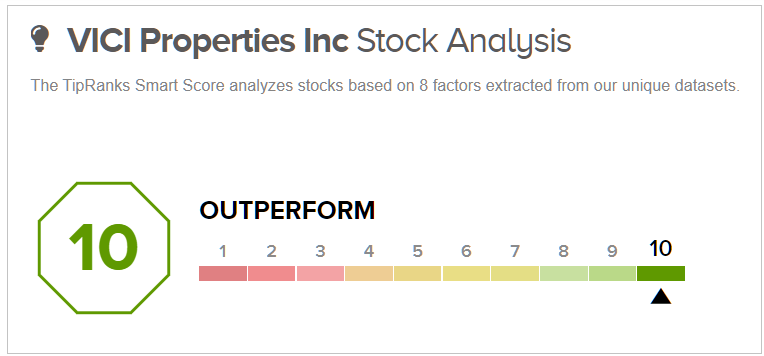

In the meantime, the company carries a Smart Score of 10/10 on TipRanks. This new proprietary metric utilizes Big Data to rank stocks based on 8 key factors that have historically been a precursor of future outperformance.

On top of the positive aspects mentioned already, Smart Score says that VICI has seen insider buying, in addition to positive sentiment from hedge funds and financial bloggers. (See VICI stock analysis on TipRanks)

This is just 1 of the 20+ stocks selected for the Smart Investor portfolio. That’s where we share more detailed insights on our weekly stock picks. You may also want to learn more about how we use TipRanks indicators to find stocks that are primed to outperform. (To discover the Smart Investor portfolio click here)