Wells Fargo has been busy studying the buying practices of Warren Buffett (Performance Profile). The Oracle of Omaha, who is now 88 years old, has amassed a fortune of over $87 billion over his career. So he clearly knows a thing or two about investing. And Buffett’s preferred investing style is- and has always been- value investing. In essence this means buying undervalued stocks with strong fundamentals and hanging on in there until shares prices catch up.

We can get a better idea of what Buffett is looking for from a 2014 letter to shareholders. Here Buffett set out the six key criteria he uses to decide if a company is a savvy buy. He revealed that he normally seeks out companies with $75 million + of pretax earnings; demonstrated consistent earning power; good returns on equity while using little or no debt; strong management; simple business models; and a clear asking price.

Four years on, the hedge fund guru has inspired Wells Fargo’s Colleen Hansen to create her own filter for the perfect ‘Warren Buffett stocks.’

These are the seven indicators used by the firm:

- 5-year average return on equity (ROE) over 15%;

- 5-year average return on invested capital (ROIC) over 15%;

- Debt-to-equity (D/E) less than or equal to 80% of the industry average;

- 5-year average pretax profit margin (PM) 20% higher than the industry average;

- Price-to-earning ratios (P/E) below 10-year historical and industry average P/E ratios;

- Price-to-book value multiples (P/B) below historical and industry multiples;

- Price-to-cash flow (P/CF) ratios below the industry average

And, as you will see below, filtering for these requirements generates a diverse list of stocks. Here we also add an additional factor to the picture. By plugging the stock tickers into TipRanks, we can pinpoint which of these stocks boast the most bullish Street consensus. This is according to all the stock’s ratings over the last three months. Interestingly only one stock fits the bill for both Hansen/Buffett and the Street. Is this the stock you should buy now? Let’s take a closer look at the most compelling stocks from the report:

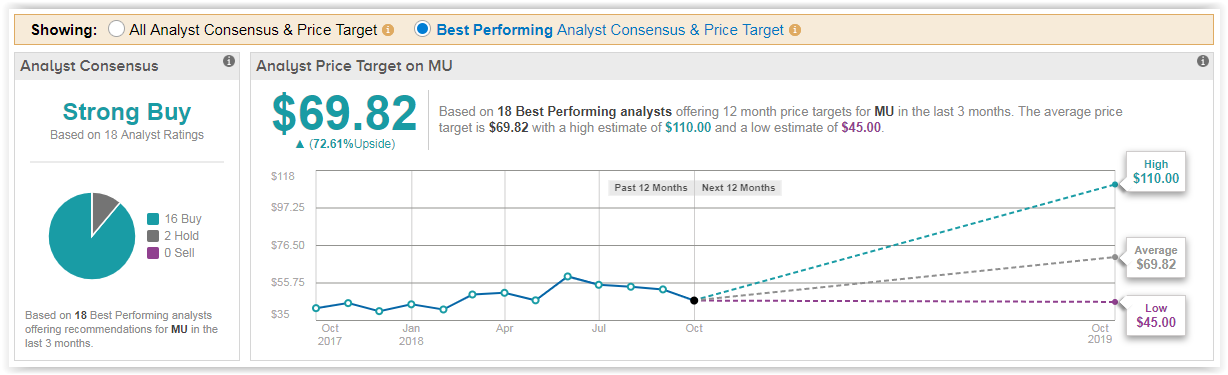

1. Micron Technology, Inc. (MU)

Analyst Consensus: Strong Buy

Red hot chip stock Micron (MU – Research Report) is the one stock that ticks all the boxes. For example, it is currently tracking a five-year average return on equity (ROE) of 28.4%. This is with a current P/E versus Industry P/E of 4.0 vs. 22.2.

If we dial into ratings only from top-performing analysts, we can see that this stock scores a ‘Strong Buy’ consensus rating. One analyst who has just come out in favor of MU is top Mizuho Securities analyst Vijay Rakesh (Track Record & Ratings). He is impressed by Micron’s announcement that it is exercising its right to buy Intel’s stake in IM Flash Technologies, a joint venture between the two companies. The deal includes a $1.5 billion cash payment and will see Micron take over Intel’s debt to the enterprise, which is about $1 billion. The two semiconductor giants formed IM Flash Technologies when they started working on 3D XPoint memory in 2006.

Rakesh commented, “With almost $6B invested between MU/INTC, and the lone 3D Xpoint fab, we believe this gives MU a strategic lead developing high speed memory for AI, similar to the Elpida Graphics/mobile DRAM acquisition for MU. We believe the Intel 3D Xpoint Optane solution has seen interest from hyperscale OEMs for accelerating the AI roadmap training and manipulating big data.”

“Looking out MU expects to control its own 3D Xpoint roadmap, development and drive margins and could be key to the long-term secular AI and deep learning enterprise data center roadmap,” the analyst added.

As such, Rakesh reiterates a Buy rating on MU stock, with a price target of $60, which implies an upside of 48% from current levels. According to TipRanks, which measures analysts’ success rate based on how their calls perform, Rakesh has a 46% average return when recommending MU, and is ranked #75 out of 4892 analysts.

2. Foot Locker, Inc. (FL)

Analyst Consensus: Moderate Buy

Did you know that this US retail giant has a Current P/E versus Industry P/E of 11 vs.18.6? And that the stock has just been highlighted as a ‘Fresh Pick’ by top Baird analyst Jonathan Komp (Track Record & Ratings). He sees improving performance over at Nike as good news for Foot Locker (FL – Research Report) as well:

“While a significant portion of Nike’s total growth is being driven by the Nike digital business, importantly for Foot Locker, the wholesale business is back to growth (had been flat/negative prior six quarters) and Nike’s Consumer Direct Offense is consolidating volume to its most strategically important retail partners (including Foot Locker),” the note said.

He also boosted his FL price target from $52 to $55 (16% upside potential) Even so, sales and margin questions through fiscal 2019 saw Komp reiterate his Hold rating on the stock.

Out of 9 best-performing analysts covering the stock, 6 are bullish while 3 are staying sidelined. Meanwhile the average analyst price target of $58 indicates 22% upside potential. See what other Top Analysts are saying about FL.

3. Michael Kors Holdings Ltd (KORS)

Analyst Consensus: Moderate Buy

Michael Kors (KORS – Research Report) stock is buzzing following the news that it has snapped up Versace for a cool $2.12 billion. With the deal (expected to close in F4Q19), KORS will become an increasingly diverse ~$6.0bn company, operating over 1,200 global stores.

“While KORS again appears to have paid a full price (Jimmy Choo in 2017), we believe the deal supports the formation of a global fashion luxury group and an improved long-term growth profile” cheered five-star Guggenheim analyst Robert Drbul (Track Record & Ratings) on the news.

However ultimately he remains sidelined on the stock, as: “we are mindful of near-term EPS dilution (-HSD% in FY20E) and believe work remains on improving Michael Kors’ own brand positioning; we remain NEUTRAL.”

Out of 11 recent analyst ratings, 7 are Hold while 4 are Buy. Notably the average analyst price target translates into significant upside potential of 38%. See what other Top Analysts are saying about KORS.

4. Urban Outfitters, Inc. (URBN)

Analyst Consensus: Moderate Buy

Fashion is the name of the game. Retail chain Urban Outfitters (URBN – Research Report) also makes the cut. B Riley’s Susan Anderson (Track Record & Ratings) sees prices rising 44% to $52. She writes: “we recently upgraded URBN from Neutral to Buy based on how the clean inventory is during our weekly store checks and the lower promotional cadence Y/Y, as well as the pull back in the stock leading to a good entry point.”

The best part: this is a retail stock with a strong online offering. Indeed, Anderson notes that URBN has the highest online penetration in our coverage at 40% and continues to grow +DD.

From only best-performing analysts, the ratings break down currently looks like this: 3 buy ratings with 7 hold ratings. We can also see that the $50 average analyst price target works out at 30% upside potential from current levels. See what other Top Analysts are saying about URBN.

5. Altria Group Inc (MO)

Analyst Consensus: Moderate Buy

As the holding company of Philip Morris USA and UST, Altria (MO – Research Report) is the largest U.S. tobacco seller, with brands like Marlboro as well as a 10% interest in Anheuser-Busch InBev (BUD). Wells Fargo shows that Altria boasts an impressive 5-year average ROE of 139.8%. Meanwhile its debt/ equity is at just 82.5% versus the industry’s 184.4%.

Only one top analyst, Stifel’s Christopher Growe (Track Record & Ratings), has published a recent rating on Altria. That rating is a Buy. This comes with a $65 price target (indicating only 5% upside potential). Growe argues Altria can keep growing its earnings per share at about 8% annually. However he sees a potential “reputational risk” of entering the marijuana sector.

‘Best’ of the rest

Here are the 4 other stocks on Wells Fargo’s Buffett-buy list: EQT Midstream Partners (EQM– Moderate Buy), Franklin Resources (BEN– Hold), Regeneron Pharmaceuticals (REGN– Hold) and Bed Bath & Beyond (BBBY– Moderate Sell). As you will see the Street so far indicates a cautious stance on their outlook- but who knows, maybe Buffett’s winning formula will manage to prove the Street wrong?!

Enjoy Research Reports on the Stocks in this Article:

Altria Group (MO) Research Report

Foot Locker (FL) Research Report

Michael Kors (KORS) Research Report

Micron Technology (MU) Research Report

Urban Outfitters (URBN) Research Report

You can research more potential investments with TipRanks’ stock screener tool. The screener covers more than 5000 stocks and offers a range of filters to refine your search. It’s everything you need to get the best information for smart investing. Go to the Stock Screener now.