It may be always sunny in Philadelphia, but not so much for Wells Fargo ($WFC). The bank will be leaving the city’s main sports arena once its current sponsorship contract with the venue ends in 2025.

The Wells Fargo Center in Philadelphia will have a different name starting in 2025, when the current contract runs out. As to why it is giving up sponsorship of the center, which is home to hockey’s Philadelphia Flyers and basketball’s Philadelphia 76ers, Wells Fargo said simply, “…we have made the business decision not to renew the naming rights contract.”

The sports arena will now have to look for a new sponsor. Wells Fargo actually inherited the arena sponsorship when it merged with Wachovia back in 2014. Meanwhile, Wells Fargo has been actively pulling back on sports sponsorships, having given up a PGA Tour event last year.

Getting the Name Out

Instead, Wells Fargo is looking at other breeds of roundabout marketing. First, it is stepping up its Homebuyer Access grants in Oklahoma, offering up $10,000 grants to “eligible homebuyers who currently live in or are pursuing homes in certain underserved communities in 12 new metropolitan areas,” noted FOX 25.

And, Wells Fargo also offered a piece of its own history to the Wesley W. Jung Carriage Museum in Greenbush, Wisconsin, noted the Sheboygan Press. Wells Fargo donated one of its own stagecoaches to the museum, a vintage 1875 Abbot-Downing Company Concord stagecoach. Wells Fargo’s stagecoach museum was planning to liquidate its stock as Wells Fargo was cutting off the stagecoach in branding, so the Wisconsin museum got a new coach for its own collection.

Is Wells Fargo Stock a Buy, Sell or Hold?

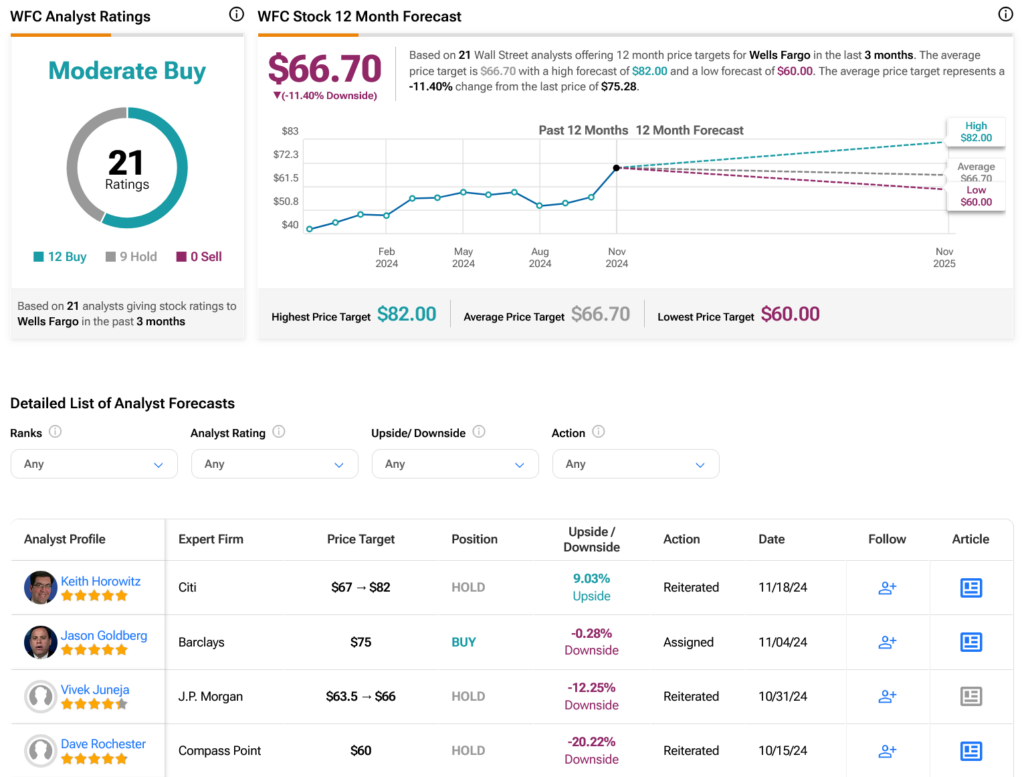

Turning to Wall Street, analysts have a Moderate Buy consensus rating on WFC stock based on 12 Buys and nine Holds assigned in the past three months, as indicated by the graphic below. After a 71.09% rally in its share price over the past year, the average WFC price target of $66.70 per share implies 11.4% downside risk.