Shares of Wells Fargo fell 7.8% on Friday after the banking giant reported revenues of $17.93 billion that fell short of analysts’ expectations of $18.13 billion. Moreover, the figure compared unfavorably to the year-ago period’s revenues of $19.86 billion.

Wells Fargo’s (WFC) lower revenues reflect declines across all of its business segments.

Meanwhile, the company’s earnings per share of $0.64 topped the Street’s estimate of $0.60. The bottom-line result also marked a 6.7% improvement from the year-ago quarter’s earnings of $0.60 per share, reflecting lower noninterest expenses. (See WFC stock analysis on TipRanks).

In response, Oppenheimer analyst Chris Kotowski reiterated a Hold rating on the stock. Kotowski wrote, “We think it was a solid quarter, in particular the “core” expense control showed signs of discipline. Asset quality trends were also stable. While NPAs (Non-Performing Assets) ticked up slightly from 0.89% in 3Q20 to 1.00%, NCOs (Net Charge Offs) trended down from 0.29% to 0.26% QoQ—a solid outcome in this environment.”

Overall, the consensus among analysts is a Moderate Buy based on 9 Buys and 6 Holds. The average analyst price target of $34.17 implies upside potential of about 6.7% to current levels. Shares have plunged 33.7% in one year.

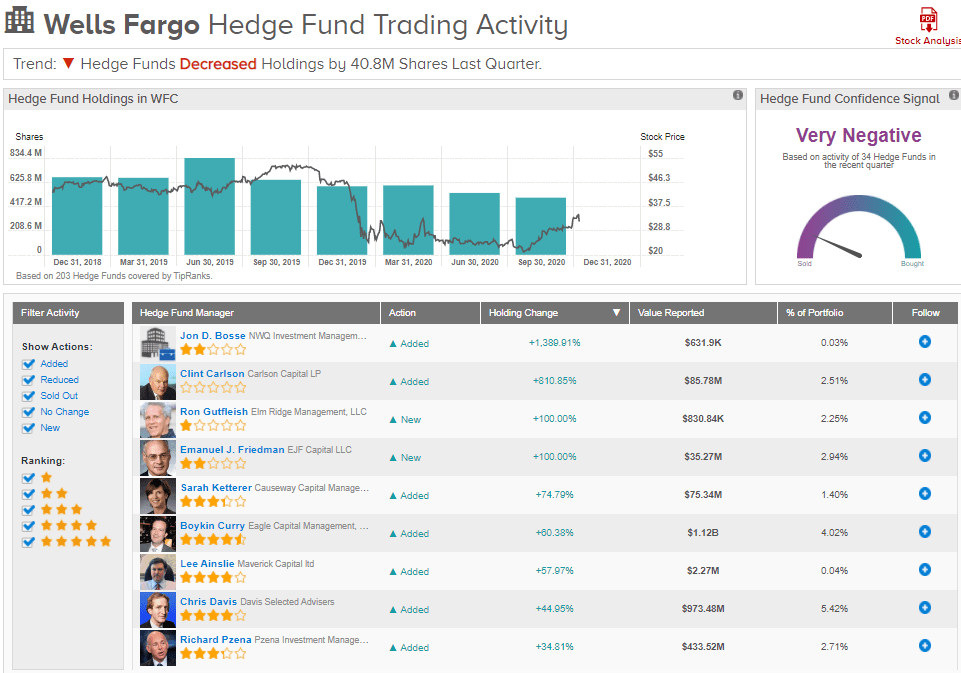

However, TipRanks’ Hedge Fund Trading Activity tool shows that confidence in WFC is currently Very Negative as 34 hedge funds decreased their cumulative holdings in WFC by 40.8 million shares in the last quarter.

Related News:

Citibank To Redeem Notes Worth $2.55B In January; Street Sees 9% Upside

BancorpSouth Buys FNS For $108M

JPMorgan On The Hunt For Asset Management Businesses – Report