T-Mobile (TMUS) and Sprint (S) won clearance to merge from a federal judge Tuesday, sending T-Mobile shares up 12%, and Sprint shares up 77.5% by close of trading yesterday.

Rejecting arguments by a group of state attorneys general that allowing the companies to merge would encourage anticompetitive behavior, U.S. District Court Judge Victor Marrero demurred that to the contrary, T-Mobile’s “maverick” ways have historically forced “the two largest players in its industry to make numerous pro-consumer changes” to compete with it. In the judge’s view, allowing the merger will in fact help “to continue T-Mobile’s undeniably successful business strategy for the foreseeable future.”

To that end, T-Mobile COO Mike Sievert promised to press ahead and try to complete his company’s acquisition of Sprint by April 1. With the Department of Justice and Federal Communications Commission already having given the deal their blessing, this merger should finally happen — two years after it was first announced.

Or not.

Not all analysts are convinced this story is over just yet. In a note released immediately after the judge’s verdict, Nomura analyst Jeff Kvaal warned that “we expect the state AGs to appeal.” RBC Capital analyst Jonathan Atkin noted that such an appeal, if filed, could delay closing of the merger by “an additional 4-5” months — potentially delaying closure until September 2020.

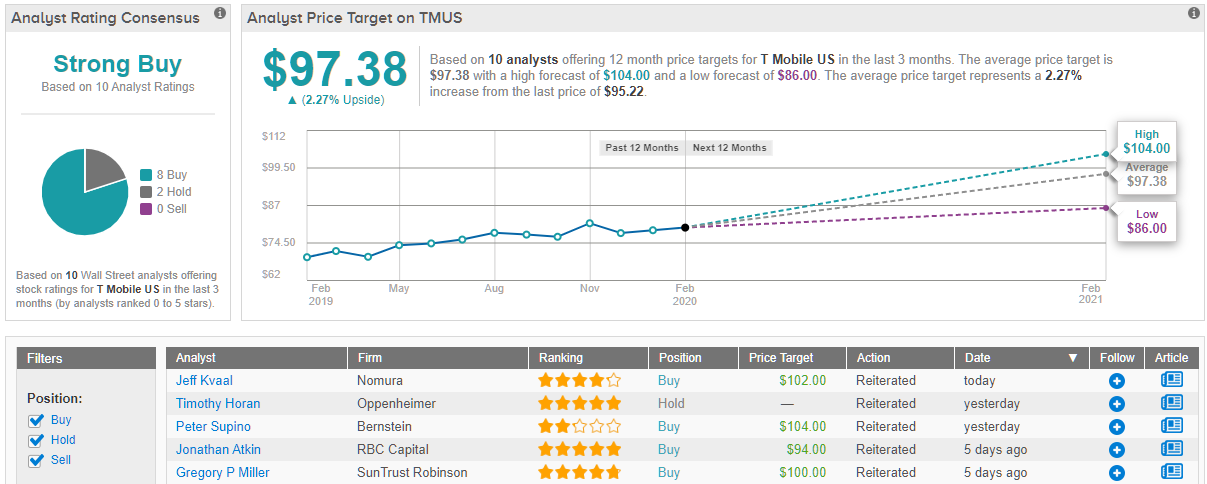

Delay or no delay, Kvaal believes T-Mobile/Sprint have the advantage at this point, and puts the likelihood of the merger closing eventually at about 80%. (And accordingly, Kvaal raised his price target on T-Mobile stock today to $102 per share, implying there’s a further 8% upside to be gained.

Even if he’s wrong about that, though, Kvaal argues that if the merger is dashed on appeal, a “standalone” T-Mobile would still be worth $93 on its own. And that means that even after Tuesday’s price rise, there’s little downside in the stock. (And again, potentially 8% upside).

Over the last three months, TMUS stock has received a whopping 8 Buy ratings and just 2 Hold ratings. As a result, the stock has a ‘Strong Buy’ analyst consensus rating. (See T-Mobile stock analysis on TipRanks)

But what about T-Mobile’s rivals AT&T (T) and Verizon (VZ)? Where does the judge’s decision leave them?

In the short term, Kvaal argues that disruption from T-Mobile’s efforts to integrate its and Sprint’s customers is likely to spike “churn” at the latter company, and predicts at least some Sprint customers will jump ship for AT&T or Verizon — the more so as both these companies are expected to “exploit” the situation by offering promotional deals to entice customers away from T-Mobile. In the longer term, though, Kvaal sees a merged T-Mobile/Sprint as a strong rival to the telecom giants, boasting “more subscribers, more spectrum, a better network, and broader distribution.”

And Dish? Isn’t T-Mobile supposed to give Dish access to its network as a condition of the DOJ and FCC signing off on this deal. Well, yes, it is, and Oppenheimer analyst Timothy Horan chimes in on this point to predict that Dish may partner with one or more cable companies to sell wireless service. Still, Kvaal isn’t at all optimistic that Dish will be able to compete effectively in mobile. Neither, for that matter, is Atkin, who worries that Dish will have “to compete in a highly mature and competitive market fraught with execution risk and significant capital requirements.”

Heavily leveraged Dish may discover it’s bitten off more than it can chew.

To find good ideas for tech stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.