ASOS PLC (GB:ASC) is a British retail brand offering an exclusive range of clothing, footwear, and cosmetics, mainly to the young population globally. During the pandemic, ASOS was one of the stocks that saw remarkable growth, but it subsequently witnessed a significant decline. The company’s share price has plummeted by 78% over the past year, including a 62% fall in the last three months.

This has led to the company’s shares being expelled from the FTSE 250 index. Consequently, ASOS will transition to the FTSE SmallCap index on June 16.

The Weak Statistics

Despite receiving positive feedback on its trading update in January, the company’s shares have faced difficulties since then. In May 2023, the company published its half-yearly earnings for 2023. The company posted a pre-tax loss of £291 million as sales were hit by tightening household budgets.

The company also anticipates a further decrease in sales in the second half. The results hurt investors mainly due to reduced resources allocated to the U.S. and the significant decline in cash flow.

Analysts’ Opinion

The analysts expect higher losses for the full year of 2023 and a significant likelihood that the company’s share price will remain at a low level. However, projections indicate a turnaround toward profitability in 2024, accompanied by growth in 2025.

Three days ago, analyst Miriam Josiah from Morgan Stanley confirmed her Hold rating on the stock while reducing the price target from 720p to 470p. This implies a growth of 34.2% in the share price.

Analyst Richard Edwards from Goldman Sachs expects more than 70% growth in the share price. He also reiterated his Hold rating five days ago.

ASOS Share Price Forecast

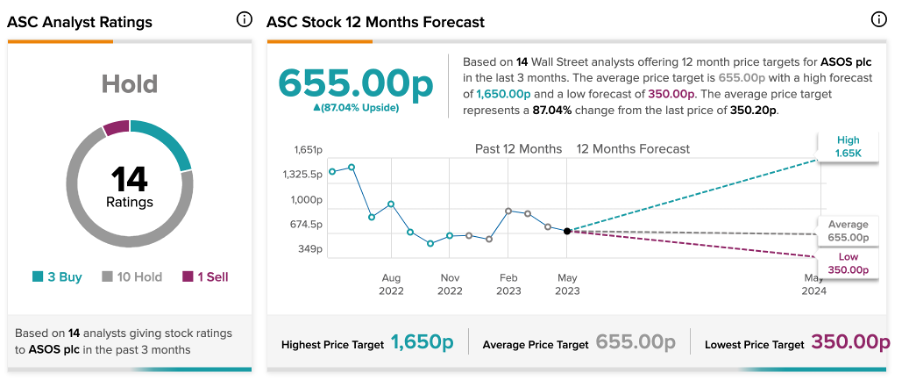

According to TipRanks consensus, ASC stock has a Hold rating. This is based on a total of 14 recommendations, of which 10 are Hold.

At an average price target of 655p, analysts predict an upside of 87% in the share price for the next 12 months.

The Takeaway

After dwindling share prices, the retailer faced further skepticism after releasing disappointing half-year results in May. A major concern raised was the company’s cash flow, prompting ASOS to raise money to strengthen its balance sheet. However, investors remain anxious about whether this infusion will be sufficient and will pull up the share price in the short term.

However, in the long run, analysts predict a huge upside of more than 80% in the share price and recommend holding onto the stock.