Amongst all the companies currently filing earnings reports, one of the most anticipated was from streaming giant Netflix (NFLX). The Street had been wondering what kind of an impact the increasing competition to the undisputed streaming king would have on its earnings figures. The 2010’s star performer posted its FQ4 2019 report yesterday and has been receiving feedback from both sides of the Street since then.

Netflix’s overall sales for the quarter came in at $5.467 billion, an increase of 31% year-over-year and ahead of the Street’s estimate of $5.452 billion. EPS of $1.3 easily beat the Street’s estimate of $0.53. A further increase came from global streaming revenue which came in at $5.399 billion (up 32% year-over-year). Operating income increased substantially, too; at $459 million, the figure more than doubles the prior year’s $216 million.

So far, so good, everyone agrees. Where the analysts begin to differ is on the implications of new subscriptions. Netflix added 420,000 new US subs in 4Q19, 30% less than the guidance of 600,000. Furthermore, Netflix added 8.76 million subscribers worldwide in the quarter – up 20% year-over-year and over 1.3 million more than the company expected. The bears will point out the growth rate is slowing down, though; 21.4% in last quarter’s report while in Q4 2018, the figure came in at 25.9%.

The Bull

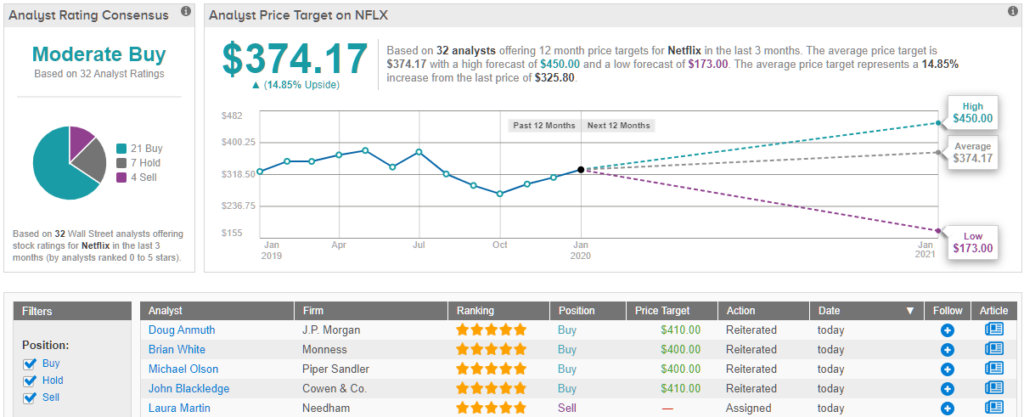

Monness’s Brian White is running with the bulls. The 5-star analyst believes the additional subs are impressive, especially in the face of increasing competition. To this end, White reiterated a Buy rating on NFLX, while also bumping up his price target, from $350 to $400. The updated figure suggests possible upside of a further 22% from current levels. (To watch White’s track record, click here)

White said, “As Netflix continues to aggressively invest back into the business with new content, the company’s operating margins remain well below its long-term operating margin target at maturity. Therefore, we believe traditional P/E metrics or other profit-driven metrics are not applicable and we value the stock on an enterprise-value-to-revenue ratio. Given Netflix’s leadership position in the market, growing scale, rapid growth and subscription-based model, we believe investors will continue to pay a premium for the stock.”

The Bear

There are several reasons why the 4Q19 US sub miss is worrying, according to Needham’s Laura Martin. The 5-star analyst opined, “a) in 4Q19, Netflix launched a record 802 hours of original programming (up 3% y/y), including 8 films with 24 Academy Award nominations such as “The Irishman” and “Marriage Story;” b) Disney+ and Apple+ were each free for the first 30 days, so NFLX only competed with them for consumer spending in December, at most; and c) marketing expenses hit 16% of revs in 4Q19 (vs 13% avg in 2019 and 11% in 3Q19).”

Martin also points out that US subs have historically been 3 times more profitable than international subs. The gap is widening too, according to Martin; “Going forward, NFLX will aggregate low ROI international subs with US subs, which masks NFLX’s true ROI trends,” the analyst said said.

Martin, therefore, reiterated an Underperform rating on Netflix, although she did not include a price target. (To watch Martin’s track record, click here)

Consensus Verdict

Does the Street’s remote-control switch to the up or down channel when viewing Netflix’s potential? Up is currently edging it out. A Moderate Buy rating breaks down into 19 Buys, 7 Holds and 4 Sells. Should the average price target of $370 be met, investors will see gains of 13% in the next 12 months. (See Netflix stock analysis on TipRanks)