In this piece, we used TipRanks’ Comparison Tool to check out two energy stocks — DVN and MUSA — to see which has the best potential. Regarding upside potential from analyst price targets, DVN stock looks the best, but let’s look into each stock and the energy industry further.

Earlier this year, once-embattled energy stocks enjoyed a dramatic lift as Russia made the reckless decision to invade neighboring Ukraine. Suddenly, the entire paradigm shifted, with western powers and Moscow locked deep into a tit-for-tat battle of sanctions and reactionary penalties.

Still, consumers enjoyed a respite from soaring prices as the economy adjusted to the developments. However, with circumstances again pointing to higher energy prices, investors need to consider pivoting back to the underlying sector.

Just recently, The Wall Street Journal reported that U.S. gasoline prices had fallen for 13 weeks in a row. Per the news outlet, this was “the longest consecutive weekly slide in more than three years, as global demand for oil continues to fall.”

“Weaker economic growth in China and Europe has led to softer demand for oil, which has driven down the price of gasoline for U.S. drivers, analysts said.” As well, the U.S. Energy Information Administration noted a conspicuous drop in domestic demand.

Still, the WSJ warned that consumers shouldn’t expect prices to continue falling. For instance, hurricanes in the Gulf of Mexico could impose a wild card for gas prices. Tom Kloza, global head of energy analysis for OPIS, stated, “I think the next big gasoline move—a 50 cent move—is probably higher, not lower.”

The other glaring factor that could help drive up fuel costs – and, by logical deduction, energy stocks – is the crisis in Ukraine. Recently, Moscow just about cut off natural gas outflows to Europe, which is a major dilemma for western nations. The European region “imports around 40% of its natural gas and 30% of oil from Russia.”

Still, such dependencies can also benefit investors who move into viable energy stocks, but which one would be the most appropriate for market participants? Here are two ideas to consider.

Devon Energy (NYSE: DVN)

Billed as a leading independent oil and natural gas exploration and production company, Devon Energy focuses on the upstream segment of the hydrocarbon industry. This categorization refers to companies that identify, extract, or produce energy-related commodities. In other words, upstream firms discover the raw materials that eventually make their way down to your car.

Fundamentally, Devon Energy represents one of the top energy stocks because of its favorable geographical location. All of the company’s operations are onshore in the U.S., thus virtually eliminating issues such as the nationalization of private companies. Based in Oklahoma City, Devon concentrates on five core areas: the Delaware Basin, Eagle Ford, Anadarko Basin, Powder River Basin, and Williston Basin.

On a broader level, Devon is particularly attractive because of the intense global demand. With Europe facing a potentially harsh winter, the region needs access to heating fuels. The Biden administration is redoubling efforts to address the supply crunch. While companies like Devon might not immediately offer a solution, the long-term objective of Europe is to reduce its dependency on Russian energy to zero.

Therefore, those investors who are interested in energy stocks for the long haul should consider DVN. Indeed, the future looks bright for the company. In the second quarter of 2022, Devon posted $5.63 billion in revenue, up 133% from the year-ago level. As well, net income skyrocketed to $1.93 billion, up 655% on a year-over-year basis.

Is DVN Stock a Buy, According to Analysts?

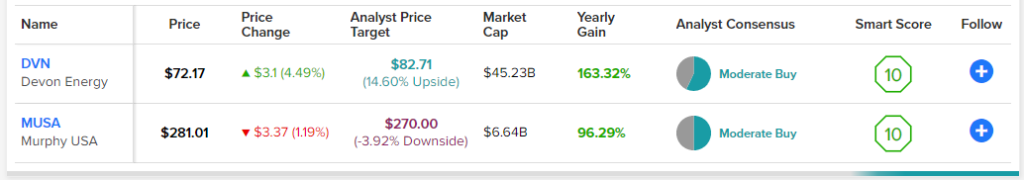

Turning to Wall Street, DVN stock has a Moderate Buy consensus rating based on eight Buys and six Holds assigned in the past three months. The average DVN stock price target is $82.71, implying 14.6% upside potential.

Murphy USA (NYSE: MUSA)

On the opposite end of the energy spectrum are downstream players like Murphy USA. The downstream segment involves anything associated with the post-production phase of oil and gas. Primarily, this ties into the retail and marketing aspects. When you pull up to the gas station, you’re dealing with a downstream entity.

To be fair, the influx of electric vehicles poses a direct challenge to hydrocarbon-related downstream energy stocks like MUSA. With gas prices still elevated compared to historical norms, more than a few consumers have thought about making the transition to EVs. Further, with experts warning that prices could move back up into the stratosphere, the transition to electrification entices.

Still, hydrocarbon-related energy stocks maintain their relevance, mainly because of economics. According to data from Kelley Blue Book, the average price for a new EV earlier this year hit nearly $63,000. Not too many people can afford that, considering the pre-pandemic U.S. household income was $69,560.

One of the more compelling aspects of Murphy USA is its near-term nature. Since people are filling up their tanks every day, if you anticipate that energy prices will rise, MUSA could be quite lucrative.

On paper, Murphy USA also delivered the goods to stakeholders. In Q2 2022, the company posted revenue of $6.77 billion, up nearly 52% against the year-ago quarter. On the bottom line, the downstream specialist delivered net income of $183 million, up 42% year-over-year.

Is MUSA Stock a Buy, According to Analysts?

Turning to Wall Street, MUSA stock has a Moderate Buy consensus rating based on two Buys and two Holds assigned in the past three months. The average MUSA stock price target is $270, implying 3.9% downside potential.

Conclusion: DVN for the Long Term, MUSA for the Short Term

Although both energy stocks mentioned above feature significant upside potential, the most appropriate choice comes down to timeframe. For those willing to wait for the bullish narrative to fully mature, Devon has the upper hand. As global demand increases, the company can diversify its operations.

However, for a near-term bet on energy stocks, Murphy USA might respond quicker to real-time economic conditions. Since downstream players are in the trenches, they may provide quicker returns. Nevertheless, upside potential may be limited compared to the best upstream firms.