In this piece, we used TipRanks’ Comparison Tool to evaluate three asset management stocks with yields at or above 3% that Wall Street is bullish on. These stocks are worth considering, as they all have upside potential.

Many dividend stocks are sporting the highest yields they’ve had in recent memory, thanks in part to recent weakness. When it comes to fallen high-yielders, it’s hard to pass up on the value to be had in the financial space. The big banks have been a significant drag, as have asset managers, many of which boast yields well above the 3% level.

Though recession fears could mount in the second half, adding even more pressure to the fragile financial stocks, value seekers may wish to consider giving the sector a second look, as today’s low prices may vanish in a few months’ time.

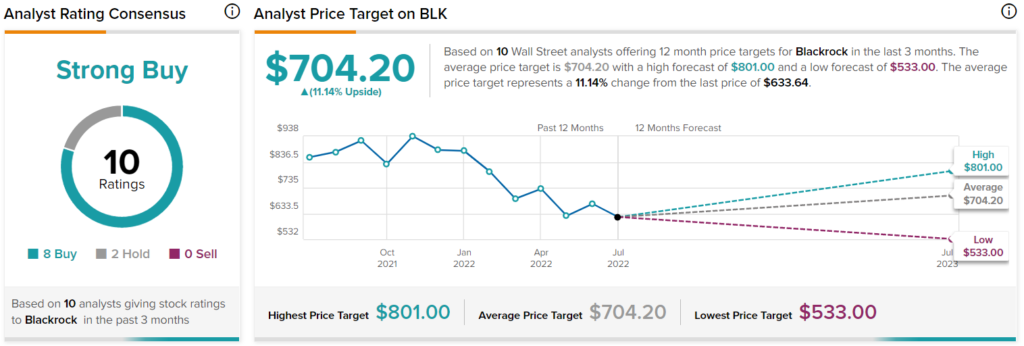

1. BlackRock (BLK)

BlackRock is the world’s largest (and possibly best-known) asset manager. The stock plunged just north of 40% from peak to trough recently. With a modest 16.4 times trailing earnings multiple and a juicy 3% dividend yield, shares of the $95.6 billion behemoth seem worthy of a second look amid the financial wreckage.

Undoubtedly, the bear market in stocks and bonds has weighed heavily on assets under management, causing the firm to miss the mark on earnings for its second quarter. For Q2, per-share earnings came in at $7.36, short of the $7.87 consensus estimate. Revenue also came in relatively light, at $4.53 billion, missing estimates by about $8 million.

Though the market waters have been choppy, ETFs and indexed products held their own rather well. Surprisingly, BlackRock still sees positive flows amid the market turmoil.

As the market heals from an unforgiving first half, I’d look for BlackRock to make up for lost time. The boom in passive investing is unlikely to fade due to this rough patch, and it should power BLK stock higher over time.

Wall Street is bullish, with the average BlackRock price target of $700.56 implying 11.1% upside potential.

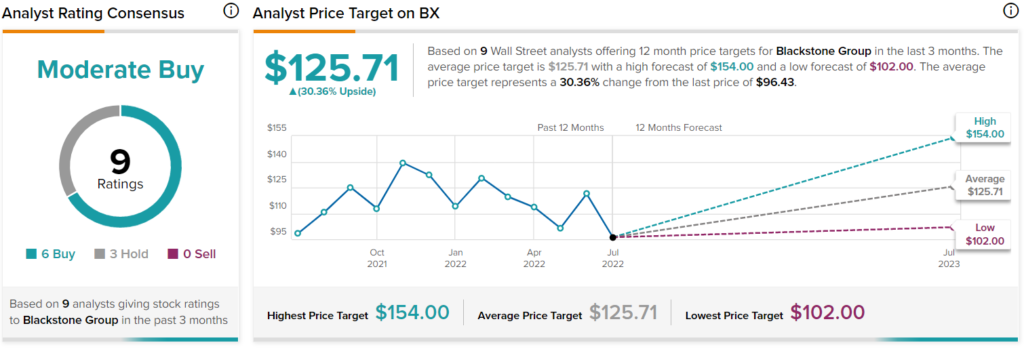

2. Blackstone (BX)

Blackstone is another asset manager with a cheaper multiple (13.2 times trailing earnings) and a swollen dividend yield of 4.66%. The firm specializes in alternative assets (think real estate, private equity, and hedge funds). It’s been in the game for a long time and is unlikely to be derailed by the current market downturn.

Blackstone beat earnings for the first quarter, with EPS of $1.49, above the $1.42 consensus estimate. Revenue also beat expectations, coming in at $4.15 billion, $697 million higher than analysts predicted. Assets under management (AUM) climbed to $940.8 billion, an impressive 38% year-over-year growth.

Despite headwinds, Blackstone continues to see its fee-based earnings surge. Looking longer term, alternative asset investment demand is likely to remain robust. Real assets that provide a lower correlation to equity markets are still sought after, and I suspect they will continue to be well after this period of market volatility ends.

With strong managers and a long, impressive track record, it’s hard not to be tempted by the stock’s 34% haircut. Wall Street remains bullish, with the average Blackstone price target of $125.71 implying 30.4% upside potential.

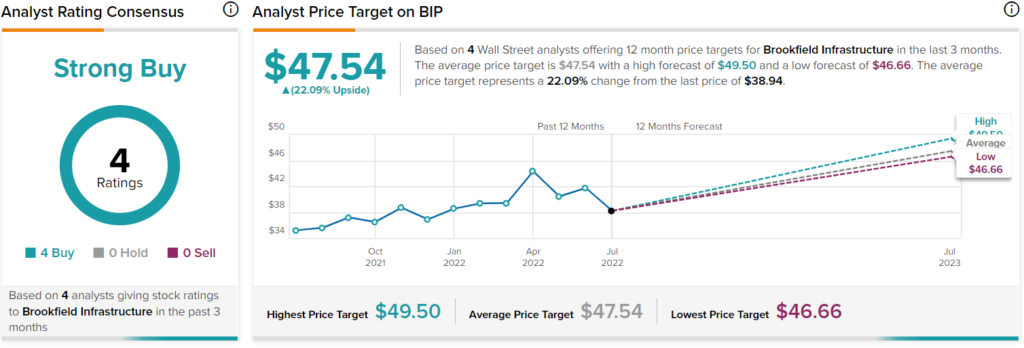

3. Brookfield Infrastructure Partners (BIP) (TSE:BIP.UN)

Brookfield Infrastructure Partners is a Canadian investment manager focused on infrastructure investments. The firm owns vital assets that tend to fare well during periods of economic weakness. Think rail infrastructure, electric transmission lines, toll roads, and pipelines.

Like BlackRock and Blackstone, Brookfield is a very respected name within the asset management community. Management has a knack for making smart deals and tends to be aggressive whenever it sees an opportunity.

The company has made many acquisitions over the years across a wide range of nations. The company is well-diversified and is well-positioned to bounce back from the recent barrage of selling.

Shares of BIP trade at 33.7 times trailing earnings, with a 5.38% dividend yield. Also, with a 0.72 beta, the stock is slightly less volatile than the broader markets under normal circumstances.

Today, the stock is down just shy of 15% from its peak. With such slowdown-resilient, cash-flow-generative assets in the Brookfield portfolio, it’s tough to pass up on the latest slide in shares. They’re well-worth a premium, with recession odds as high as they are.

Turning to Wall Street, analysts remain incredibly bullish, with the average Brookfield Infrastructure Partners price target of $47.54 implying 22.1% upside potential.

Conclusion: Analysts are Most Bullish on Blackstone Stock

Asset managers seem oversold at this juncture. Of the three names mentioned in this piece, analysts expect the most upside from Blackstone over the coming year. For those looking to play defense ahead of a slowdown, Brookfield Infrastructure Partners seems like a solid bet.