Intuitive Surgical, Inc. (ISRG) has been in the spotlight lately, with its 3:1 stock split taking effect on October 5. Also, ISRG received a downgrade from a renowned Wall Street firm on October 1, which sent the shares spiraling down. Shares were down 1.3% in pre-market trading at the time of writing.

Intuitive Surgical manufactures minimally invasive robotic-assisted products to improve the clinical outcomes of patients, most notably with the da Vinci surgical system. ISRG has a market cap of $115.48 billion, and its shares have gained 41.6% over the past year. (See Intuitive Surgical stock charts on TipRanks)

The 3:1 stock split was approved by the company’s Board on August 5 to be affected by an amendment to the company’s Certificate of Incorporation. As per the approval, each shareholder of record on September 27 would receive two additional shares of ISRG common stock for every one share held, with trading on the split-adjusted basis to become effective on October 5, 2021.

Analysts’ View

On October 1, Citigroup analyst Joanne Wuensch downgraded the stock to a Hold rating from a Buy while maintaining a price target of $367 (split-adjusted basis), implying 11.2% upside potential to current levels. Following the news of the downgrade, ISRG stock fell almost 4% on October 4.

Wuensch stated that she was “taking a pause” on recommending ISRG stock. The analyst cited management’s comments on the impact of the Delta variant in early September at a Wells Fargo Healthcare Conference, following which momentum in the shares stalled.

According to Wuensch, the company did not expect any material impact on its business or financials due to supply chain irregularities, nor did it anticipate any further deterioration due to the Delta variant and the COVID-19 pandemic.

Overall, the stock has a Moderate Buy consensus rating based on 5 Buys and 10 Holds. The average Intuitive Surgical price target of $340.89 (split-adjusted basis) implies 3.3% upside potential to current levels.

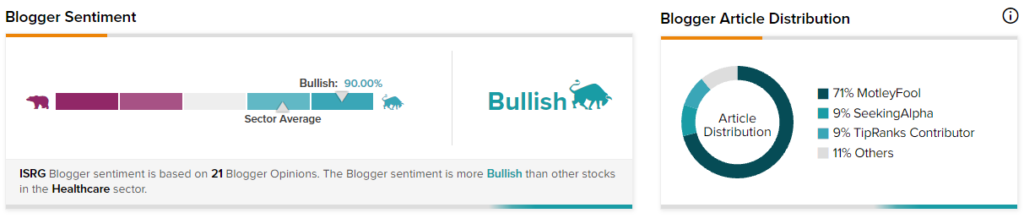

Additionally, TipRanks data shows that financial blogger opinions are 90% Bullish on ISRG, compared to a sector average of 71%.

Related News:

Scientific Games to Buy ACS PlayOn, Enhance Cashless Solutions

J & J Applies for Emergency Use Authorization for COVID-19 Booster

Xerox Snaps Up Competitive Computing; Shares Rise