With so many headwinds facing Nio Inc. (NIO), it’s surprising that shares have managed to stay afloat.

Its number of cars sold, while improving significantly in the last reporting period, are still behind expectations at this point of its growth cycle.

Reports have also recently stated NIO had secured significant financing to give it breathing room. Not only were the reports wrong, but the amount of financing, if secured, was far below the $1 billion originally stated.

Add in concerns over coronavirus, and it remains difficult to see why the company continues to find support for its share price.

In this article, we’ll look at why the company’s share price hasn’t collapsed.

Balance Sheet Issues

As of the quarter ending September 30, 2019, NIO only had approximately $274.3 million in cash remaining, plunging from the $1.123 billion it had at the end of March 2019.

During the latter part of December 2019, the company said it won’t last through 2020 unless it receives a significant cash infusion.

The company has been able to reduce net income losses over the last three reporting periods, improving from the $1.42 billion loss in the third quarter of 2018 and a $478.6 million loss in the second quarter of 2019, to a loss of $352.8 million in the third quarter of 2019. The improvement came from more vehicles delivered and cutting costs. Gross margins were -12.1% in the third quarter.

Additionally, vehicles delivered during the reporting period finished at 4,799, up from the 3,553 delivered in the prior quarter. Revenue improved to $257 million, up from the $219.7 million generated in the second quarter.

Not to mention operating profit in the quarter was a loss of $337.1 million, an improvement over the operating loss of $469.9 million in the previous quarter.

While the company is moving in the right direction, it isn’t improving fast enough to continue operations with its current capital structure.

Financing

A Chinese financial news report recently asserted NIO has secured $1 billion in new financing from GAC Group, a firm located in Guangzhou. Not long after the news broke, NIO had to clear up the matter by saying it was only in negotiations for financing; it hadn’t secured any yet.

GAC Group confirmed the negotiations, but added that the $1 billion figure was far beyond what it was considering. The company said that at most, it would provide $150 million in financing to NIO. Even if it received that cash infusion, NIO wouldn’t make it until summer before needing more operational capital.

Another concern is a previous attempt to secure financing which resulted in the deal falling apart because of concerns over whether or not NIO could survive. Those concerns remain in place, and casts a deep shadow over the future prospects of the company.

The bottom line in regard to financing is that not only does NIO need a lot more than the $150 million, it also needs to be able to get it without terms that are too steep. This is going to be difficult to accomplish.

Coronavirus

The threat of the coronavirus has weighed on the Chinese market. While in the early days of the outbreak it did appear to have some impact on NIO’s share price, the stock is up 9% so far in 2020.

I think it could come back as a negative catalyst if China fails to contain the situation and the deaths rise in the country. A number of nations have put travel bans in place. If it starts to have an effect on imports to China, NIO could find itself under pressure if this drags on for a long time or gets worse.

Any news of the virus hitting workers of NIO could be devastating to the company. For now, it seems like investors are shrugging it off. I’m not sure that will remain the case if things get much worse than they are now.

The Tesla Factor

Probably more than any other factor, the comparison of NIO with Tesla by some investors has kept its share price higher than its actual performance justifies.

The reason this is important is because there are hopes by investors that just like early investors in Tesla, they could obtain sizeable returns if NIO is able to survive its short-term challenges. I think they’re right.

When I say that, I mean that if it is able to secure enough financing, and it can continue to increase vehicle deliveries, it could in fact start to enjoy a similar growth trajectory Tesla did. I believe this, more than anything else, is what’s supporting the share price of NIO.

Wall Street Analysts Weigh In

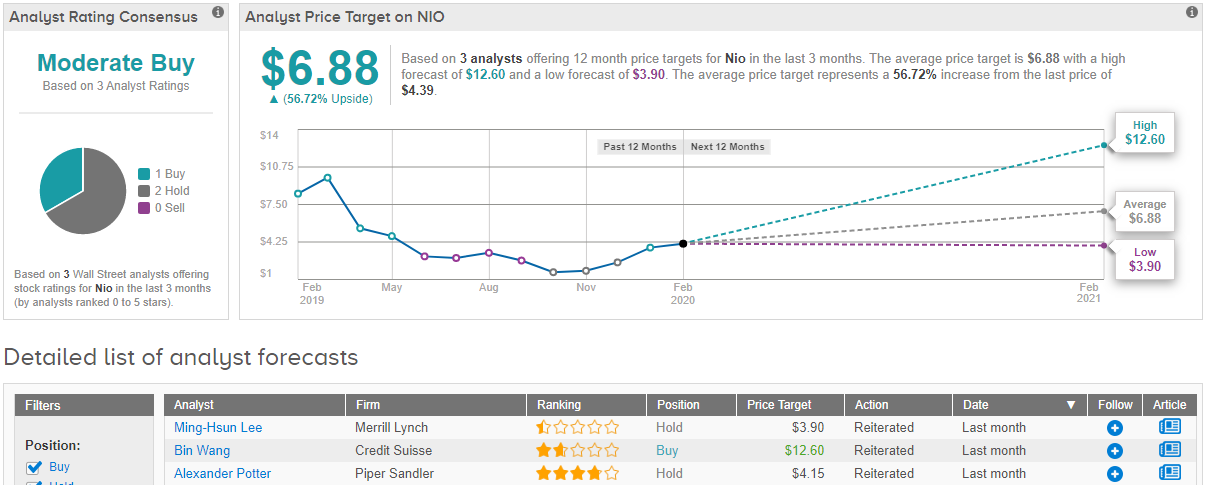

What do Wall Street analysts think about NIO? As it turns out, the consensus is a mixed bag. 1 Buy rating and 2 Holds assigned in the last three months add up to a Moderate Buy Street consensus. At $6.88, the average price target brings the upside potential to 57%. (See Nio price targets and analyst ratings on TipRanks)

Conclusion

The question going forward is whether or not NIO can survive by securing the capital it needs, and if it does secure financing, can it continue to increase the number of cars delivered while lowering costs and improving margins.

It’s moving in the right direction, but it has yet to prove it can accomplish this lofty goal.

NIO is a good play if investors use capital they can afford to lose entirely. With the potential upside if a number of factors go its way, it won’t take a large investment in the company for investors to see a big return.

In the end, its future viability and survival is directly related to whether or not it can secure a lot more financing. If it is unable to do so, nothing will be able to keep the company from shutting its doors. On the other hand, if it lands a big deal, it will result in its share price soaring much higher.