Shares of EV pioneer Tesla (NASDAQ: TSLA) have taken a shellacking in the stock market this year. With its stock down over 60% year-to-date, most investors would be wondering whether it’s the right time to pick up the stock. One thing is for certain; the firm’s underlying business is as strong as ever, with its top and bottom line growing at an impeccable pace. Moreover, there are multiple catalysts for the firm in 2023, which could lift its price from its doldrums. Hence, we are bullish on TSLA stock for the long haul.

Indeed, despite the sharp drop, there may still be some premium left in Tesla’s stock, making it a great time for those looking for potential gains to jump in and start buying. TSLA stock is trading at around seven times trailing twelve-month sales, roughly 30% lower than its 5-year average and much more in line with its fundamentals and long-term outlook.

Tesla Saw Terrific Execution

Despite the global macroeconomic uncertainty, Tesla had an outstanding quarter. Revenue skyrocketed by 56%, operating profit was record-breaking, and free cash flow increased a staggering 148%, reaching $3.3 billion. To top it off, Tesla’s cash position grew to $21.1 billion.

These impressive results were largely thanks to the company’s surging vehicle deliveries, with over 343,830 cars delivered in the third quarter alone, an eye-watering 42% increase year-over-year. With numbers like these, it’s clear that Tesla is thriving in a tumultuous economic climate and setting the trend for other EV companies.

Tesla has proved time and time again its spectacular ability to navigate headwinds and execute effectively. It expects full-year production to grow by 50% versus 2021, and deliveries are likely to follow suit. Not only this, but during the third-quarter earnings call, CEO Elon Musk hinted at order levels remaining robust throughout the fourth quarter. Hence, demand remains remarkably high.

Growth Catalysts Ahead for Tesla

Tesla’s vehicle delivery growth in the third quarter of the year was undoubtedly impressive, demonstrating the company’s persistence and ambition. Even more impressive, though, is its growth in energy storage products, up 62% on a year-over-year basis. Tesla deployed a record-breaking 1,100 megawatt-hours of energy storage to serve its customers with its energy storage solutions.

Demand for these products is far outstripping supply, and to meet this demand, Tesla has ramped up production at its California factory. This positive trend also looks to continue into the fourth quarter, showing that Tesla isn’t likely to slow down anytime soon.

Another major growth driver could be its hugely popular Cybertruck. Musk recently announced that the “final lap” of preparatory work is winding down, and production is expected to begin in mid-2023. The sales associated with Cybertruck’s launch could be a major boost for Tesla, especially with revenues from energy storage still representing a relatively small portion of overall revenue. Investors should be watching closely for updates on the electric truck as it continues toward its launch.

The initial plan was to begin production in late 2021, but it has been repeatedly delayed amidst global supply chain challenges and logistical constraints. Though the wait may seem longer than expected, Tesla’s estimated 1.5 million reservations by November 2022 are a testament to its potential success as a vehicle option when it eventually hits the market.

Is Tesla Stock a Buy?

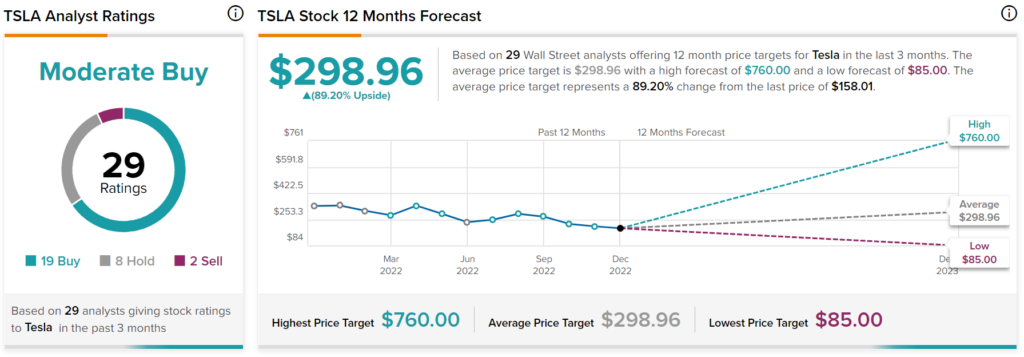

Turning to Wall Street, Tesla stock maintains a Moderate Buy consensus rating. Out of 29 total analyst ratings, 19 Buys, eight Holds, and two Sell ratings were assigned over the past three months. The average TSLA stock price target is $298.96, implying 89.2% upside potential. Analyst price targets range from a low of $85 per share to a high of $760 per share.

Should You Consider TSLA Stock?

Despite an incredibly challenging environment, Tesla’s strong performance over the last year shows the company’s momentum in sharply accelerating demand for electric vehicles. These are secular trends that could provide investors with solid returns over a sustained period due to the company’s innovative technology and manufacturing expertise. Coupled with all of the favorable tailwinds in this space, the stock’s recent dip presents an opportune time to look into the security and potentially open a position.